Time has shown that the one certainty in the stock market is uncertainty. Regardless of how experienced you are or how many advanced investing tools you have at your disposal, nobody can reliably predict how stock prices will move.

That’s the beauty of dividends: They offer investors a chance to earn returns regardless of how a company’s stock price performs, and they can be a good income source, too, if you hold enough shares.

For investors looking to add ultra-high-yield dividend stocks to their portfolio, the following two tobacco companies can be good choices.

1. Altria Group

Altria Group (NYSE: MO) is the global leader in tobacco, with a portfolio that includes brands like Marlboro, Copenhagen oral pouches, and NJOY electronic cigarettes.

Altria’s stock has struggled quite a bit over the past few years, but 2024 has been a nice (and much-needed) turnaround, partly due to the success of non-tobacco products like NJOY.

Many investors are hesitant to invest in tobacco companies because of the harm that smoking does to people’s health, so Altria has traditionally offered an ultra-high-yielding dividend to attract and retain investors. It has stayed true to that strategy, too. Its trailing-12-month (TTM) yield of around 8.3% is more than 6 times the S&P 500‘s yield.

The biggest concern regarding Altria’s business is the decline in smoking among U.S. adults. In 2005, nearly 21 out of every 100 U.S. adults smoked. As of 2021, that share had declined to around 12 out of every 100. That’s great news for public health, but it’s not the best news for Altria’s core business.

For better or worse, increases in cigarette prices alone aren’t enough to deter most people from buying them, and Altria has leaned on its pricing power to offset dropping sales volume. That has helped keep the company’s finances strong and ensure it can remain shareholder friendly.

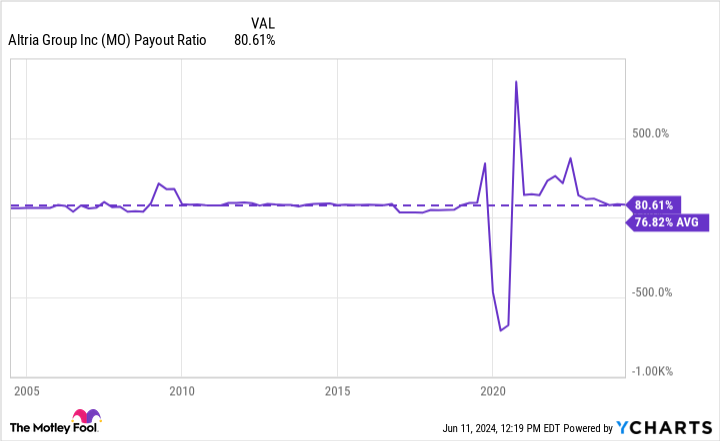

Altria’s current payout ratio of around 80% might seem high, but that’s in line with where the company has historically kept it (aside from the abnormal levels early in the pandemic). The company is a Dividend King, so this statistic shouldn’t cost investors any peace of mind wondering if it will sustain its dividend.

2. British American Tobacco

British American Tobacco (NYSE: BTI) isn’t quite as large as Altria, but it has a diversified portfolio of brands that have performed well for it over the years, including Newport and its vaping brand, Vuse.

As with Altria, declining smoking rates have affected British American Tobacco’s business, but the company has done well with its brands in nonsmoking categories like vaping and heated tobacco (where it has a 16.8% volume market share) and oral nicotine pouches (27% volume market share). In the U.S. market, Vuse holds a 51.5% value share (how much money it makes selling its products compared to what others make), and its new single-use Vuse Go 2.0 should help bolster its position.

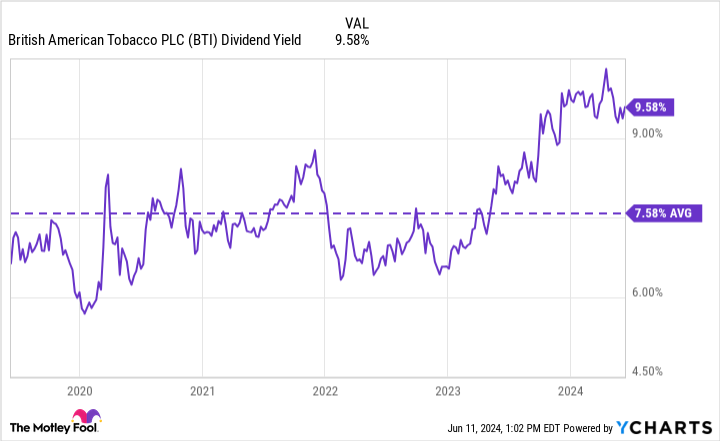

British American Tobacco continues to be a huge cash generator, converting over 90% of its operating profits into cash flow. This has allowed it to remain very shareholder friendly and generous with its dividends. Its TTM yield is over 9.5%, one of the highest yields for a stock that isn’t a real estate investment trust, and well above its five-year average.

British American Tobacco also plans to increase shareholder value via stock buybacks. It plans to spend 700 million pounds ($890 million) on stock buybacks this year and another $1.15 billion in 2025.

With a lucrative dividend and a low valuation (its price-to-earnings ratio is close to the lowest it has been in about five years), British American Tobacco offers long-term investors more upside than downside.

Should you invest $1,000 in Altria Group right now?

Before you buy stock in Altria Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Altria Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $767,173!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 10, 2024

Stefon Walters has no position in any of the stocks mentioned. The Motley Fool recommends British American Tobacco P.l.c. The Motley Fool has a disclosure policy.

Want Safe Dividend Income in 2024 and Beyond? Invest in These 2 Ultra-High-Yield Stocks. was originally published by The Motley Fool

Signup bonus from