Shares of Global Industrial (NYSE: GIC) have gotten off to a rough start so far in 2024, with the company’s share price sliding 33% from its 52-week highs.

The New York-based company distributes maintenance, repair, and operations (MRO) products to a diversified base of over 400,000 industrial customers — many of them small and medium-size businesses (SMBs). The company has seen organic sales growth slow over the last two years, with these more vulnerable customers battling inflation and higher interest rates.

However, after the recent share price decline, it could be a prime time to consider buying shares of the steady distributor. Here’s why.

Global Industrial’s success in its niche

While it is nearly impossible to avoid cyclicality in the industrial sector, Global Industrial’s focus on the MRO products niche makes it slightly more consistent over time. The company sells a wide array of products needed for everyday operations, including storage and shelving, material handling, janitorial and maintenance, safety and security, furniture and work benches, pallet carts, and more.

Basically, Global Industrial sells any big and bulky MRO products that you can imagine — and thanks to the repeat purchases inherent in these types of products (over a few years), the company’s 90% customer satisfaction rate keeps these recurring transactions flowing in. It has been focusing on making the buying process as easy as possible for customers — fully 60% of its sales are generated on its e-commerce channel.

What really sets Global Industrial apart as an investment, however, is that it generates 50% of its sales from private-label products. These items tend to produce margins that are 15% to 20% higher than national brands, making them hugely important to the company.

Cheaper than branded products, these private-label offerings are often no-brainer selections for customers, as most MRO products are standardized, and a brand name isn’t critical. This private label niche grew by 16% annually over the last five years, and continues to lead Global Industrial’s growth.

The company currently accounts for only 2% of the highly fragmented SMB MRO market, so its growth story should still be in its early chapters — especially as it moves into new product verticals like healthcare, hospitality, and pneumatics.

While Global Industrial’s organic sales growth only clocked in around 4% to 5% during the last two quarters as its SMB customers reined in spending and industrial spending remained soft, its recent acquisition of Indoff could reignite growth. Generating a return on invested capital (ROIC) of 28% over the last year, the company has proven capable of creating outsize profits compared to its debt and equity.

Here’s why I think adding Indoff to its operations could improve these ROIC figures.

Integrating the $73 million Indoff acquisition

In 2023, Global Industrial paid $73 million to acquire Indoff, a business-to-business distributor of commercial interiors, material handling products, and other MRO products. Recording sales of $180 million in 2022, Indoff’s valuation at acquisition was a mere 0.4 times sales, and it immediately lifted Global Industrial’s revenue by roughly 15%.

While Indoff’s gross margin of 23% is well below Global Industrial’s 34% mark, its project management and installation capabilities help the combined company grow the service offerings it has available for its customers in the MRO industry.

In just one year of Indoff’s integration, its gross profit margin has already improved by 150 basis points. Best yet, this margin should continue rising as Global Industrial brings its e-commerce capabilities over to Indoff while also growing the acquired company’s suite of private-label products.

Though Global Industrial’s earnings per share (EPS) has dipped slightly since the acquisition due to standard integration costs, the company should see EPS restart its growth over the next few quarters as these synergies continue improving. This future EPS growth will be something for investors to monitor closely in the coming months.

Why buy Global Industrial now?

Currently, Global Industrial shares trade with a price-to-earnings (P/E) ratio of 17 and a price-to-free-cash-flow (P/FCF) ratio of 14.

By comparison, the S&P 500 index trades at an average of 25 times earnings. Using a discounted cash flow model, we can find that the company only needs to grow by 4% annually over the next decade to justify its current share price. With the company having grown sales by 8% annually over the last five years, this required growth rate of 4% looks extremely manageable.

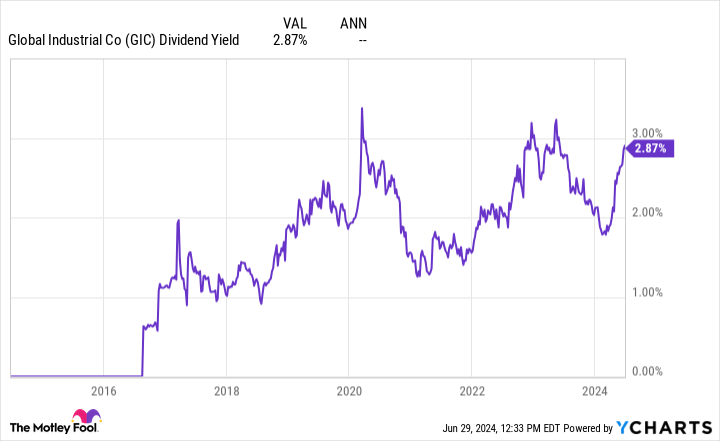

Best yet for investors, Global Industrial’s dividend yield of 2.9% sits near all-time highs. And despite growing its investor-friendly dividend by 14% annually over the last five years, it only uses 46% of its net income to fund these payments, leaving a long runway for future payout increases.

Ultimately, the market has Global Industrial priced to barely keep pace with inflation. Nevertheless, Global Industrial’s success in its stable niche, its strong ROIC paired with a shrewd appetite for acquisitions, and its quickly growing dividend make the company an excellent stock to buy at its discounted price and hold forever.

Should you invest $1,000 in Global Industrial right now?

Before you buy stock in Global Industrial, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Global Industrial wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $751,670!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 2, 2024

Josh Kohn-Lindquist has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

1 Magnificent Dividend Stock Down 33% to Buy and Hold Forever was originally published by The Motley Fool

Signup bonus from