Tobacco giant Altria Group (NYSE: MO) is one of the best-performing stocks of all time, but slowing growth has reduced it to a high-yield income specialist that has badly lagged the broader market for the past decade.

The good news is that recent developments are painting a brighter future for Altria. The company’s growing potential in smokeless products offers investors hope, while its familiar dividend creates a lucrative one-two punch that could make Altria a respectable market performer again.

There are three key reasons to consider buying the stock today.

1. Eating market share in next-generation products

The nicotine industry has settled on several non-burning products as the eventual replacement for smoking: electronic cigarettes, heated tobacco devices, and oral nicotine pouches. Altria has dominated the U.S. market with Marlboro and its other brands for decades. However, it’s vulnerable as it battles competitors for market share in next-generation categories.

It hasn’t been easy, but Altria is starting to gain ground in several areas. It’s competing in oral nicotine pouches with its former sister company, Philip Morris International, which owns the market leader, Zyn. Altria’s On! brand increased its market share to 7.1% of the oral tobacco category in the first quarter, up from 6.4% a year ago. Q1 On! volumes were up 32.1% year over year.

Last June, Altria acquired the pod-based electronic cigarette product NJOY. Since then, it has ramped up its distribution to over 82,000 stores in just a year, a 132% increase. That has helped the brand grow its market share from 5.1% to 11.5% since the acquisition. Altria also recently received Food and Drug Administration (FDA) market authorization for several NJOY menthol variations. It’s the first company to receive menthol approval.

To be clear, Altria still depends on smokeable products, which needs to change eventually. However, these market share gains show Altria is successfully executing its strategy with next-generation products. Now, it just needs time to build them into a more meaningful piece of the business.

2. Slow Iqos launch could buy Altria’s core business time

Altria’s biggest threat might be Philip Morris’ plans to launch its leading heated tobacco brand, Iqos, in the United States. The two tobacco companies just ended an agreement under which Altria had exclusive rights to market Iqos in the U.S. market, freeing Philip Morris to pursue its own plans. Launched overseas in 2014, Iqos has proven capable of switching smokers away from cigarettes in international markets. Iqos’ success would potentially accelerate Altria’s cigarette declines.

However, Iqos doesn’t appear as immediate a threat as it once did. Philip Morris is waiting for FDA authorization of its newest model, Iluma, for a broad rollout. The application was submitted to the FDA in October. It’s tough to say how long approval might take; the original device’s application took two years to gain approval. Philip Morris had planned a Q2 test launch in four cities (starting in Texas) using its older, approved model, but there hasn’t been an indication yet that it’s happened.

Meanwhile, Philip Morris is grappling with keeping up with surging Zyn demand that has caused supply shortages in retail and attracted political attention. Iqos isn’t going away, but it looks like it’s on the back burner for the time being. Any delay benefits Altria’s core business. Besides, it’s unknown when and to what degree Iqos will impact its cigarette sales. Investors probably shouldn’t panic until there is reason to.

3. The dividend remains a launch pad for investment returns

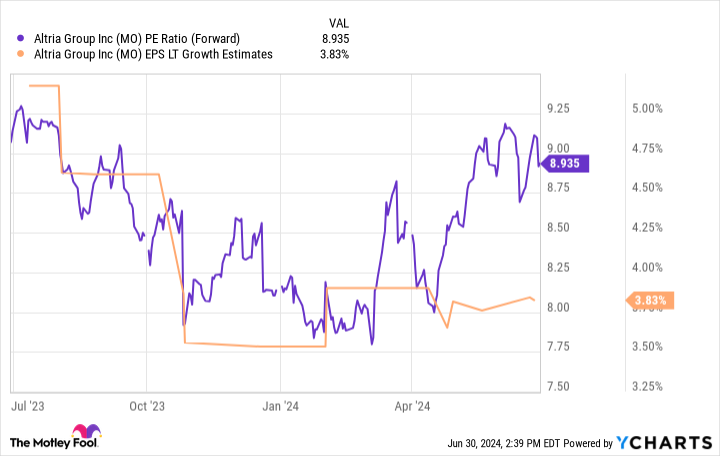

The magic of Altria stock is that it doesn’t need much growth to provide solid investment returns. The company’s famous dividend yields 8.6% today, almost what the broader market returns in an average year. The stock once traded at an unsustainable valuation, and that painful unwinding was the biggest culprit behind Altria’s poor past performance. The P/E ratio has fallen from 25 in 2016 to under 9.

Could the stock go lower? Of course! Still, Altria’s current valuation makes far more sense for the company’s growth prospects, which makes a repeat of the past five years less likely.

Assuming Altria’s P/E ratio stays the same, earnings growth should translate to investment returns. Analysts believe earnings will grow by an average of 3% to 4% annually over the next three to five years. Add that 8.6% yield, and investors could enjoy 11% and 12% annual returns.

That’s far better than what shareholders have endured for most of the past decade.

Should you invest $1,000 in Altria Group right now?

Before you buy stock in Altria Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Altria Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $786,046!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 2, 2024

Justin Pope has positions in Philip Morris International. The Motley Fool recommends Philip Morris International. The Motley Fool has a disclosure policy.

3 Reasons to Buy Altria Stock Like There’s No Tomorrow was originally published by The Motley Fool

Signup bonus from