The energy and utilities sectors are known for their high yields. Dividends compensate patient shareholders for enduring the cyclicality of the oil patch. Meanwhile, utilities often choose to reward investors with dividends, given the sector’s low growth. However, focusing too much on yield alone can lead to poor investment decisions. The key is to find […]

Tag: Dividend

These Dividend Stocks Are an Investor’s Best Friend

Dividend stocks tend to struggle in high-interest-rate environments. The core reason is investors have an abundance of low-risk, high-yield income options when interest rates spike. Conversely, fund managers have historically pivoted to top-tier dividend stocks when interest rates fall. The logic behind this trend is that dividend stocks ought to deliver superior returns to risk-free […]

1 Yields 8.6%, Another 6.5% — but Which Is the Best Dividend Stock to Buy for Passive Income Investors?

Fool.com contributor Parkev Tatevosian compares two high-yield dividend stocks to determine which is better for passive income investors. *Stock prices used were the afternoon prices of May 13, 2024. The video was published on May 15, 2024. Should you invest $1,000 in Altria Group right now? Before you buy stock in Altria Group, consider this: […]

2 Beaten-Down Ultra-High-Yield Dividend Stocks That Are Historically Cheap and Begging to Be Bought Right Now

One of the greatest aspects about putting your money to work on Wall Street is there are countless ways to grow your wealth. Regardless of your risk tolerance or investment focus, there are thousands of individual companies and/or exchange-traded funds (ETFs) that can meet your criteria. But among this endless sea of possible investment strategies, […]

Improve Your Retirement Income with These 3 Top-Ranked Dividend Stocks

Here’s a revealing data point: older Americans are scared more of outliving wealth than of death itself. And unfortunately, even retirees who have built a nest egg have good reason to be concerned – with the traditional approaches to retirement planning, income may no longer cover expenses. That means retirees are dipping into principal to […]

Seeking 12% Dividend Yield? Analysts Suggest 2 Dividend Stocks to Buy

Now that we’ve had time to digest the April jobs numbers, some strategists are getting worried about the economy’s mid-term outlook. The jobs report showed 175,000 new jobs added in the month – but that was the lowest gain in the past six months, and was accompanied by an uptick in unemployment, from 3.8% to […]

This 7.2%-Yielding Dividend Stock Could Be About to Add a Lot More Fuel to Its Growth Engine

Enterprise Products Partners (NYSE: EPD) has an illustrious history of growing its cash distributions to investors. It has reached the quarter-century milestone of consecutive annual-payout increases. Several factors have helped fuel its growth, including its ability to secure and build high-return, organic-expansion projects. The master limited partnership (MLP) has several more expansion projects currently under […]

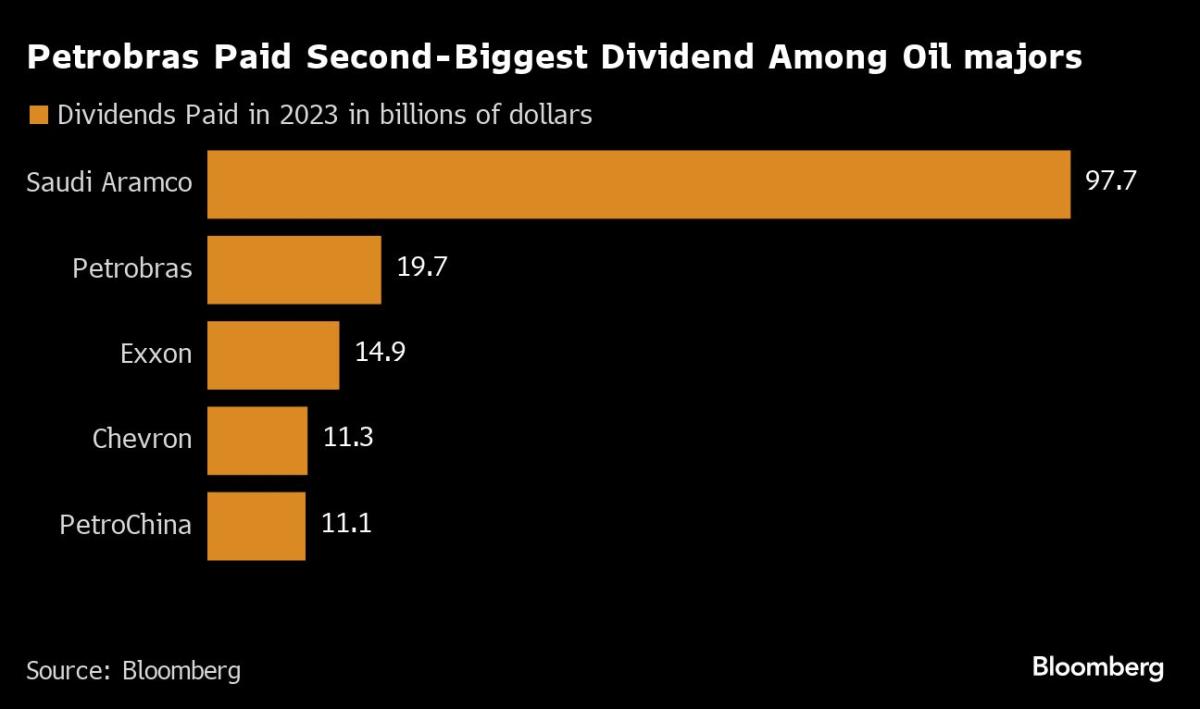

Brazil President Lula Fires Petrobras CEO After Dividend Dispute

(Bloomberg) — Brazil’s President Luiz Inacio Lula da Silva fired Jean Paul Prates, the chief executive of the country’s state-owned oil company, Petroleo Brasileiro SA, following a dispute over dividend payments. Most Read from Bloomberg The firing was confirmed by people familiar with the matter, who asked not to be identified discussing private matters. Petrobras, […]

Alibaba Stock Dips as Huge Investment Losses In Q4 Overshadow Revenue Growth and Dividend

Alibaba Stock Dips as Huge Investment Losses In Q4 Overshadow Revenue Growth and Dividend Alibaba Group Holding Limited (NYSE:BABA) stock is trading lower Tuesday after the company reported its quarterly results. The Jack Ma co-founded e-commerce giant reported fiscal fourth-quarter 2023 revenue growth of 7% year-on-year to $30.73 billion, beating the analyst consensus estimate of $30.40 billion. Adjusted […]

Hershey (HSY) is a Top Dividend Stock Right Now: Should You Buy?

Whether it’s through stocks, bonds, ETFs, or other types of securities, all investors love seeing their portfolios score big returns. However, when you’re an income investor, your primary focus is generating consistent cash flow from each of your liquid investments. While cash flow can come from bond interest or interest from other types of investments, […]

Petrobras Curbs Politically Fraught Dividend Payments

(Bloomberg) — Brazil’s state-controlled oil giant Petrobras is curbing politically charged dividends after reporting lower profits. Most Read from Bloomberg Petrobras’s board approved 1.04 reais a share, or 13.45 billion reais ($2.6 billion), in dividends for the first quarter, it said in a regulatory filing Monday. Analysts were expecting $3.2 billion, according to the average […]

The Smartest Dividend Stocks to Buy With $1,000 Right Now

The past few years have been challenging for most real estate investment trusts (REITs). Higher interest rates have weighed on real estate values to increase their income yields above those of lower-risk income investments like bonds. In addition, higher rates have made it more expensive for REITs to borrow money to fund development projects and […]