“If you don’t find a way to make money while you sleep, you will work until you die.” These words of wisdom come from Berkshire Hathaway‘s legendary CEO Warren Buffett — one of history’s best dividend investors.

Incredibly, the Oracle of Omaha’s investment conglomerate is on track to earn more than $6 billion over the next year just for sleeping on the stocks already in its portfolio. With that astounding level of passive income generation in mind, read on to see why two Fool.com contributors think that investors can score wins by adding these Buffett-backed dividend stocks to their own portfolios.

One of Buffett’s smartest stock plays

Keith Noonan: Buffett has famously said that his preferred holding period for stocks in the Berkshire Hathaway portfolio is “forever.” Much of the investment conglomerate’s incredible track record of success can be traced back to the Oracle of Omaha’s focus on finding great businesses that are worth owning for the long haul.

Of course, that doesn’t mean that Berkshire never exits its stock positions. But it’s exceptionally rare that Buffett’s company completely closes out a holding only to make another big bet on the same stock shortly after. As rare as it is, that’s exactly what happened with Bank of America (NYSE: BAC) stock.

Roughly three and half years after initiating a position in the banking giant, Berkshire Hathaway sold all of its Bank of America stock in the fourth quarter of 2010. Buffett wound up selling the stock at roughly a third of the price that his company had initially purchased shares at.

Bank of America had seen a weaker-than-anticipated recovery as it emerged from the Great Recession and continued to struggle with issues related to the housing crash and subprime mortgage crisis. The company was also facing uncertainty about whether the U.S. debt ceiling would be raised.

But Buffett set up a deal to make a big investment in the stock in 2011. Berkshire wound up purchasing $5 billion worth of the bank’s preferred shares, and it also secured the rights to purchase 700 million shares of Bank of America stock at a price of $7.14 per share. Buffett’s company wound up exercising the stock warrants in June 2017 and scoring massive profits on the deal.

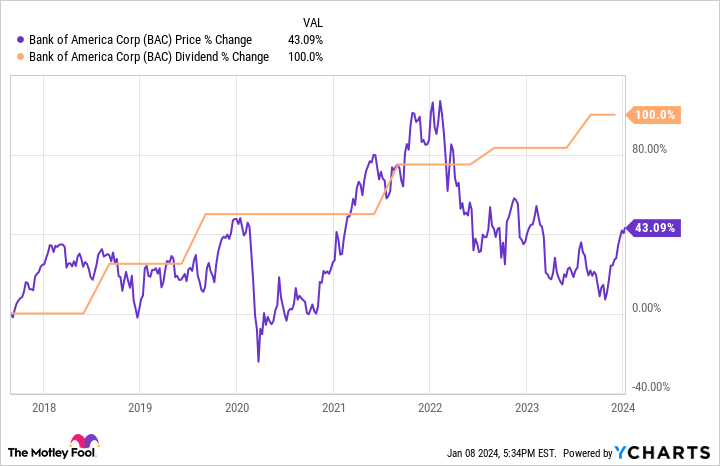

Not only did Berkshire see continued gains on the stock, it’s also benefited from hikes for the company’s dividend.

Today, Bank of America stock sports a dividend yield of roughly 2.8%. The stock pays a forward dividend of $0.96 per share. That means that even if the company doesn’t raise its payout over the next year, Berkshire will enjoy nearly $1 billion in annual dividend income just for sitting on its Bank of America holdings.

Bank of America has continued to strengthen its position in the banking industry, and there’s a good chance that long-term investors will score wins with the stock.

No wonder Warren Buffett loves Coca-Cola stock

Parkev Tatevosian: Warren Buffett has several excellent dividend stocks in the Berkshire Hathaway portfolio. One of my favorites right now is Coca-Cola (NYSE: KO). The beverage giant has roughly a century of history serving customers tasty drinks they have grown to love. That trust and brand loyalty could keep Coca-Cola around for yet another century or maybe more.

Over the decades, Coca-Cola has grown to a massive scale, with revenue of $43 billion in 2022 (complete 2023 numbers are not yet available). Operating income totaled $12 billion in 2022, up from $11 billion in 2013. Dividends per share have also increased from $1.12 in 2013 to $1.76 in 2022.

Given that Coca-Cola is wonderfully profitable, it can support dividend payments for the long term. You see, the most sustainable method to pay dividends is through profits. Much like an individual cannot spend more than they earn, a corporation cannot support a dividend over earnings in the long term.

Depending on the strength of its balance sheet, Coca-Cola can continue paying a dividend when earnings turn south for a while. However, eventually it will run out of savings and exhaust its borrowing capacity.

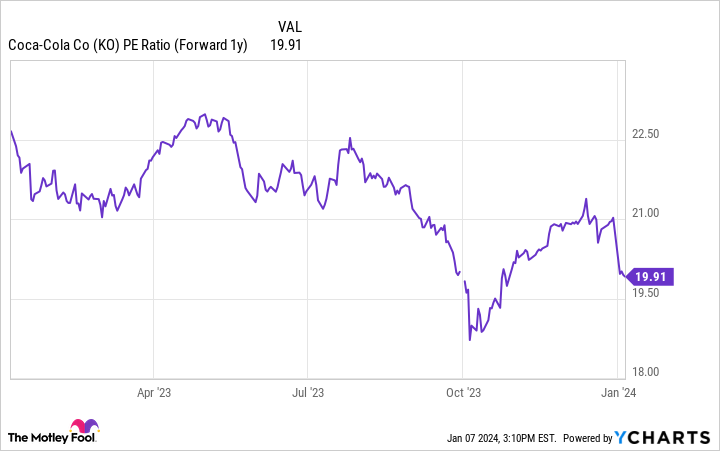

Coca-Cola’s stock is not expensive at a forward price-to-earnings ratio of 19.9. There you have it. A company with roughly a century of serving customers well, solid profits that support the dividend, and an attractive valuation.

Should you invest $1,000 in Bank of America right now?

Before you buy stock in Bank of America, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Bank of America wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 8, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Keith Noonan has no position in any of the stocks mentioned. Parkev Tatevosian, CFA has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bank of America and Berkshire Hathaway. The Motley Fool recommends the following options: long January 2024 $47.50 calls on Coca-Cola. The Motley Fool has a disclosure policy.

2 Warren Buffett Dividend Stocks to Buy in 2024 and Hold Forever was originally published by The Motley Fool

Signup bonus from