Nvidia (NASDAQ: NVDA) and Broadcom (NASDAQ: AVGO) both announced 10-for-1 stock splits in recent times. That’s because shares of these technology giants have surged, surpassing $1,000, as demand from artificial intelligence (AI) customers boosted revenue quarter after quarter. Nvidia completed its stock split earlier this month, and Broadcom’s operation is set for next month.

The AI market may be in the early days of its growth story, and this is great news for both of these tech giants. Analysts predict that today’s $200 billion market may surpass $1 trillion by the end of the decade. This along with Nvidia’s and Broadcom’s own growth prospects make both companies compelling buys right now. But if you could choose just one of these stock split giants to buy right now, which one makes the better choice? Let’s find out.

The case for Nvidia

Nvidia sells the world’s top-performing graphics processing unit (GPU), or the chip that powers some of the most crucial AI tasks like training and inferencing, for example. The tech giant also sells a wide range of products and services to help companies reach their AI goals and even aims to lead in new fields such as sovereign AI — an area involving the development of AI by countries. Nvidia predicts sovereign AI, which brought in zero revenue last year, will bring in billions this year.

And this is on top of an already bright growth picture. Nvidia’s earnings have climbed in the triple digits quarter after quarter, and revenue has reached records thanks to the dominance of its chips and related products in the AI market. This could continue as Nvidia has promised to update the performance of its chips on an annual basis — and the company has the financial strength to keep this innovation going.

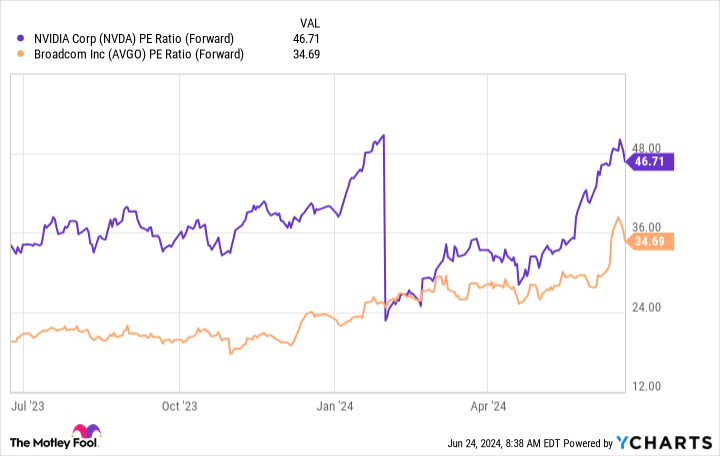

Today, Nvidia is more expensive than it was prior to its stock split even though the per-share price is lower. Stock splits lower the stock price but don’t impact the market value of the company or the stock’s valuation. So Nvidia is a solid buy today, but a pricier one than it was a few weeks ago.

The case for Broadcom

Broadcom is a semiconductor and networking expert, making the switches and other products used everywhere from our homes to our smartphones — and growth has particularly taken off for Broadcom in AI datacenters. In the most recent quarter, AI revenue surged 280% to $3.1 billion, and the company predicts AI revenue will reach beyond $11 billion for the full year.

The company is a leader in the global Ethernet switch chips market, and this should be a driver of growth moving forward. Seven of the biggest eight AI clusters operating today use Broadcom Ethernet products, and the company predicts that next year all “mega-scaled” GPU clusters will use Ethernet.

Broadcom earnings and share price also could gain thanks to its recent acquisition of VMware, a cloud software company. Including VMware, the company’s revenue soared 43% to $12.5 billion (excluding VMware, the gain was only 12%) in the quarter.

A look at valuation shows us Broadcom, like Nvidia, has become more expensive in recent times as its stock price has continued to gain. Still, the company makes a good buy at these levels.

Should you buy Nvidia or Broadcom?

The choice is difficult as both of these companies play key roles in the high-growth area of AI. But if I had to choose one stock to pick up right now, I would go for Broadcom. The stock is trading at a discount to Nvidia, which hasn’t always been the case in the recent past, and its level in relation to forward earnings estimates is very reasonable.

NVDA PE Ratio (Forward) data by YCharts

Also, it’s important to keep in mind that Broadcom is just starting to see the positive impact of the VMware purchase — as this gains momentum, we should see the results in earnings, and this could serve as a catalyst for stock performance.

Should you buy Broadcom now or wait for the split? The split will offer you the opportunity to purchase a smaller stake in Broadcom without relying on fractional shares. Considering today’s Broadcom price and the ratio of the split, the stock probably will trade for about $165 post-split. So, with just that amount, you can buy a share of Broadcom once the operation is complete.

But if you plan to invest the amount of Broadcom’s current price (about $1,600) or more, there’s no reason to wait. This top AI stock is one to get in on now and hold onto as the AI story develops.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $723,729!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 24, 2024

Adria Cimino has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

Better Artificial Intelligence (AI) Stock Split Buy: Nvidia vs Broadcom was originally published by The Motley Fool

Signup bonus from