Many investors have left retailers for dead, but shares of electronics retail giant Best Buy (NYSE:BBY) quietly hit a new 52-week high today. Not only that, but the stock looks like it has plenty of room for more upside ahead. I’m bullish on Best Buy based on its renewed momentum, inexpensive valuation, attractive dividend yield, and potential to benefit from an AI-driven refresh cycle for PCs.

Analysts are Coming Around to the Stock

The move hasn’t garnered much attention, but Best Buy is soaring to a brand new 52-week high after gaining a scorching 27.7% gain over the past month. The stock has now bounced 45.7% off of its 52-week low and is up 21% year-to-date.

The Minnesota-based company is enjoying considerable momentum with sell-side analysts. Earlier in June, Bank of America (NYSE:BAC) analyst Steven Zaccone gave Best Buy a rare double upgrade from Sell to Buy based on a “tech replacement cycle” getting underway, AI-driven demand for new products, and improving margins. Zaccone increased his price target on the stock from $67 all the way up to $100.

And Zaccone isn’t alone in upgrading the stock. Recently, UBS (NYSE:UBS) analyst Michael Lasser upgraded Best Buy from Neutral to Buy based on expectations that Best Buy should enjoy a “nice recovery” in sales in the latter half of 2025 and heading into 2026.

Lasser believes that Best Buy will benefit from a consumer appliance refresh cycle as well as new products coming onto the market. The analyst assigned a $106 price target to Best Buy, implying 13% upside potential from its current level.

Let’s delve into the details of this product refresh cycle that both analysts are alluding to.

AI Laptops Poised to Drive Growth

Zaccone highlighted the fact that Best Buy’s same-store sales are growing, driven in large part by demand for new laptops. Indeed, the growing capabilities of generative AI and rapid consumer adoption of these technologies are driving demand for AI-enabled PCs and laptops. Manufacturers like HP Inc. (NYSE:HPQ) and others are releasing new lines of AI-enabled laptops with greater computing power to satisfy this demand.

These new and improved laptops will also come with higher price tags. For example, HP’s two new AI-enabled models, the consumer-targeted HP OmniBook X AI and the enterprise-focused HP EliteBook Ultra AI, will feature price tags of $1,199 and $1,699, respectively.

Best Buy CEO Corey Barrie believes the AI-driven refresh cycle is still in the early innings and said that with “roughly 40 SKUs in total, we expect to have the largest assortment…” of AI-enabled laptops “…at launch with more than 40% of the assortment retail exclusive to Best Buy.”

Beyond these AI laptops, there are other exciting new products that Barrie says have the potential to fuel sales growth for Best Buy. These include new Apple (NASDAQ:AAPL) iPads with M4 chips, Bose’s new open-ear headphones, and new headphones from Sonos (NASDAQ:SONO) as the high-end speaker company forays into this segment of the market for the first time.

Inexpensive Valuation

While shares of Best Buy have enjoyed a nice run, they are still decidedly cheap. Shares trade at 14.9 times consensus January 2025 earnings and just 13.5 times January 2026 consensus earnings estimates.

The broader market trades at a much higher multiple. For comparison, the S&P 500 (SPX) currently fetches a multiple of 23.6 times earnings. Therefore, while Best Buy is setting new 52-week highs, one can hardly say that it is overextended or that shares look frothy. This reasonable multiple leaves plenty of room for upside ahead.

Great Dividend Stock

In addition to this inexpensive valuation, Best Buy also sports an attractive dividend yield of 4.2%. This yield is considerably higher than that of the S&P 500, which yields just 1.3%. Best Buy’s yield is also competitive with 10-year treasuries, which currently yield 4.2%.

Not only does Best Buy feature a high yield, but it boasts a strong track record when it comes to paying a consistent dividend and increasing the size of its payouts over time. Best Buy has paid dividends for an impressive 20 years in a row and has increased its payout for 13 consecutive years. That’s the type of consistency investors can count on.

Is Best Buy Stock a Buy, According to Analysts?

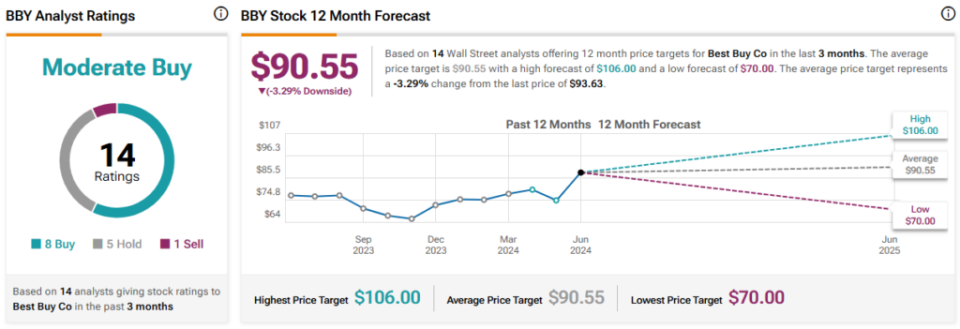

Turning to Wall Street, BBY earns a Moderate Buy consensus rating based on eight Buys, five Holds, and one Sell rating assigned in the past three months. The average BBY stock price target of $90.55 implies 3.3% downside potential from current levels.

The Takeaway

I’m bullish on Best Buy stock based on its attractive valuation and 4.2% dividend yield, along with its consistent track record as a dividend stock. BBY is enjoying considerable momentum, and Wall Street analysts are coming around to it. Furthermore, the stock appears to be well-positioned to benefit from new demand for new AI-enabled PCs and laptops over the next year or more.

Signup bonus from