Over the last century, the stock market has stood on a pedestal above all other asset classes. While investing in Treasury bonds, housing, gold, and oil would have increased your nominal wealth, none of these other asset classes has come anywhere close to the average annual returns delivered by stocks over the very long term.

What makes Wall Street so special is its diversity of investments. With thousands of publicly traded companies and exchange-traded funds to choose from, there’s a really good chance there’s an investment vehicle (or 10) to satisfy everyone’s goals and level of risk tolerance.

But among these countless puzzle pieces, few strategies have been more consistently successful than buying and holding dividend stocks over extended timelines.

Last year, investment advisory firm Hartford Funds issued a report (“The Power of Dividends: Past, Present, and Future”) that analyzed the various ways dividend stocks have outperformed their non-paying public counterparts over the long run. One data set in this report was particularly telling.

In a collaboration with Ned Davis Research, Hartford Funds showed that companies paying a regular dividend to their shareholders more than doubled the annual average return of non-payers over a span of 50 years (1973-2023): 9.17% versus 4.27%. What’s more, dividend stocks were 6% less volatile than the benchmark S&P 500, while the non-payers were, on average, 18% more volatile.

Although dividend stocks have a lengthy track record of outperformance, no two income stocks are created equally. In some situations, a plunging share price can pump up a company’s yield and lure income seekers into a trap. But this isn’t always the case.

What follows are two beaten-down ultra-high-yield dividend stocks, with an average yield of 9.69%, which are begging to be bought in June.

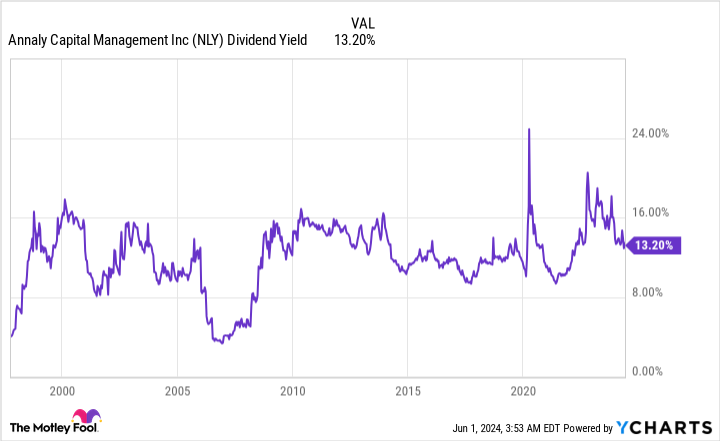

Time to pounce: Annaly Capital Management (13.2% yield)

The first supercharged dividend stock that’s been absolutely beaten to a pulp over the last decade — shares are down 58% on a trailing-10-year basis — but makes for a delectable buy for income seekers right now is mortgage real estate investment trust (REIT) Annaly Capital Management (NYSE: NLY). Annaly has returned $25 billion to its shareholders since its initial public offering in October 1997 and is currently yielding a jaw-dropping 13.2%.

There’s probably not an industry that’s been more universally disliked by Wall Street analysts for longer than mortgage REITs. The simple explanation behind this skepticism has to do with interest rates.

Mortgage REITs are highly sensitive to changes in interest rates, as well as the magnitude by which monetary policy is implemented. This is an industry that traditionally favors rate-easing cycles and transparent monetary policy changes from the nation’s central bank. But since March 2022, it’s an industry that’s dealt with the fastest rate-hiking cycle in four decades, as well as the longest Treasury yield-curve inversion of the modern era — i.e., short-term Treasury bills have higher yields than Treasury bonds set to mature in 10 or 30 years.

While there’s no denying that hawkish monetary policy, which has rapidly increased short-term borrowing rates, is negatively impacting Annaly’s net interest margin and the book value of its assets, an argument can be made that the tide is turning in its favor.

To begin with, we’ve reached a point where the Federal Reserve has begun slow-stepping its moves. Even in a rising-rate environment, Annaly can be successful. It simply needs telegraphed moves from the Fed to position its asset portfolio for success. If the Fed remains in a holding pattern on interest rates, or better yet kicks off a slow-stepped rate-easing cycle, Annaly should enjoy a modest expansion of its net interest margin.

