When access to the internet began to proliferate in the mid-1990s, the growth trajectory for American businesses changed forever. Although we’ve witnessed numerous innovative technologies and buzzy trends come and go over three decades, including genome decoding, nanotechnology, and blockchain technology, none have come close to rivaling the game-changing leap forward that the advent of the internet delivered.

However, the rise of artificial intelligence (AI) has professional and everyday investors believing that the next great technological advance has arrived.

The lure of AI is about more than just improving operating efficiency by using software and systems for tasks that humans would normally oversee or undertake. The buzz has to do with AI software and systems having the ability to learn over time without human intervention. This can give AI-driven solutions application in virtually all sectors and industries.

Though estimates are all over the place when it comes to the long-term growth potential of AI, the analysts at PwC believe it can add $15.7 trillion to the global economy by 2030.

It’s otherworldly dollar figures like this that have investors flocking to the undisputed artificial intelligence leader, Nvidia (NASDAQ: NVDA).

On paper, Nvidia’s ramp has been textbook

Since the green flag waved at the start of 2023, shares of Nvidia have skyrocketed by 766% and added up to $3 trillion in market value. For a brief period last week, Nvidia was the largest publicly traded company, ahead of Microsoft and Apple.

The fuel that’s lit a fire beneath Nvidia’s stock is its top-tier AI-graphics processing units (GPUs). The company’s H100 GPU has become the go-to chip used by businesses wanting to train large language models and run generative AI solutions. Last year, Nvidia was responsible for 98% of the 3.85 million AI-GPUs that were shipped, per TechInsights.

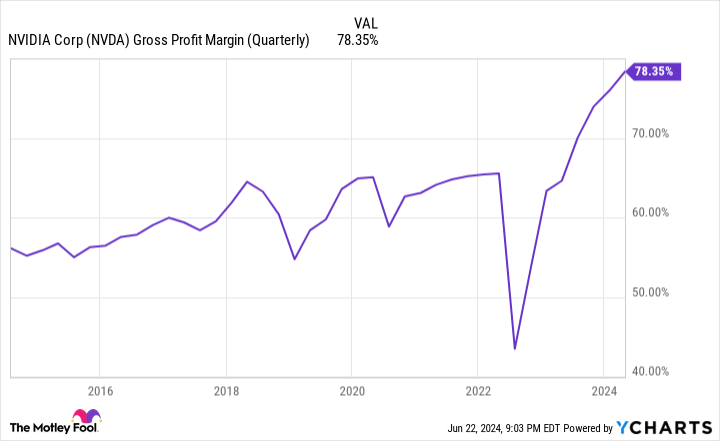

In addition to possessing compute advantages with its H100 GPU, the supply of these in-demand chips has been heavily outweighed by demand. As a result, Nvidia has been able to substantially increase its sales price, which helped lift its adjusted gross margin to more than 78% in the fiscal first quarter (ended April 28).

The innovation doesn’t stop with the H100, either. In March, CEO Jensen Huang unveiled Blackwell, Nvidia next-generation AI-GPU architecture, which is designed to expedite various facets of accelerated computing, including quantum computing, generative AI, and engineering simulations. More recently, Nvidia introduced the world to its “Rubin” AI platform, which is expected to make its debut in 2026.

On paper, Nvidia’s scaling has been textbook. But dig beneath the surface and you’ll find three ominous signs that suggest this AI leader is in a bubble.

1. A forecast decline in sequential gross margin

The first sign that Nvidia may not, in fact, be perfect, can be seen in the company’s adjusted gross margin guidance for the fiscal second quarter. After delivering a scorching-hot 78.35% adjusted gross margin in the first quarter, Nvidia has forecast a 75.5% adjusted gross margin (+/- 50 basis points) for the current quarter. This represents a projected sequential decline of 235 to 335 basis points.

On one hand, Nvidia’s gross margin has meaningfully expanded over the last five quarters, thanks in large part to its phenomenal AI-GPU pricing power. But a retracement of 235 to 335 basis points in adjusted gross margin signals that competitive pressures are starting to weigh on its pricing power.

During the third quarter, Intel is expected to begin rolling out its Gaudi 3 AI-accelerator chip on a broad scale. Meanwhile, Advanced Micro Devices has been ramping up production of its MI300X AI-GPU. Even if Nvidia’s chips maintain their competitive compute advantage, the sheer presence of these new chips reduces the AI-GPU scarcity that’s fueled its pricing power.

