There are plenty of direct ways to invest in the housing market, such as homebuilders or residential construction companies. On the other hand, home improvement companies like Home Depot or Lowe’s (NYSE: LOW) — or a paint supplier like Sherwin-Williams — indirectly benefit from strong consumer spending.

Luxury homebuilder Toll Brothers (NYSE: TOL) is a direct way to play a supply/demand balance in housing. Whirlpool (NYSE: WHR) makes appliances and benefits from home sales and discretionary spending. And Lowe’s stands out as a great value.

Here’s why all three dividend stocks are excellent choices if you think spending on housing and home improvement is ready to rebound.

Build a better passive income portfolio with Lowe’s

Scott Levine (Lowe’s): When looking for stocks to benefit from the rebound in the housing market, it’s important to emphasize the need for patience. With the housing market currently facing headwinds from high interest rates, it’s unsurprising that home improvement powerhouse Lowe’s is also struggling. But this is hardly the company’s first rodeo.

Tracing its history back to 1921, Lowe’s has seen its share of rises and falls in the housing market, and it still remains an industry leader today. Moreover, it deserves considerable recommendation for its steadfast dedication to rewarding shareholders. For investors committed to a stock to both play the bounce back in the housing market and generate passive income, Lowe’s — with its 2.1% forward-yielding dividend — is a must-watch stock to have on their radars.

The first quarter of 2024 was rocky for Lowe’s, with revenue and net income both falling year over year, and management isn’t confident that things will improve during the remainder of the year. On the Q1 2024 conference call, management projected 2024 revenue of $84 billion to $85 billion, a decline from the $86.4 billion it reported in 2023, with comparable sales expected to fall 2% to 3%.

Savvy investors know, however, that this outlook doesn’t mean the company is moribund. Interest rates will recede. The housing market will recover, and Lowe’s will overcome these difficult circumstances.

Undeniably, the housing market has faced challenges over the past 50 years. During that time, though, Lowe’s has continued to pay a dividend — an increasing dividend.

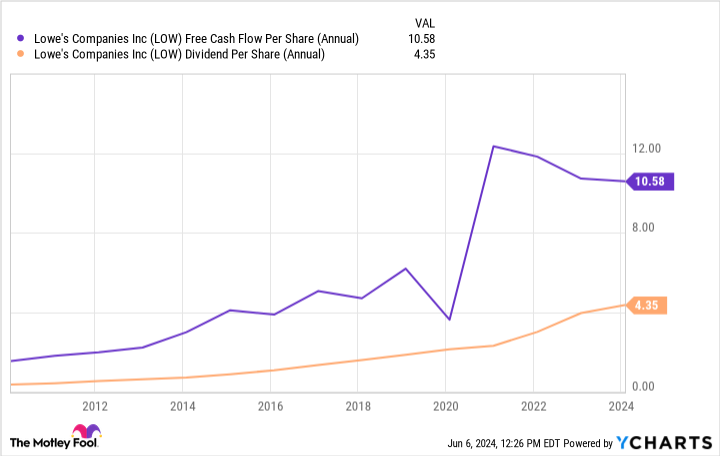

A Dividend King, Lowe’s has hiked its dividend higher for 51 consecutive years, and over the past 15 years, it has generated consistent free cash flow that has more than covered the dividend. While its situation is currently difficult, Lowe’s should overcome adversity and prosper in the long term, making it a compelling choice for income investors looking to bolster their passive income streams.

Toll Brothers is too cheap to ignore

Daniel Foelber (Toll Brothers): The luxury homebuilder has been on a wild ride the last few years, with the stock falling below $20 a share during the onset of the COVID-19 pandemic to surging to an all-time high above $135 a share earlier this year.