To add to this point, the Treasury yield curve has historically spent the majority of its time sloped up and to the right. This is to say that longer-dated bonds have supported higher yields than shorter-maturing Treasury bills. The longer your money is tied up, the higher the yield should be. When this current inversion ends, Annaly’s net interest margin and book value can benefit.

If there’s a bright side to the central bank’s hawkish monetary policy, is that it’s stopped buying mortgage-backed securities (MBS). With the Fed out of the picture as a buyer, Annaly and its peers have had a clearer path to purchase what are now higher-yielding MBSs.

Another reason income seekers can confidently pounce on Annaly Capital Management is the composition of its $73.5 billion investment portfolio. The company closed out March with $64.7 billion in liquid agency assets. “Agency” securities are backed by the federal government in the event of default. While this added protection reduces the yield Annaly receives, relative to non-agency assets, it also allows the company to safely lever its portfolio to maximize its profits. This is how it’s able to maintain a double-digit yield.

With multiple variables pointing to long-term net interest margin and book value expansion, Annaly Capital Management looks like the perfect bad-news buy for dividend investors in June.

Time to pounce: Walgreens Boots Alliance (6.17% yield)

The second beaten-down ultra-high-yield dividend stock that’s begging to be bought by opportunistic income seekers in June is none other than pharmacy chain Walgreens Boots Alliance (NASDAQ: WBA). Shares of Walgreens have retraced by 83% since hitting an all-time high in 2015, with the company’s yield recently jumping up to north of 6%.

Though it’s not a comprehensive list, Walgreens has been battered by a plethora of headwinds that include:

-

Growing competition from online pharmacies.

-

Litigation concerning its role in the opioid crisis.

-

Increased shrinkage (theft) in a few major cities where the company operates.

-

A high level of debt, which isn’t ideal in a rising-rate environment.

-

Nearly halving its dividend in January to increase its cash flow.

While retail turnaround stories don’t occur overnight, Walgreens has the leadership and necessary tools to deliver for its patient shareholders.

As I’ve pointed out in the past, the single most-important change that Walgreens recently undertook was replacing Rosalind Brewer with Tim Wentworth as its new CEO.

Unlike Brewer, who had a retail background, Wentworth has decades of experience in the healthcare sector. In particular, he was previously the CEO of Express Scripts, the largest pharmacy-benefits management company in the country, as well as the founding CEO of Evernorth, Cigna‘s health services organization. Having someone with a healthcare background is critical to Walgreens Boots Alliance’s long-term success.

Wall Street also seems to be ignoring the fact that Walgreens has levers it can pull to reduce its expenses and positively impact margins as it works its way through short-term challenges. In addition to reducing its dividend to a sustainable level, the company is targeting $4.1 billion in aggregate annual cost savings.

Further, it’s been selling off non-core assets and investment positions, presumably with the intent to lower its outstanding debt and increase its financial flexibility. Selling off its Boots unit in the U.K. might also be on the table as a debt-reduction tactic.

Although it’s been a bumpy transition, Walgreens Boots Alliance has turned its attention to healthcare services. Despite a recent writedown of its investment in VillageMD, management remains focused on providing full-service health clinics co-located in its stores. Providing differentiation with these full-service clinics, all while keeping expenses under control, could yield profitable results from healthcare services by as soon as next year.

Don’t overlook the company’s digitization efforts, either. Even though cost-cutting is a key turnaround strategy, management hasn’t been afraid to spend on technology in an effort to revamp the company’s supply chain, or to build out its direct-to-consumer website to boost organic sales.

Last but not least, the valuation is as compelling as it’s ever been. A forward price-to-earnings (P/E) ratio of 5, coupled with Walgreens Boots Alliance trading at book value, marks an incredible deal for income seekers willing to exercise patience.

Should you invest $1,000 in Annaly Capital Management right now?

Before you buy stock in Annaly Capital Management, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Annaly Capital Management wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $671,728!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 3, 2024

Sean Williams has positions in Annaly Capital Management and Walgreens Boots Alliance. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Time to Pounce: 2 Beaten-Down Ultra-High-Yield Dividend Stocks Begging to Be Bought in June was originally published by The Motley Fool

Signup bonus from