Earnings season is in full swing, and investors still have their eyes on one big item: artificial intelligence (AI). Much of the buzz surrounding AI is saved for the “Magnificent Seven” — a catchy moniker that includes megacap tech behemoths Microsoft, Apple, Alphabet, Amazon, Nvidia, Meta, and Tesla. But that doesn’t mean no other companies are riding the wave.

With a market cap of just $51 billion, Palantir Technologies (NYSE: PLTR) may not be seen in the same light as big tech, but Palantir is making inroads in the space as well, and investors realized it last week.

Following the release of a jaw-dropping fourth-quarter earnings report on Feb. 5 after the market closed, Palantir stock rocketed by roughly 50% over the next five trading days.

From revenue to operating margins to cash flow to customer acquisition strategies, Palantir is giving investors no shortage of key performance indicators to drool over. Let’s analyze the report, and what the company’s current performance could spell for its future. Despite operating in the shadows of megacap tech, now could be a lucrative time to invest in Palantir as it pushes forward in the AI arms race.

Customer acquisition at its finest

2023 was full of exciting developments in the world of artificial intelligence. Microsoft invested billions into OpenAI, the start-up behind ChatGPT. Alphabet and Amazon swiftly followed, with each investing in a competing platform called Anthropic.

In an effort to stand out, Palantir created a unique lead generation strategy to help fuel interest in its newest product, its Artificial Intelligence Platform (AIP). Specifically, the company began hosting immersive seminars that it calls “boot camps.” During these sessions, attendees can try out Palantir’s software and get a better understanding of how the company can play a critical role in generative AI-driven use cases.

During Palantir’s fourth-quarter earnings call with analysts, investors learned that the company completed over 500 boot camps last year. It conducted only 92 during 2022. While it’s clear that the boot camps are in high demand, a thorough analysis of the company’s customer growth is worth a look.

Palantir had 497 customers in the fourth quarter, a 35% increase over the year-ago period. Palantir is witnessing surging demand in the private sector in particular, with customer count increasing 44% annually.

This is important, because for many years Palantir was knocked by Wall Street bears over the company’s heavy reliance on government deals. It’s clear that the advent of AIP is building demand and business outside of its legacy public sector operation is thriving.

Margins are expanding, and cash flow is compounding

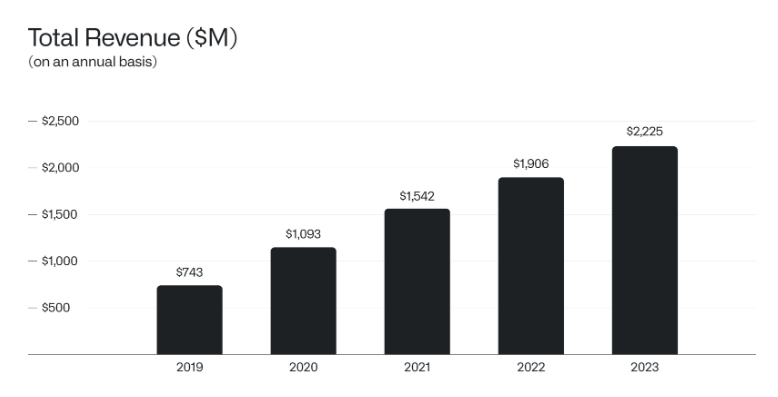

The chart below illustrates Palantir’s annual revenue for the last five years.

Palantir was founded in 2003 and the chart shows that it took almost two decades for the company to reach the milestone of $1 billion in annual revenue. And yet in just three short years, the company has doubled its revenue. This growth is astounding considering how tough the macroeconomic outlook has been in recent years, coupled with the a fierce competitive landscape.

Perhaps more importantly, Palantir is also generating healthy margin expansion, which is flowing right to the bottom line. After adjusting for non-cash expenses like stock-based compensation, Palantir’s operating margin expanded from 22% in 2022 to 28% in 2023. Furthermore, free cash flow grew 260% year over year to $730 million.

Some things to consider

The combination of top-line growth and margin expansion has helped bolster Palantir’s liquidity. As of Dec. 31, the company had $3.7 billion of cash and marketable securities, and no debt on its balance sheet.

While this is encouraging to see, investors should take note of the disparity between the company’s customer growth and its revenue acceleration. Even though customer count increased by 35% last year, Palantir’s total revenue only grew by about 17%.

To me, this signals that Palantir is playing the long game when it comes to AI. In other words, the boot camps are merely a low-cost mechanism to get customers into the pipeline and convert them into paying users of the company’s software. However, through a combination of use-case discovery rooted in AI along with enhanced customer-nurturing efforts, Palantir has the ability to upsell and cross-sell customers over time. As such, the company should enjoy significant revenue acceleration as time goes on.

I’d caution investors from buying into any hype narratives surrounding Palantir. Focusing on the long-term picture and assessing the company’s position among enterprise software providers specializing in AI will be important.

For me, the fourth-quarter report was a preview of what investors could expect on an ongoing basis. As artificial intelligence software becomes more prominent in IT budgets, Palantir should be well positioned to benefit from secular tailwinds. Now looks like a great opportunity to scoop up shares for both new and existing investors, and prepare to hold on for the long term. The ride appears to just be getting started.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 12, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, Palantir Technologies, and Tesla. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, Palantir Technologies, and Tesla. The Motley Fool has a disclosure policy.

Palantir Stock Is Going to the Moon Following Its Jaw-Dropping Earnings Report was originally published by The Motley Fool

Signup bonus from