And that’s not all…

Nvidia’s four largest customers by net sales are all internally developing AI-GPUs for their data centers. Regardless of whether these in-house chips are complementary to Nvidia’s H100 or designed to eventually replace it, we’re likely witnessing a peak in ordering activity from America’s most-influential businesses. That’s bad news for Nvidia’s adjusted gross margin.

2. Insiders aren’t buying a single share

The second ominous sign that Nvidia’s stock could be headed for trouble can be seen in the trading activity of the company’s insiders.

In December 2020, Colette Kress, Nvidia’s Chief Financial Officer, made an open-market purchase for 200 shares of her company’s stock. In the 42 months since this purchase, no Nvidia insider has bought a single share.

Recently, Nvidia insiders haven’t been able to hit the sell button fast enough. Between June 13 and June 20, Jensen Huang disposed of more than $94 million worth of Nvidia stock. This comes on the heels of dozens of additional sales from officers and directors of the company over the previous six months.

To be fair, not all insider selling activity comes with a bad connotation. Insiders will occasionally exercise options before they expire and sell their shares. They might also be selling a portion of their stake to cover a federal and/or state income tax bill.

However, the other side to this coin is that there’s only one reason insiders buy shares of stock: they expect it to rise in value. With not one well-compensated member of management or the board buying a single share of Nvidia stock on the open market for 42 months, the message is pretty clear — Nvidia’s stock is pricey.

3. Nvidia’s valuation harkens to the peak of the dot-com bubble

The third ominous sign that points to artificial intelligence leader Nvidia being in a bubble is its valuation.

On the surface, Nvidia doesn’t appear to be overly expensive. It’s valued at approximately 35 times forward-year earnings and the consensus on Wall Street is that its earnings per share (EPS) will grow by an annualized rate of 46% through 2028. If these prognostications proved accurate, Nvidia would still be reasonably cheap for investors with a long-term mindset.

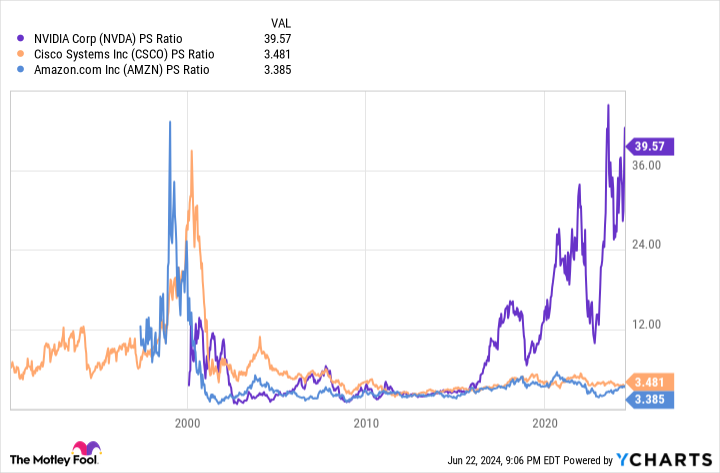

Where things get dicey is when you compare Nvidia’s trailing-12-month (TTM) price-to-sales (P/S) ratio to other market-leading businesses prior to the bursting of the dot-com bubble.

Nvidia’s peak of 42 times TTM sales pretty much matches the TTM P/S ceiling for Amazon and Cisco Systems during the dot-com bubble. Both Amazon and Cisco eventually shed 90% of their value, with Wall Street forced to lower its growth forecasts in order to give the internet adequate time to mature as a technology.

This is a key point that’s constantly overlooked with game-changing innovations, technologies, and trends. Investors have, without fail, overestimated the adoption of new technologies for 30 years. Even though AI is the hottest thing since the advent of the internet, it’s not remotely close to being a mature technology. In fact, most companies don’t even have a clear game plan of how they’re going to utilize Ai to grow their sales and profits.

With history showing us that every next-big-thing innovation over the last 30 years has endured a bubble-bursting event in its early innings, it’s only logical to expect AI to follow suit. If and when the AI bubble bursts, the most-direct beneficiary of AI euphoria (Nvidia) is likely to be hit the hardest.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $774,526!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 24, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Sean Williams has positions in Amazon and Intel. The Motley Fool has positions in and recommends Advanced Micro Devices, Amazon, Apple, Cisco Systems, Microsoft, and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel, long January 2026 $395 calls on Microsoft, short August 2024 $35 calls on Intel, and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Nvidia Is Far From Perfect: 3 Ominous Signs That Suggest Wall Street’s Artificial Intelligence (AI) Leader Is in a Bubble was originally published by The Motley Fool

Signup bonus from