Some beaten-down stocks have significant upside potential and, therefore, present attractive buying opportunities for investors. However, other companies that are failing to keep pace with the market and are likely to keep struggling for a long time aren’t worth investing in. Which group does CVS Health (NYSE: CVS) belong to?

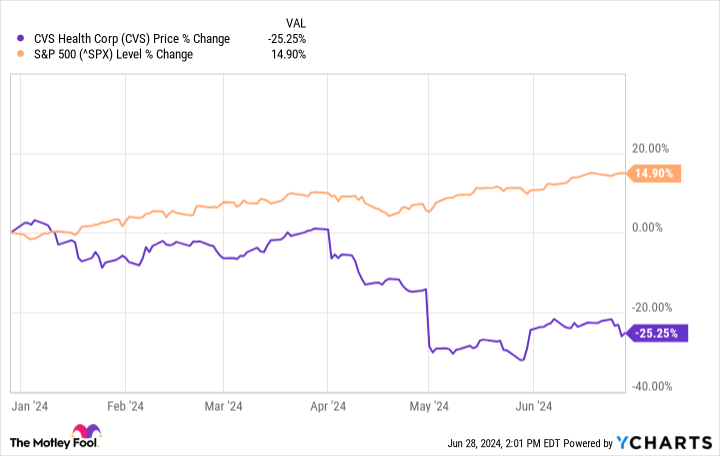

The healthcare giant is down by a massive 25% since the year started. Can CVS Health bounce back in the second half of the year? How is it likely to perform beyond the next six months? Let’s try to get answers to these questions.

Why CVS Health is struggling

CVS Health is dealing with poor financial results. Its Medicare Advantage (MA) business poses serious short-term problems. Medical care utilization rates continue to be higher than the company had anticipated, leading to significantly increased costs and lower operating profits than hoped. This dynamic, which has been going on for the better part of two years, has led to CVS Health having to decrease its guidance several times, something the market strongly dislikes. It did so again in the first quarter.

The company now expects adjusted earnings per share (EPS) and cash flow from operations of $7.00 and $10.5 billion, down from $8.30 and $12 billion, respectively. Even with the increased utilization from its MA segment, CVS Health’s revenue growth isn’t as impressive as investors would like. In the first quarter, the company’s top line clocked in at $88.4 billion, up just 3.7% year over year.

That’s partly due to CVS’ continuing slowdown in coronavirus-related revenue — from diagnostic tests, for instance — compared to earlier in the pandemic. Given this combination of headwinds, it’s not surprising that the market isn’t exactly in love with the company’s shares right now.

Is a rebound in the cards?

Unfortunately, CVS Health’s Medicare-related problems will likely continue to impact its financial results in the second half of the year. It wouldn’t be too surprising if the healthcare giant revises its guidance again. Its projected EPS for the fiscal year isn’t particularly impressive, nor will its top-line growth substantially rebound given all the issues it is facing. So investors shouldn’t expect CVS Health to perform much better through December. That said, the short-term behavior of equity markets is always hard to predict.

And even if CVS Health’s outlook through the end of the year were better, it would make little sense to invest in the stock for that reason. The more important question for long-term investors is whether it can still perform over the long run. Even with its near-term headwinds, the company seems to have the tools to do so.

There’s one important tailwind that should benefit CVS Health’s business: The world’s aging population. It means increased demand for CVS’ offerings, especially since the company boasts a comprehensive suite of services throughout the healthcare sector. It is a leading pharmacy chain that also provides primary care services and health insurance, and it is now developing biosimilar drugs.

Furthermore, CVS Health has built a strong reputation over the years. Developing a trusted brand is an important competitive advantage in any industry, but especially in healthcare, where people’s lives are at stake.

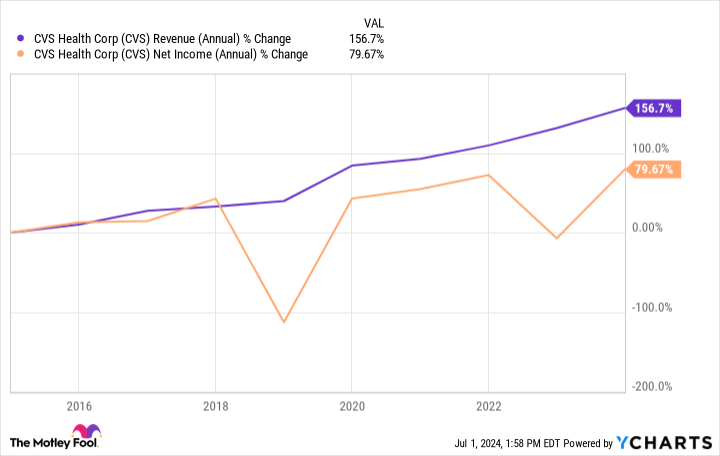

What about the company’s financial results? CVS Health has encountered issues before. But it has generally generated growing revenue and profits over the long run. The company should be able to navigate its recent headwinds.

Finally, CVS Health also offers a decent dividend program. Its payouts have increased by 142% in the past decade. CVS Health can offer growing payouts to investors for years to come. And over the long run, the company’s current issues will be long forgotten. It is still worth it for long-term investors to buy the stock.

Should you invest $1,000 in CVS Health right now?

Before you buy stock in CVS Health, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and CVS Health wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $761,658!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 2, 2024

Prosper Junior Bakiny has no position in any of the stocks mentioned. The Motley Fool recommends CVS Health. The Motley Fool has a disclosure policy.

Down by 25%, Can CVS Health Bounce Back in the Second Half of The Year? was originally published by The Motley Fool

Signup bonus from