The stock market has been on a good run lately. The S&P 500 is up 14% year to date, and the Nasdaq Composite has risen by 17%. A lot of this performance has been driven by the large, well-known tech companies in the news almost daily. However, some wonderful tech businesses don’t get as much media coverage but are worth considering as investments.

Here are two great tech stocks to buy right now. Each company has been reporting solid results and has a large market opportunity to pursue. Let’s dig in and see why.

Fortinet

Fortinet (NASDAQ: FTNT) may not be the first cybersecurity company that comes to mind for most investors, but it has been posting strong results for many years. In fact, since its 2009 initial public offering (IPO), shares are up more than 3,400%, easily outpacing the S&P 500. The story has been different over the past year when Fortinet has seen its stock fall 19%, driven by three sharp declines following earnings reports.

The stock’s recent struggles resulted from a slowdown in some key metrics. Year-over-year revenue growth has slowed in each of the last five quarters, and billings (which are a measure of future revenue) have followed a similar trajectory. These two results combined indicate to investors that things will be bumpy in the short term.

Despite this top-line deceleration, Fortinet was still able to keep its bottom line stable and generate strong free cash flow. Additionally, the company expects to see stronger results throughout the second half of 2024. Revenue for the full year is expected to grow between 8% and 10%. By comparison, revenue growth for the first quarter was only 7%. Billings are expected to be up between 0% and 3% for the full year after falling 6% in Q1.

Today’s stock price would indicate the market isn’t ready to give credit for these future results yet, but there’s a case to be made that the company’s current struggles will be short lived, presenting a compelling buying opportunity.

Procore

Some of the most successful companies in the world have gotten to where they are by disrupting incumbents in an industry. Procore (NYSE: PCOR) is trying to be a disruptor in the construction-management space. Currently, construction professionals use a wide variety of legacy-software products or other documentation systems including spreadsheets and even pen and paper. Procore has a product that is designed to get all of a project’s stakeholders together onto one platform to help streamline the construction process.

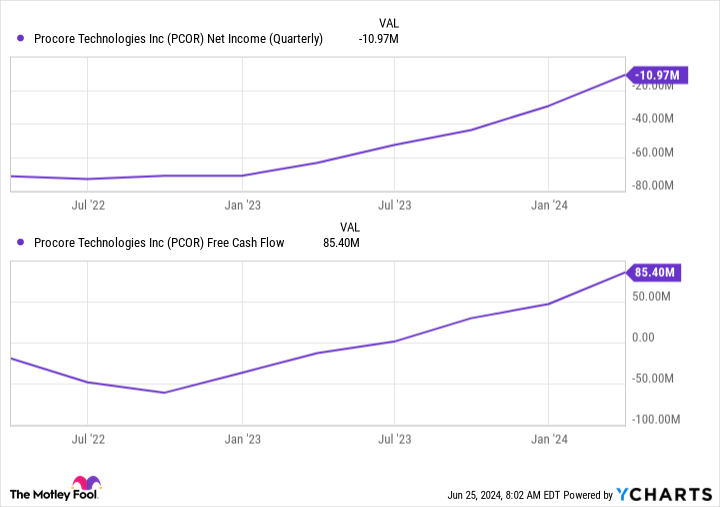

Procore has only been a public company since 2021, but it has consistently posted impressive results that improve over time. Revenue has been growing steadily, and it has wooed an increasing number of customers, including large clients spending substantial sums annually on its platform. Because the company is still in growth mode, it’s not yet profitable. However, there has been steady progress toward reaching profitability. Consider its net loss and free-cash-flow improvements over the past two years.

PCOR Net Income (Quarterly) data by YCharts.

Procore is also operating in a massive industry. The company estimates the global-construction spend will be $15 trillion in 2030. Even if that number is 50% lower in reality, there’s no denying the size of the opportunity for Procore is impressive. Steady growth over time should result in plenty of business for Procore even if it ends up sharing the market opportunity with competitors.

The bottom line for investors

Both Fortinet and Procore are posting impressive financial results in industries that should have plenty of market opportunity in the future. Neither has gotten a lot of media attention thus far, which could make them even more attractive as potential investments. Both companies present compelling risk/reward opportunities for investors.

Should you invest $1,000 in Fortinet right now?

Before you buy stock in Fortinet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Fortinet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $757,001!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 24, 2024

Jeff Santoro has positions in Fortinet and Procore Technologies. The Motley Fool has positions in and recommends Fortinet and Procore Technologies. The Motley Fool has a disclosure policy.

2 Top Tech Stocks to Buy Right Now was originally published by The Motley Fool

Signup bonus from