Nvidia captured the investing world’s attention. The semiconductor maker grew at a lightning pace over the last two years as the leading provider of the chips that make artificial intelligence (AI) possible.

Recently, the company executed a 10-for-1 stock split, meaning investors now have 10 times as many shares, with each one worth 10% of what they were just before the split. This move, while not directly affecting the value of shareholders’ portfolios, opened the door to more investors who lack access to fractional shares and therefore couldn’t afford the hefty share price before the split.

The stock is up over 10% since the split. There are many factors at play here, but smaller investors who can now afford to buy in might have contributed to the gain.

Now, another hot semiconductor stock is looking to follow suit. Broadcom (NASDAQ: AVGO), whose shares have risen over 60% in 2024 alone, is the latest to initiate a split. The company also chose a 10-for-1 ratio, to take effect on July 15.

So does this make it a solid pick? Let’s look at what Broadcom has going for it and some of the challenges it faces.

Strong revenue growth driven by AI

At the heart of the technology driving AI are the chips that have made Nvidia into a multitrillion-dollar company. But these chips do not stand alone; there are a lot of components that go into building the server farms that power AI applications like ChatGPT.

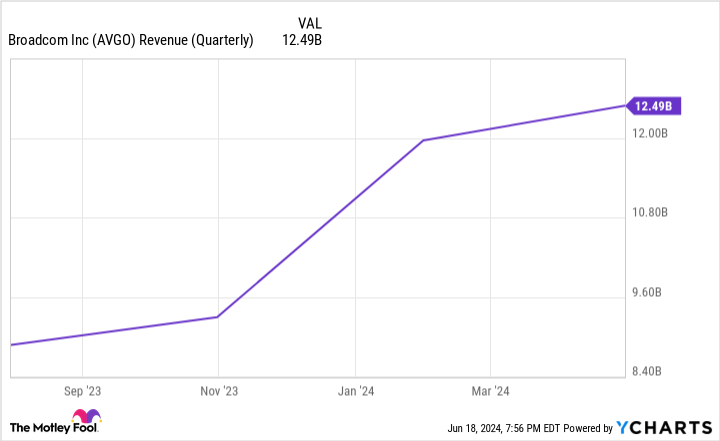

One of the most crucial components is the one that gets all of these chips to talk to one another within a server, and then gets all of the servers to do the same. That’s where Broadcom comes in with networking technology that helps communication among all the pieces that make up a server farm. That led to some serious revenue growth in this last year.

And this seems likely to continue for quite some time. The company raised its expectations for 2024 revenue to $51 billion, up from about $36 billion the year before.

It’s not just AI — Broadcom’s recent acquisition is paying off, too

Last year, Broadcom bought VMware, whose products enable companies to build out cloud solutions. It has been a big boost to the company’s bottom line.

In its most recent earnings report, Broadcom CEO Hock Tan said that it wasn’t just AI that was driving growth. “Broadcom’s second-quarter results were once again driven by AI demand and VMware. … Infrastructure software revenue accelerated as more enterprises adopted the VMware software stack to build their own private clouds,” Tan said.

The $69 billion investment the company made last year for VMware appears to have been a good bet by helping the company to succeed outside the AI market everyone is focused on.

Keep an eye on the company’s balance sheet

Broadcom grew to its current size due in large part to its habit of buying up the competition. This means the company now has huge revenue but is also highly leveraged, which could spell trouble if revenue doesn’t grow the way the market seems to believe it will.

One measure of this is its debt-to-equity ratio, which indicates how much a company is relying on debt versus shareholder equity. Broadcom currently has a ratio of 1.5. That’s pretty high. Nvidia, for example, has a debt-to-equity ratio of just 0.5, a much healthier number.

This may come back to bite Broadcom down the line in a more unfavorable market. Despite this, the company is still a compelling choice in the AI field. Just keep an eye on how it intends to deal with this debt.

Should you invest $1,000 in Broadcom right now?

Before you buy stock in Broadcom, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Broadcom wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $830,777!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 10, 2024

Johnny Rice has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

After Nvidia’s Stock Split, This Semiconductor Stock Is Next. Here’s What to Expect. was originally published by The Motley Fool

Signup bonus from