Artificial intelligence (AI) has turned out to be a massive catalyst for technology stocks in the past year or more, and that’s not surprising as companies and governments around the globe are opening their wallets to speed up the adoption of this technology that’s expected to contribute big time to the global economy.

PwC expects AI to contribute a whopping $15.7 trillion to the global economy by 2030. As a result, global spending on AI-related hardware, software, and services is expected to hit a whopping $900 billion in 2026. The good news for investors is that there are many ways in which they can capitalize on the booming demand for AI.

Broadcom (NASDAQ: AVGO) and Oracle (NYSE: ORCL) are two such companies that are already benefiting from the proliferation of AI. Shares of both companies have shot up impressively of late following their latest quarterly reports, and they seem all set to go parabolic. A parabolic move refers to a steep spike in a company’s stock price in a short time, similar to the right side of a parabolic curve.

Whether or not that happens, let’s look at some solid reasons why these two tech stocks would be good investments now.

1. Broadcom

Semiconductors are in hot demand thanks to the crucial role they’re playing in training and deploying AI models, which is precisely the reason why Broadcom has just raised its full-year growth outlook. The company released fiscal 2024 second-quarter results (for the three months ended May 5) on June 12 and raised its revenue guidance from sales of AI chips to $11 billion for the full year, up from $10 billion.

Broadcom has also increased its full-year revenue guidance to $51 billion from an earlier estimate of $50 billion. The company attributes the improved outlook to the robust demand for its networking solutions and custom AI chips that are deployed in data centers. As a result, the company’s AI revenue jumped an impressive 280% year over year in the previous quarter.

Hyperscale cloud computing providers are increasing their investments in data centers to make them faster so that they can tackle AI workloads. These investments are helping Broadcom win more business, with its hyperscale cloud customers choosing to deploy Broadcom’s next-generation custom AI accelerators.

The overall market for custom chips was worth an estimated $30 billion last year, with a third of those chips poised to be deployed in data centers. It is predicted that custom chips deployed in data centers could double in revenue by 2025, growing to $20 billion. Broadcom’s terrific growth indicates that it is making the most of this opportunity.

Additionally, the number of networking switches that Broadcom sold last quarter doubled on a year-over-year basis thanks to the need for fast connectivity in data centers to handle AI workloads. With the market for AI-focused data center switches expected to grow at 38% a year through 2029, generating $19 billion in annual revenue at the end of the forecast period, Broadcom is sitting on a couple of solid catalysts thanks to the growing adoption of AI.

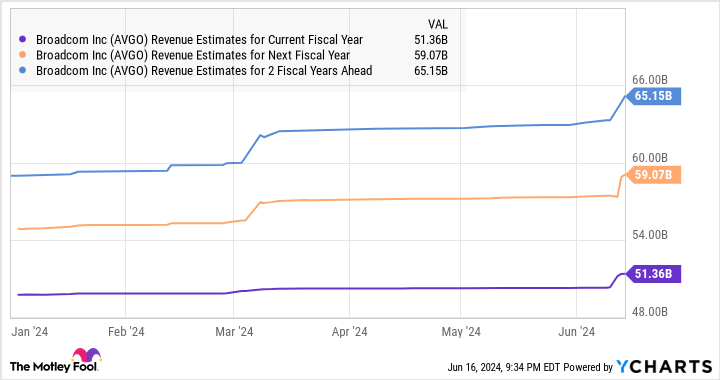

This explains why analysts have increased their revenue growth expectations from Broadcom.

The market could reward Broadcom’s AI-fueled growth with more upside. The stock jumped significantly following its latest quarterly report, and it could well sustain that momentum ahead.

2. Oracle

Oracle stock popped impressively following the release of its fiscal 2024 fourth-quarter results (for the three months ended May 31) on June 11. Investors cheered the massive jump in the company’s revenue pipeline, which was driven by the growing demand for its generative AI cloud infrastructure.

More specifically, Oracle’s remaining performance obligations (RPO) increased a terrific 44% year over year to $98 billion. That was faster than the 29% increase in this metric in the fiscal third quarter and also outpaced the 4% growth in Oracle’s revenue during the quarter to $14.3 billion.

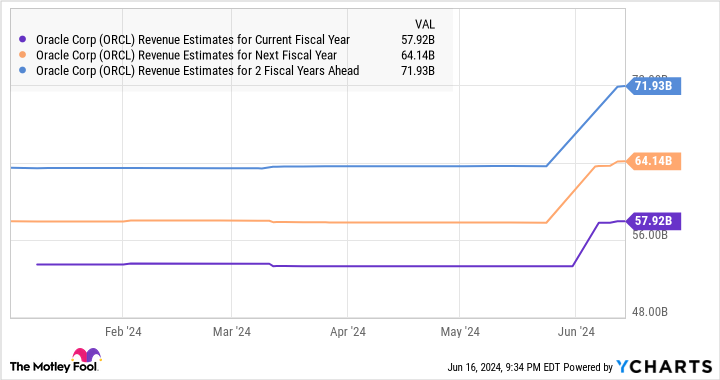

As RPO refers to the total value of a company’s future contracts, and the healthy growth in this metric points toward better growth prospects for Oracle. This is evident from the chart:

Oracle’s revenue increased 6% in fiscal 2024 to $53 billion. The chart suggests that it is set to grow at a faster pace in the current fiscal year and beyond. However, it won’t be surprising to see Oracle outperforming analysts’ expectations, as it is making solid progress in the cloud AI market.

CEO Safra Catz’s comments on the latest earnings conference call suggest the same:

First, as you saw, OpenAI selected Oracle to run deep learning and AI workloads on Oracle Cloud Infrastructure. Like many others, OpenAI chose OCI because it is the world’s fastest and most cost-effective AI infrastructure. In total, we signed over 30 AI contracts for over $12 billion this quarter and nearly $17 billion this year.

More importantly, Catz expects “continued strong cloud demand to push Oracle sales and RPO even higher and result in double-digit revenue growth this fiscal year,” driven by the company’s efforts to add more cloud capacity, which will allow its cloud infrastructure business to grow at a faster pace with each passing quarter.

Also, with the demand for cloud AI services expected to clock almost 31% annual growth through 2030, Oracle seems to be at the beginning of what could be a massive growth curve. That’s why investors should consider buying the stock, which is trading at 22 times forward earnings, a discount to the Nasdaq-100 index’s forward earnings multiple of 28 (using the index as a proxy for tech stocks).

This AI stock has jumped 31% in 2024 so far, and a big chunk of those gains have arrived after its results were released. And as the company’s massive cloud AI opportunity and revenue pipeline indicate, it could sustain its newly found pace and even accelerate.

Should you invest $1,000 in Broadcom right now?

Before you buy stock in Broadcom, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Broadcom wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $830,777!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 10, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Oracle. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

2 Artificial Intelligence (AI) Stocks That Could Go Parabolic was originally published by The Motley Fool

Signup bonus from