Jun. 21—OLD LYME — Just as the company embarks on one of its most ambitious development plans ever, READCO Property Management LLC, a family-owned business run by Michael Lech with more than 2 million square feet of commercial space, has been bought out by multifamily home specialist and project partner Trio Properties LLC of Glastonbury.

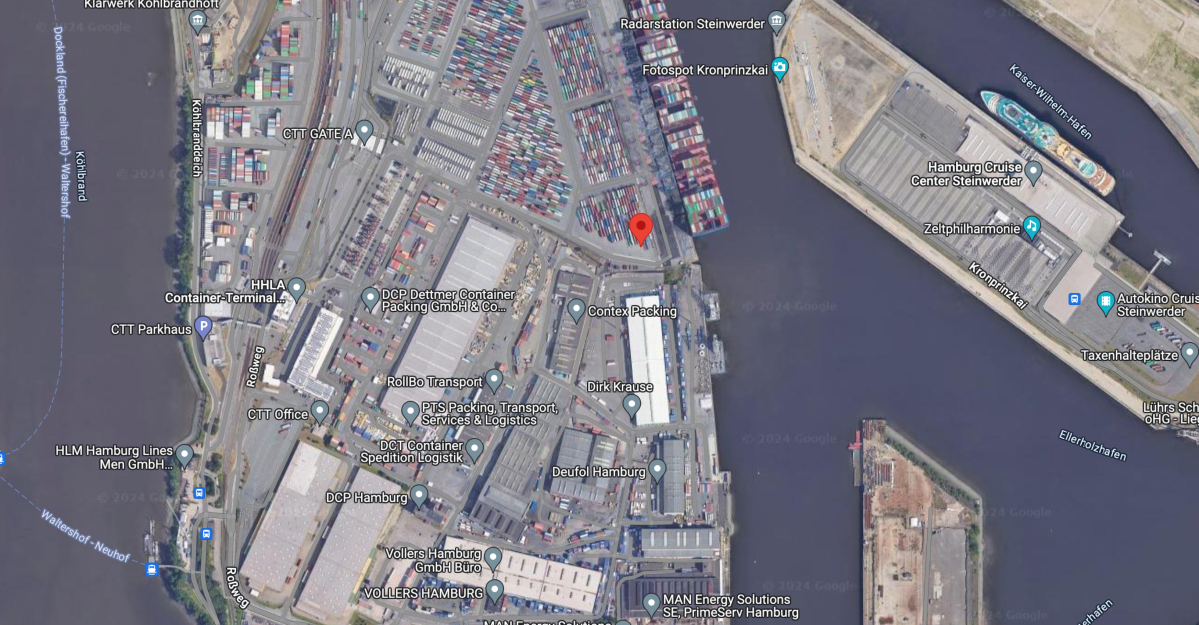

The combined company, to be called Trio Property Management LLC, is currently seeking approvals for a massive $70 to $80 million project on Route 2 in Pawcatuck that will involve creating a total of 232 apartments while demolishing a vacant movie theater and bank building and creating medical and recreational facilities.

The decision to add a multifamily dimension to the project was made only recently, and is currently in front of the Stonington Planning & Zoning Commission, which already gave approval to READCO to develop the site as a neighborhood development district.

“It’s a big project for us,” Lech said. “We really think this will be a tipping point for Route 2. We think multifamily homes could be a big addition to the Route 2 corridor. We want to set a standard.”

Lech, in a phone interview Thursday, said he is remaining on to manage the READCO portfolio as chief investment officer within Trio, adding that all of his Old Lyme employees will be retained as well. The combined company, with about 130 employees total, is headquartered in Glastonbury, but has projects all over the state and into New York and other contiguous states.

Trio is led by longtime partners Jeff Ferony and Jeremy Browning, who now have 2,500 multihousing units as well as manage a smaller collection of commercial and retail spaces totaling about 200,000 square feet.

“Successful property management is about the people behind the buildings, and both READCO and Trio share the great fortune of having some of the best in the business,” Ferony, president of the combined management portfolio, said in a release.

“We have a lot of complementary skills,” added Browning, who will lead property development operations under the READCO name, in a Zoom interview. “We have a similar philosophical approach, a people-first philosophy.”

According to the release, commercial and multifamily developments will be executed under the READCO name. READCO already owns or manages several major properties in southeastern Connecticut, including the Lighthouse Square shopping center in Groton, the East Lyme Stop & Shop and Hartford HealthCare facilities in Mystic and Waterford, among others.

The mixed-use project in Stonington, to be called Pawcatuck Farms, will include a 30,000-square-foot Hartford Healthcare medical facility as well as a large recreational complex currently targeting pickleball as the main element. Other outdoor recreational areas could include such amenities as a pool, green space and basketball courts.

The area also includes a Stop & Shop supermarket and McDonald’s restaurant, both of which will remain.

If all goes well, READCO hopes to break ground on the project in the fall, with the first of the apartments due to be completed within 14 to 18 months, Browning said. Financing is being sought through Build4CT, a program of the Connecticut Housing Finance Authority, which would require at least 20% of units be set aside as affordable to a single person making $63,000 a year or less (or a higher salary for larger families).

“We certainly love the area,” Browning said. “We’re great with what’s happening in New London and Groton.”

And he’s very happy with the strength of the Trio team re-enforced by Lech’s expertise in commercial investment.

“All of our corporate team will have a deeper bench and a broader resource base,” Browning said.

Lech said he sees the sale of his company to Trio, the terms of which were not released, as a way to collaborate around the latest wave of development that is taking off in the region: multifamily, spurred by job creation at Electric Boat and its suppliers.

“That’s where all the action is right now,” Lech said. “We really see multifamily as the strongest factor in the state right now.”

Signup bonus from