Even in a world where interest rates are higher than they were a few years ago, a yield of over 20% still stands out no matter what type of environment we are in, and that’s exactly what the REX FANG & Innovation Equity Premium Income ETF (NASDAQ:FEPI) offers investors.

I’m bullish on this newer, still under-the-radar dividend ETF from REX Shares based on its gargantuan yield, attractive monthly payout schedule, and portfolio of highly-rated tech stocks.

What Is the FEPI ETF’s Strategy?

FEPI’s strategy is to own large-cap tech stocks (the 15 stocks in the Solactive FANG Innovation Index) and write covered calls against these holdings in order to create enhanced income potential.

It’s a strategy that has grown in popularity in recent years, as similar funds like the JPMorgan Equity Premium Income ETF (NYSEARCA:JEPI) and the JPMorgan Nasdaq Equity Premium Income ETF (NASDAQ:JEPQ) have grown into some of the market’s most popular ETFs.

Essentially, FEPI sells covered calls against its holdings and uses the options premiums it receives from selling these calls in order to pay its holders a monthly distribution. This can be a great strategy for generating steady and above-average income, as evidenced by FEPI’s frequent payouts and large yield. These large-cap tech stocks drive considerable investor interest and feature plenty of volatility, so they are particularly well-suited for generating attractive options premiums.

The downside of this strategy is that FEPI holders potentially sacrifice upside from capital appreciation because if its holdings climb above the strike price for the calls it is selling, FEPI holders miss out on this additional upside.

For example, FEPI’s top holding is Nvidia (NASDAQ:NVDA). This is a theoretical example, but let’s say FEPI sells one contract of June 21 Nvidia calls with a strike price of $130 for a $120 premium. In this hypothetical example, the fund benefits by receiving a premium of ~$120 from the buyer of the options for selling these calls, which it can distribute to its holders.

However, if the shares of Nvidia rise above $130 on the closing date, to $150 for example, the fund is contractually obligated to sell these shares to the buyer of the call for the contracted price of $130, meaning that it didn’t benefit from any of the appreciation of $20 per share past the strike price.

However, if the shares of Nvidia stay below the strike price, the fund managers can sell new calls against them and repeat the process all over again to continually generate consistent income.

As long as investors understand these potential tradeoffs and accept the fact that they will likely miss out on some upside from price appreciation from time to time, this can be an attractive and effective strategy for generating considerable income on a monthly basis.

Massive Yield

It’s important to note that the level of FEPI’s monthly payout is not set in stone, and the fund doesn’t guarantee that it will make a monthly payout.

That being said, since launching in October 2023, the fund has been remarkably consistent so far, making a payout each month — the smallest of these was $1.09 in April. We covered FEPI shortly after it launched last year, writing that it had the potential for significant payouts, and this has largely played out.

Many websites will list FEPI’s yield as 14.9% — which is still incredibly attractive — but that doesn’t tell the whole story. This is its yield on a trailing 12-month basis, and the fund only launched late last year, so it has only made seven months of payments thus far.

Looking at the yield on a forward basis paints a clearer, though imperfect, picture. Using the fund’s most recent payout of $1.16 in May as the monthly payout going forward, the fund boasts a massive distribution yield of 25.2%. Even if payouts decrease slightly from May’s level and fluctuate, this yield will still be very high.

It’s hard to understate just how outsized this yield is. The S&P 500 (SPX) yields just a meager 1.4%, while 10-year treasury bonds yield a risk-free 4.4%. Even FEPI’s aforementioned peers, like JEPI and JEPQ, yield 7.7% and 9.8%, respectively, on a forward basis (using the same methodology as above).

Concentrated Holdings

FEPI owns 15 stocks, and its top 10 holdings account for 67.8% of its portfolio. FEPI is not very diversified and is highly concentrated, but diversification is not the fund’s goal.

Below, you’ll find an overview of FEPI’s top 10 holdings using TipRanks’ holdings tool.

As you can see, FEPI’s portfolio consists largely of the highly-rated large-cap technology stocks that have powered the market higher in recent years, such as Nvidia and its fellow magnificent-seven stocks, fellow chipmakers Micron (NASDAQ:MU) and Broadcom (NASDAQ:AVGO), and a handful of other tech names.

These holdings are highly rated by TipRanks’ proprietary Smart Score system. The Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks a score from 1 to 10 based on eight market key factors. A score of 8 or above is equivalent to an Outperform rating. Eight of FEPI’s top 10 holdings feature Outperform-equivalent Smart Scores, and three, Broadcom, Amazon (NASDAQ:AMZN), and Alphabet (NASDAQ:GOOGL), feature “Perfect 10” Smart Scores.

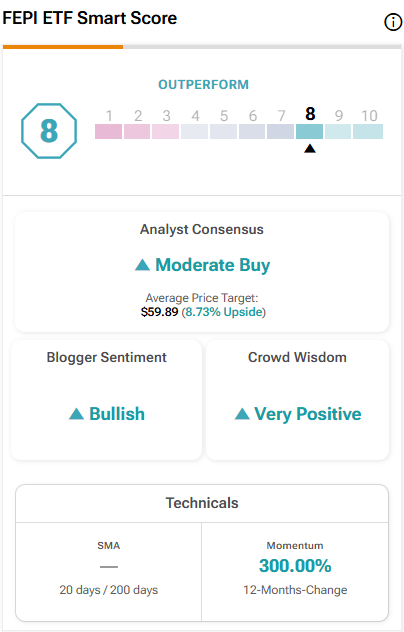

FEPI boasts an Outperform-equivalent ETF Smart Score of 8.

How Much Does FEPI Charge?

One downside of FEPI is that its expense ratio of 0.65% is fairly pricey. An investor putting $10,000 into the fund will pay $65 in fees annually. However, this is an actively managed fund with a fairly complex strategy, so the higher expense ratio is not necessarily surprising. If the fund can continue to deliver monthly payments to holders and maintain such a high yield, then few investors will complain about the expense ratio. However, if FEPI falters, then more investors will begin to question its expense ratio.

Not Without Risks

As discussed above, investors in the fund are potentially forgoing some upside from price appreciation in exchange for this large yield.

Beyond that, this is a fairly new fund and strategy, so it remains to be seen if its strategy will pan out over time or if it will be able to continue paying out this much over the long term.

Lastly, the fact that the fund is highly concentrated and heavily exposed to just one part of the market, large-cap tech, exposes investors to considerable risk if this segment of the market suffers.

Is FEPI Stock a Buy, According to Analysts?

Turning to Wall Street, FEPI earns a Moderate Buy consensus rating based on 13 Buys, four Holds, and zero Sell ratings assigned in the past three months. The average analyst FEPI stock price target of $59.89 implies 8.7% upside potential from current levels.

The Takeaway: A Standout Investment for Income Investors

Even in a world of higher yields, FEPI’s yield of over 20% stands out. I’m bullish on the ETF based on this massive yield and its monthly payout schedule, as well as its highly-rated portfolio.

As long as investors understand and are comfortable with the fact that this big-time yield comes with the tradeoff of potentially leaving a portion of potential upside from capital appreciation on the table, then FEPI can be a good option for generating monthly income. For this reason, I wouldn’t necessarily allocate my whole portfolio toward FEPI, but I believe it can be a useful tool for generating income within a diversified portfolio.

Signup bonus from