The S&P 500 is setting one new all-time high after another in 2024. The widely used stock market benchmark climbed 15% in the first half of 2024, and it’s up more than 50% from the lows of the 2022 bear market.

The largest companies have led the current market rally in the S&P 500. In fact, market concentration is reaching levels investors haven’t seen since the 1970s.

The rising market concentration is a result of various factors. It’s worth pointing out that many of the largest companies have seen solid earnings growth as they’ve been well positioned amid the artificial intelligence boom. But rising concentration has historically reversed, and one market indicator suggests the tides may be about to turn.

U.S. money supply is finally growing again

Declining growth in money supply is historically tied to increased concentration among stocks, according to Khuram Chaudhry, Head of European Quantitative Strategy at J.P. Morgan. When money is easily accessible for cheap, smaller companies can grow more easily. When money supply is tight, bigger companies have the advantage of using existing cash flows and their balance sheet to fund their growth.

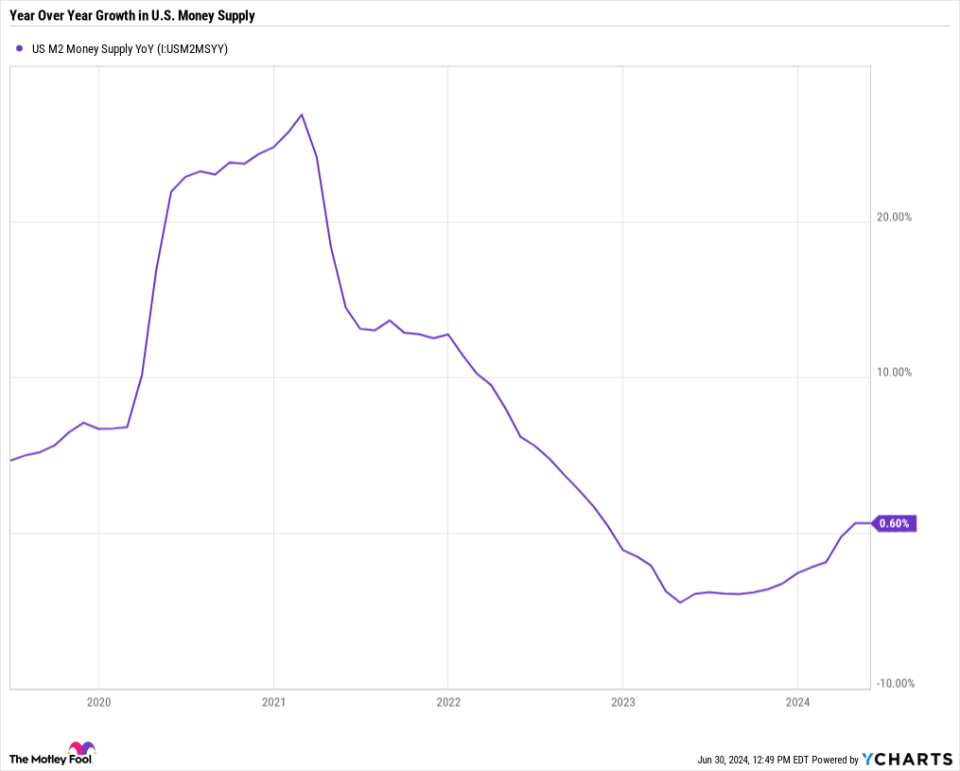

Starting in 2021, we saw a decline in a measure of the U.S. money supply called the M2 money supply. M2 includes cash in circulation, deposit accounts, money market accounts, and certificates of deposit. It’s basically all the easily accessible money in the country. By 2022, amid tightening policies from the Federal Reserve, year-over-year growth in the M2 money supply was negative. It stayed that way through the first quarter of this year.

But M2 money supply is finally growing again. In April and May, M2 money supply increased about 0.6% year over year. While it remains well below its peak levels from 2022, we’re finally seeing increased liquidity.

The money supply could get a further boost later this year, as the Fed looks to ease its constraints. Chairman Jerome Powell said he expects to cut interest rates one time this year, but many analysts think that’s conservative. Futures markets indicate that the majority of traders currently expect at least two interest rate cuts by the end of this year.

As money supply growth accelerates, it could make it easier for smaller companies to grow. As a result, those smaller companies could lead the next leg in the current market rally.

How to invest as money supply growth accelerates

If you expect easing fiscal policies will reverse the steep run up in market concentration, there are a few ways you could invest.

The most straightforward way to invest in declining market concentration is to use an equal-weight index fund like the Invesco S&P 500 Equal Weight ETF (NYSEMKT: RSP).

The S&P 500 is a cap-weighted index, which means the largest companies have a bigger influence over how the index moves than smaller companies do. With the current level of market concentration, the top three companies account for over 20% of the entire index’s value. The top 10 account for over 37%. If you invest in a standard S&P 500 index fund, your portfolio is highly dependent on just a handful of companies.

With an equal weight S&P 500 index fund, the fund invests all your money equally across every component of the S&P 500. The portfolio gets rebalanced once per quarter and adjusted for new companies joining the S&P 500 and old companies leaving. Historically, the equal weight index outperforms the cap-weighted index, as smaller companies generally grow faster than the largest companies. That hasn’t been the case recently, though.

Another option is to invest outside of the S&P 500. There are thousands of investable stocks trading on public exchanges. The S&P 500 only tracks about 500 of the largest companies. Declining market concentration would favor small- and mid-cap stocks as well. Buying shares of a Russell 2000 index fund like the iShares Russell 2000 ETF (NYSEMKT: IWM) is a great way to get exposure to small-caps. The Vanguard Extended Market ETF (NYSEMKT: VXF) provides a way to match the performance of nearly every stock in the market except those in the S&P 500.

While no indicator is right all the time, money supply growth isn’t the only factor that suggests now may be a great time to start investing in smaller companies. So, you may want to tilt your portfolio toward investments like those above as more and more signs point toward a big change in the stock market.

Should you invest $1,000 in Invesco Exchange-Traded Fund Trust – Invesco S&P 500 Equal Weight ETF right now?

Before you buy stock in Invesco Exchange-Traded Fund Trust – Invesco S&P 500 Equal Weight ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Invesco Exchange-Traded Fund Trust – Invesco S&P 500 Equal Weight ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $751,670!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 2, 2024

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Adam Levy has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends JPMorgan Chase. The Motley Fool has a disclosure policy.

U.S. Money Supply Is Finally Growing Again, and It Could Signal a Big Change Is Coming in the Stock Market was originally published by The Motley Fool

Signup bonus from