Despite my optimism about the long-term prospects of curative gene therapy and CRISPR Therapeutics (NASDAQ:CRSP) stock, a sense of pragmatism and potentially a reality check are in order. Noting the necessary development of treatment centers and the need for more long-term data to encourage greater treatment adoption, I accept that CRISPR stock may not take off for some time. Nonetheless, I remain bullish, given the company’s leading position in the gene-editing space.

CRISPR Therapeutics: The Opportunity

CRISPR Therapeutics has developed life-changing treatments for genetic diseases affecting millions of people worldwide. Its first marketable product, CASGEVY is a gene therapy for sickle cell disease (SCD) and beta-thalassemia, which impacts over 300,000 newborns annually. Not all these people have severe forms of illness, which can be debilitating and disproportionately impact those of African heritage.

The treatment employs CRISPR-Cas9 technology to precisely cut DNA at specific locations, allowing the correction of genetic mutations. The CRISPR-based therapy costs around $2.2 million per patient. That might sound expensive, but it’s worth noting that SCD-related lifetime medical costs were estimated at $1.7 million in 2023; this is simply the cost of treating the illness — not providing a cure.

It would be wrong to assume that millions of people will be lining up for this treatment right away. I’ve seen a range of estimates, but let’s be conservative. Assuming just 20,000 patients, the total revenue generated would be $44 billion. It’s a huge and potentially underappreciated market.

However, it’s important to note that Vertex Pharmaceuticals (NASDAQ:VRTX) owns 60% of the therapy, combining CRISPR’s gene-editing expertise with Vertex’s commercialization capabilities. This partnership enhances the potential to bring these therapies to market efficiently but means CRISPR Therapeutics would receive $17.6 billion in sales in this hypothetical example. Still, this would be significant for a company with a market cap of just $5.5 billion.

CASGEVY has been widely approved in key markets, including the U.S., UK, EU, and Saudi Arabia – where SCD is particularly prevalent – marking a significant milestone in its adoption and potential to revolutionize genetic disease treatment. Regulatory approvals in major regions underscore the therapy’s promising efficacy and safety profile.

CRISPR Therapeutics and several of its peers have targeted SCD and beta-thalassemia because the illness is caused by a mutation in a single gene (HBB gene), making it a simpler target for gene editing technologies like CRISPR-Cas9 compared to diseases involving multiple genes such as heart disease, type 2 diabetes, and obesity. In many ways, it’s an easy first target.

The current treatment serves as a litmus test for the broader application and adoption of novel gene-based therapies. The Swiss company has a diverse portfolio of gene-based therapies, including treatments targeting hepatocellular carcinoma (liver cancer), hematological malignancies (blood cancers), diabetes, and cardiovascular disease.

What’s Stopping CRISPR Therapeutics?

The stock has actually pulled back since the beginning of the year when it started gaining regulatory approval for CASGEVY. The obvious reason for this is that there has been little major news to follow these developments, and investors may be losing patience. However, I believe a dose of reality and plenty of pragmatism is in order.

First, unlike small-molecule drugs, CRISPR needs to establish a host of authorized treatment centers. These tend to be at established healthcare institutions and are not standalone facilities. In the Q1 report, management said that it had established 25 treatment centers globally. That seems like a good start and no doubt leverages Vertex’s network.

The next issue is rollout and adoption. CRISPR’s trial data was very impressive, and there were fewer safety concerns expressed compared to Bluebird Bio’s (NASDAQ:BLUE) more expensive treatment. To date, the trial data covers a more than five-year period for the longest follow-up. In SCD, 36 of 39 patients were free from vaso-occlusive crises (VOC) for at least 12 consecutive months, as reported in the primary endpoint data. This figure rose to 38 of 39 at 16 months, as reported in the secondary endpoint data — the mean duration of VOC-free was 27.9 months.

In transfusion-dependent beta-thalassemia, the company reported that 49 of 52 evaluable patients were transfusion-independent for at least 12 consecutive months. The mean duration of transfusion independence was 31 months.

The longer and better the trial data, the strong adoption is likely to be. In the Q1 earnings call, management said “Multiple patients have already had cells collected,” indicating that people had elected to go for the $2.2 million treatment. A study has demonstrated that there is a clear correlation between the severity of the illness and the patient’s willingness to try gene therapy.

This assumed slow pace of adoption is reflected in analysts’ forecasts. The company isn’t expected to turn a profit until 2027. It’s currently trading at 63.7x earnings for 2027. At this moment, however, its cash burn rate doesn’t appear to be too much of an issue.

Is CRISPR Therapeutics Stock a Buy, According to Analysts?

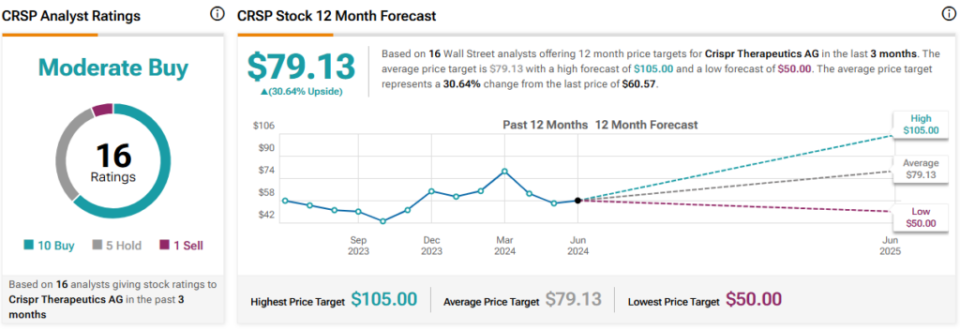

On TipRanks, CRSP comes in as a Moderate Buy based on 10 Buys, five Holds, and one Sell rating assigned by analysts in the past three months. The average CRISPR Therapeutics stock price target is $79.13, implying a 30.6% upside potential.

The Bottom Line on CRISPR Therapeutics

I believe there is a huge amount of potential in gene-editing therapies, and I hope to live in a world where the incurable diseases of today become curable. However, putting my hopes to one side, I remain optimistic about CRISPR Therapeutics. It has the strongest treatment offering for SCD and beta-thalassemia, and its pipeline is strong and diverse — much stronger than its peers.

Signup bonus from