Nvidia (NASDAQ: NVDA) is the “it” stock of the year, and that’s an understatement. It’s up 150% this year, crushing the broader market, and that catapulted it to the very top spot as the largest public company by market cap. It’s since dropped down to third place behind leaders Microsoft and Apple, and top status may continue to change hands.

What does this mean for investors?

A stock’s market cap is the total value of all of its shares. It’s calculated by multiplying share price by the number of shares outstanding. Nvidia stock trades at about $123 as of this writing and has 24.6 billion shares outstanding, giving it a total market cap of $3 trillion.

Market cap doesn’t tell investors much about a stock, but it can still be informative. The companies with the highest market caps are doing well and have investor confidence. They’re winning companies. They’re well-established leaders, and there’s little risk to their businesses.

At the same time, they may not grow as fast as smaller companies that have yet to be discovered. But does that mean they tend to underperform the market?

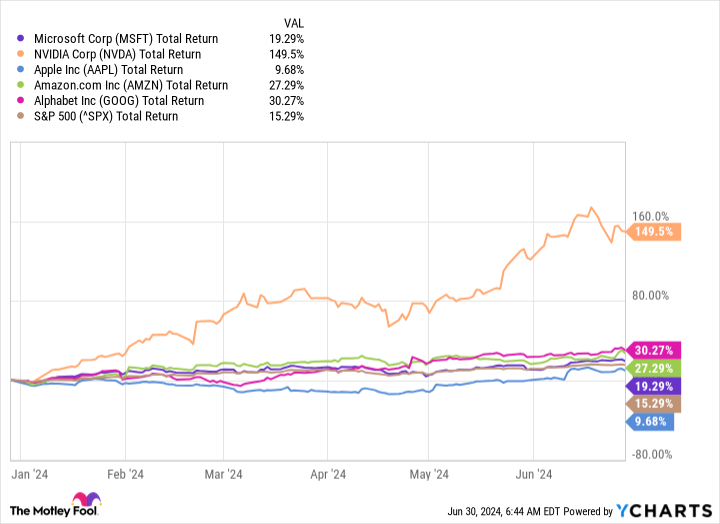

The five companies with the highest market caps right now, with the exception of Apple, have all been beating the market this year. The others include Amazon and Alphabet.

MSFT Total Return Level data by YCharts

That’s testament to the concept that winners keep on winning. These are all top companies that have a proven track record and are keeping it up.

Why is Nvidia’s market cap increasing?

Nvidia has garnered an incredible amount of attention due to its generative artificial intelligence (AI) chips. There’s enormous demand for all kinds of generative AI applications, and Nvidia is the leading producer of chips that can handle the data loads for these kinds of applications.

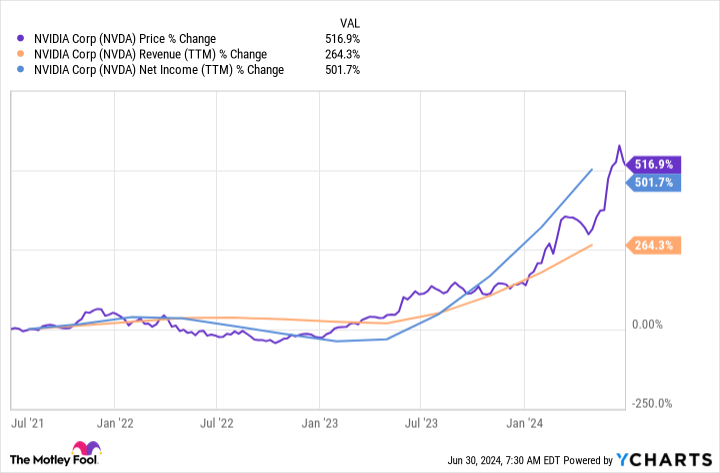

Stock price movements aren’t always logical, but broadly, share price increases as a company performs well. There are all kinds of metrics that measure performance: revenue growth, margins, profitability, and return on equity are a few examples. Nvidia has been reporting stunning growth since the beginning of the generative AI craze, driving a huge price increase.

Why did it fall back?

Nvidia stock also benefited from excitement around its recent 10-for-1 stock split, which fueled more interest in the stock and still more increases. It briefly topped the market cap charts right after the split, but since that wasn’t driven by any specific company performance metric, it fell back into third place.

Part of that fall was due to valuation concerns. It’s getting quite expensive; even after the pullback, Nvidia stock trades at a price-to-earnings (P/E) ratio of 72. That’s a well-deserved premium valuation, but even the best companies can’t support an earnings multiple that outweighs its worth. Microsoft, by comparison, trades at a P/E of about 39.

Does it make sense for Nvidia to be the most valuable company in the world? It doesn’t take in nearly the same amount of sales as Amazon or profit as Apple. But neither does Microsoft. Nvidia is growing faster than all of the other top five market cap companies, though, and the market is pricing that into its valuation.

If Nvidia continues to provide the infrastructure for applications that drive global business, it will likely stay near the top of the market cap list for the foreseeable future. But it may not be able to keep up this kind of growth forever, and investors should be prepared for a pullback.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $761,658!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 2, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jennifer Saibil has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Nvidia Briefly Became the Largest Company on the Stock Market. What Does This Mean for Investors? was originally published by The Motley Fool

Signup bonus from