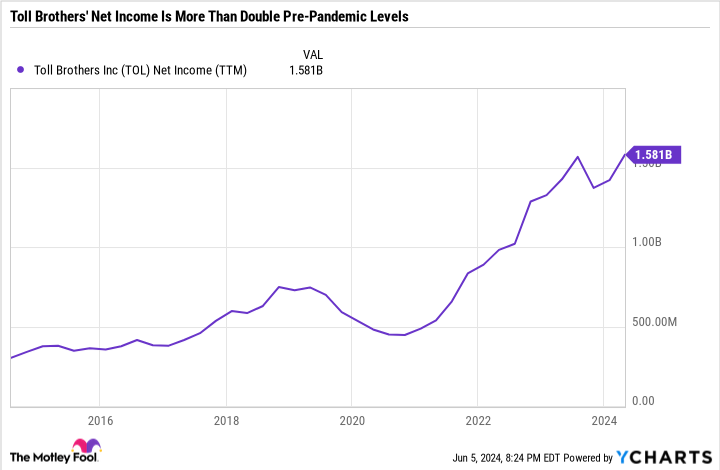

The price action of Toll Brothers paints a starkly contrasting picture to the doom-and-gloom housing market headlines. It’s been a rally led by fundamentals, with Toll Brothers generating an all-time high net income.

As is common with cyclical companies, Toll Brothers’ growth is expected to stall. Analyst consensus estimates for 2024 earnings per share (EPS) are $14.19 and $14.16 for 2025 — which sounds bad at first glance. But a price per share of $120.25 gives Toll Brothers just an 8.5 price-to-earnings ratio based on these estimates. For context, Toll Brothers’ 10-year median P/E is 11.8.

Toll Brothers pays a dividend. But with the stock’s rapid rise in recent years, the yield has decreased to just 0.8%.

Despite its low yield, Toll Brothers is a value stock worth considering if you believe the housing market is undersupplied. If that is true, there could be an extended growth period of new construction.

However, it’s important to be aware of macroeconomic indicators, like U.S. credit card debt, home prices, and mortgage interest rates. With all of these indicators pointing toward market headwinds, it makes sense why Toll Brothers’ earnings are expected to stagnate. Still, the stock could still be a long-term winner as long as supply continues to outpace demand.

Whirlpool is a value option for income-seeking investors

Lee Samaha (Whirlpool): I’m not going to sugarcoat this: Whirlpool’s first-quarter earnings disappointed, raising the risk that the company won’t hit its full-year earnings expectations. However, if the company merely meets management’s full-year guidance, there’s a strong chance the stock will be materially higher.

Let’s put it this way: The guidance calls for flat like-for-like earnings before interest and taxation (EBIT) margin and net sales resulting in ongoing EBIT of $1.15 billion dropping down into $550 million to $650 million in free cash flow (FCF). The current market cap of $5.08 billion implies a price-to-FCF multiple of just 8.5 times the midpoint of guidance. Moreover, FCF would provide ample coverage for the current dividend payout of $384 million, which puts the stock on a dividend yield of 7.5%.

This is fine, but Whirlpool’s first-quarter earnings report revealed disappointing developments. Sticky supply chain inflation led management to tell investors it’s trending toward the low end of the expected $300 million to $400 million in cost cuts. Meanwhile, raw material price inflation also threatens margins, and management abandoned its promotional investments in North America as it failed to achieve “our value-creation expectations,” according to CFO Jim Peters on the earnings call.

On a brighter note, the other three segments, major domestic appliances (MDA) Latin America, MDA Asia, and Global small domestic appliances (SDA), all grew margins and EBIT in the first quarter. In addition, Whirlpool announced a 5% price increase in MDA North America.

If the price increases stick and the other three segments continue trending, Whirlpool can hit its targets. Throw in the possibility of an improved housing market driving discretionary spending on MDA, and Whirlpool’s upside potential is significant.

Should you invest $1,000 in Lowe’s Companies right now?

Before you buy stock in Lowe’s Companies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Lowe’s Companies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $740,688!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 3, 2024

Daniel Foelber has no position in any of the stocks mentioned. Lee Samaha has no position in any of the stocks mentioned. Scott Levine has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Home Depot. The Motley Fool recommends Lowe’s Companies and Sherwin-Williams. The Motley Fool has a disclosure policy.

3 Dividend Stocks That Are Coiled Springs for a Rebound in the Housing Market was originally published by The Motley Fool

Signup bonus from