Super Micro Computer (NASDAQ: SMCI), a company that’s been around for 30 years, soared into the spotlight only in recent times. The company makes equipment such as servers, workstations, and full rack scale solutions — and these and other items are in high demand thanks to artificial intelligence (AI) customers.

As a result, earnings went from slow progression several years ago to high growth over the past few years. And Supermicro’s share performance followed, soaring more than 4,000% in just five years. The S&P 500 even invited Supermicro into the index in the first half of the year — proof the company has made it into the elite group of players driving growth.

So Supermicro has become pretty successful, but considering the steep share price gains, is it too late to invest in the stock now? Let’s find out.

Growing faster than its industry

First, let’s take a look at how Supermicro’s business took off as the AI boom accelerated. A key reason for the company’s growth, which has been more than five times faster than its industry over the past 12 months, has to do with its ability to quickly deliver customized products to customers.

Supermicro does this by working hand in hand with the world’s top chip designers, including Nvidia, so that when they launch a new chip, Supermicro can immediately integrate it into its products. Also, the company’s products use many of the same components, making it easy and fast to build new systems and tailor a platform to a customer’s needs.

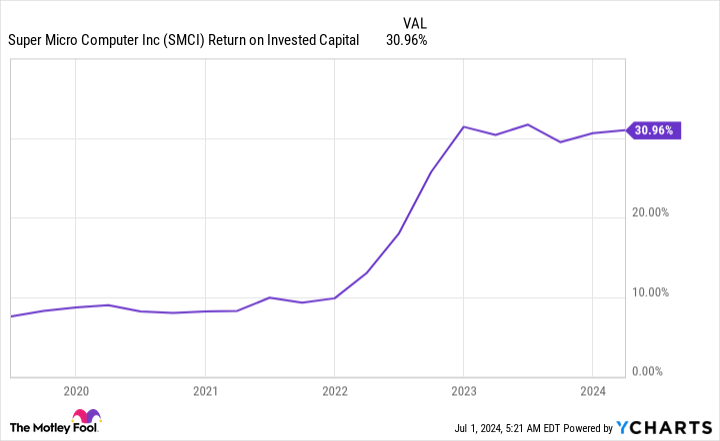

This has helped Supermicro grow revenue from about $3 billion in 2021 to that amount in just one quarter earlier this year. Return on invested capital also has soared, showing the company is benefiting from its investments.

Looking ahead, there’s reason to believe Supermicro’s growth and popularity among customers will continue, for a few reasons. The company has seen sustained record demand for its full rack scale solutions incorporating chips from Nvidia, Intel, and Advanced Micro Devices. Nvidia’s upcoming launch of its new Blackwell architecture and other releases from these companies should keep this momentum going.

A new growth driver

And Supermicro’s development of direct liquid cooling (DLC) technology may finally pay off. The intense operations in AI data centers generate high levels of heat, and this problem is set to worsen as the technology accelerates. DLC addresses the issue, which means Supermcro’s work in this area could offer it a new growth driver.

About 15% of racks shipped this year will include DLC, and that will increase to 30% next year, The Register reported, citing a speech by Supermicro CEO Charles Liang at the Computex event. And here too, Supermicro is able to achieve the speed customers like. Liang said lead time on orders has declined to two to four weeks — that’s down from as much as a year, according to the newspaper.

Finally, Supermicro has ramped up manufacturing, adding, for example, a new facility in Malaysia focused on high volume at a lower cost structure. The addition of this site will increase the company’s total revenue capacity to beyond $20 billion.

Too late to buy?

Now, let’s get back to our question: Is it too late to get in on Supermicro after its enormous gain in recent years? A look at valuation shows us that Supermicro trades for 34x forward earnings estimates, down from a peak of more than 45 earlier this year.

It’s also important to consider that the AI market is forecast to grow to more than $1 trillion by the end of the decade, up from about $200 billion today. This implies we’re still in the early stages of the AI story.

So, yes, if you bought shares of Supermicro a few years ago, you made a great move. But if you didn’t, it isn’t too late to benefit from this company’s growth — because there’s likely a lot more ahead, considering all the points I mention. And that’s why Supermicro still makes a fantastic AI growth buy for the long-term investor right now.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $757,001!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 24, 2024

Adria Cimino has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel and short August 2024 $35 calls on Intel. The Motley Fool has a disclosure policy.

Is It Too Late to Buy Super Micro Computer Stock Now? was originally published by The Motley Fool

Signup bonus from