Dividend growth stocks have long been revered by investors as powerful vehicles for compounding wealth over the long term. By consistently increasing cash payouts to shareholders, these companies provide a rising income stream that can be reinvested, and turbocharged by the magic of compounding. And the best dividend growth stocks don’t just raise payouts but generate consistent earnings growth that drives steadily rising stock prices.

It’s the powerful one-two punch of escalating dividend income and capital appreciation that makes this an optimal investing strategy for building long-lasting wealth. With that in mind, here are two top dividend growth stocks that deserve consideration in any portfolio today: Abbott Laboratories (NYSE: ABT) and Target (NYSE: TGT).

Abbott Laboratories: A healthcare dividend stalwart

Abbott is a diversified global healthcare company operating across four main verticals: Medical devices, diagnostic products, pharmaceuticals, and nutritional products. Some of its most well-known products include the FreeStyle Libre glucose monitoring system, coronary stents, and Similac infant formula.

Despite a strong 12.4% gain in large-cap U.S. stocks in 2024, Abbott’s stock is actually down 1.64% year to date. However, the healthcare titan’s shares aren’t exactly cheap at 23 times forward earnings, compared to 21 for the S&P 500 index.

What makes Abbott such an attractive dividend play is its consistency. The company has raised its payout for a remarkable 52 consecutive years, marking over half a century of dividend growth.

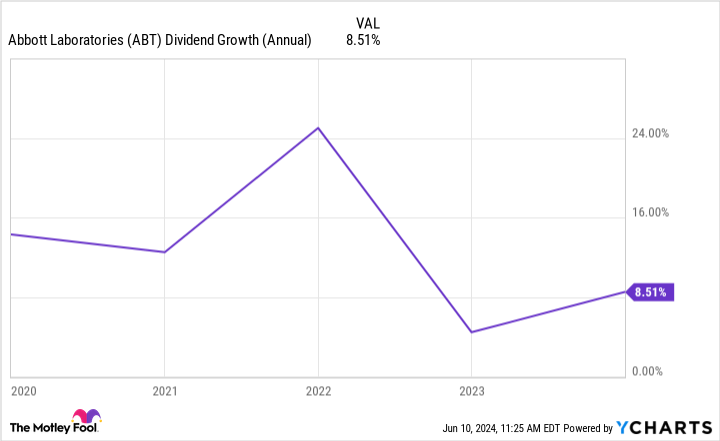

Abbott’s current dividend yield of 2% may not seem extraordinary, but it’s the growth rate that impresses. Over the past five years, Abbott has increased its dividend at an 8.5% annualized clip, topping the 6% average for its peer group.

With a reasonable payout ratio of 64.8%, Abbott has ample capacity to continue rapidly raising its dividend. After all, analysts project a noteworthy 11% earnings growth for the healthcare giant in 2025, fueled by escalating demand for its diversified product suite. Revenue is also expected to grow by a healthy 7.3% next year.

For investors seeking a rock-solid dividend growth stock in the defensive healthcare sector, Abbott checks all the boxes.

Target: A retail income growth machine

While Abbott flexes its strength in healthcare, Target has established itself as a formidable dividend grower in the retail space. As one of the largest general merchandise retailers in the U.S., Target reaches customers through nearly 2,000 stores and an expanding e-commerce presence.

Target’s stock is up a respectable 3.4% in 2024, but it lags behind the S&P 500’s double-digit gains. This performance gap leaves Target’s shares looking like a bargain at just 15.4 times forward earnings, compared to 21 for the index.

The retailer offers a mouthwatering 3% dividend yield to go along with its compelling value proposition. And like Abbott, Target has raised its payout for over five decades — an impressive 52 consecutive years and counting.

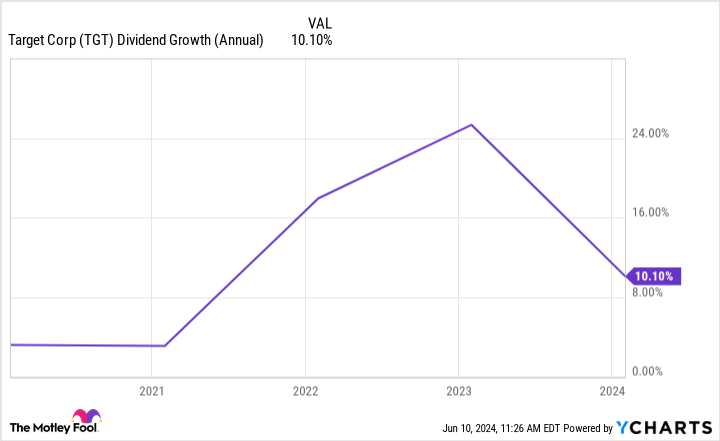

Target’s five-year annualized dividend growth rate of 10.1% towers over the 6% average for peers in the dividend growth category. With a conservative 49.1% payout ratio, Target also has ample room for additional dividend hikes.

For its next fiscal year, analysts forecast Target will grow earnings by 11.6% and revenue by 3.7%. As the company enhances its digital fulfillment capabilities and merchandising mix to appeal to cost-conscious customers, Target appears poised to deliver years of reliable dividend increases.

All told, Target offers an above-average dividend yield and growth rate at a bargain basement price.

Should you invest $1,000 in Abbott Laboratories right now?

Before you buy stock in Abbott Laboratories, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Abbott Laboratories wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $746,217!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 10, 2024

George Budwell has positions in Target. The Motley Fool has positions in and recommends Abbott Laboratories and Target. The Motley Fool has a disclosure policy.

2 Magnificent Dividend Growth Stocks to Buy Now was originally published by The Motley Fool

Signup bonus from