When looking for high-yield stocks in the energy patch, there is no better place to look than the midstream space. Midstream companies are involved in a number of activities, but are largely known for transporting crude, natural gas, and NGLs (natural gas liquids) through their networks of pipeline assets.

These pipeline companies generally have minimal exposure to energy prices, and are largely a play on increasing volumes for hydrocarbons. On that front, the midstream industry could be a big beneficiary of the proliferation of generative artificial intelligence (AI) in data centers, as AI applications consume a tremendous amount of energy.

In fact, Boston Consulting Group predicts that data centers could make up as much as 7.5% of total U.S. electricity consumption by 2030. As new data centers get built out to meet this demand, they will need to be near cheaper natural gas resources, and with their increased energy consumption will come increased natural gas pipeline volumes.

Let’s look at two high-yield midstream stocks that could benefit from this AI energy consumption trend that investors should be buying right now.

1. Energy Transfer

With nearly 90,000 miles of pipeline, 235 billion cubic feet (bcf) of working storage capacity, and more than 65 natural gas processing and treating facilities, Energy Transfer (NYSE: ET) is one of the largest natural gas transporters in North America. The company has the largest integrated midstream system in the U.S., touching nearly all points of the midstream process from the wellhead to the final destination.

Permian natural gas is among the cheapest in the U.S., since the drilling is being done for oil, which is drawing power-hungry data centers to the region. With increased natural gas consumption from AI, Energy Transfer is positioned for expansion projects off its existing Permian system to deliver natural gas to meet the increased energy needs of these data centers.

Meanwhile, the company finds itself in some of the best financial shape in its history, with a solid balance sheet and a very well-covered distribution. The master limited partnership (MLP) has an 8.2% yield based on its most recent quarter distribution, and it plans to raise it by between 3% to 5% a year moving forward.

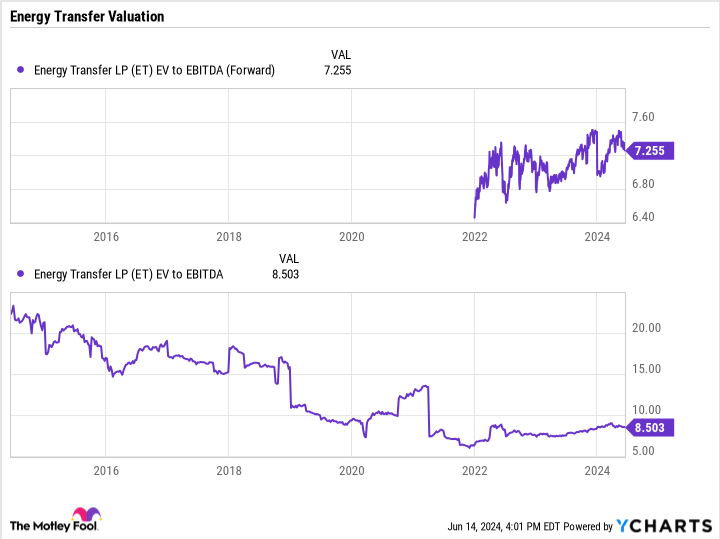

Trading at 7.3 times on an enterprise value (EV)-to-forward EBITDA basis, the stock is attractively valued both compared to its midstream peers and on a historical basis. I prefer to use this metric when valuing midstream companies, as it takes their debt into consideration, and excludes non-cash items such as depreciation.

Given Energy Transfer’s valuation, strong balance sheet, and potential growth opportunities stemming from increased AI power consumption, this currently looks like a smart stock to invest $1,000 or more in, as it offers both a high yield and strong price appreciation potential.

2. Kinder Morgan

With about 67,000 miles of natural gas pipeline, Kinder Morgan (NYSE: KMI) transports approximately 40% of the natural gas consumed in the United States. It also has 702 bcf of working storage capacity, representing about 15% of U.S. capacity. With a solid set of assets in the Permian and throughout Texas, the company is also well set up to benefit from growing natural gas demand from data centers in the area.

Kinder Morgan management was particularly vocal about the positive effect AI energy consumption would have on its business during its last earnings conference call. It said utilities throughout North America were “sounding the alarm” of increased energy consumption coming from data centers and that natural gas would play an important role in power generation to meet this increasing demand. The company said it was already working with one Southeast utility looking to connect to its system, given its need for a reliable power supply.

The company is well set up to avoid fluctuations in commodity prices, with 68% of its cash flow coming from take-or-pay or hedged contracts where volumes and prices are fixed, and 27% from fee-based contracts where prices are fixed and volumes are variable. Only 5% of its cash flow comes from activities that are exposed to commodity prices.

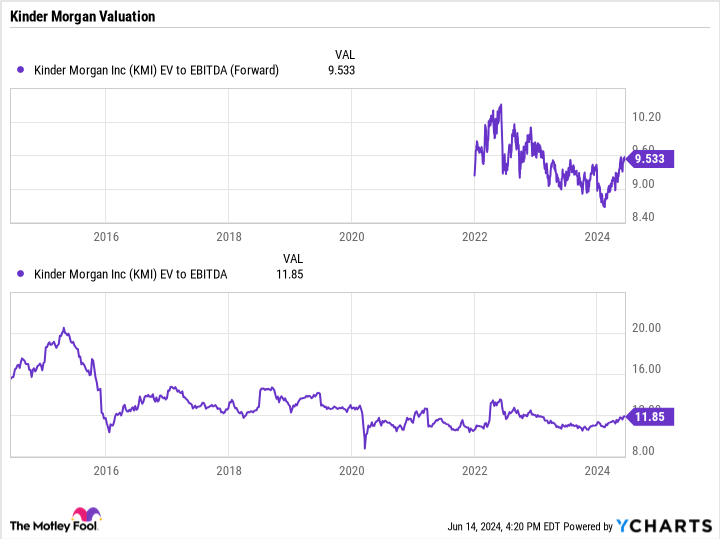

Trading at 9.5 times on an enterprise value (EV)-to-forward EBITDA basis, the stock is attractively valued when looking at its recent history. Unlike Energy Transfer, Kinder Morgan is structured as a corporation. Thus, its financial structure doesn’t require shareholders to file a Schedule K-1, which some investors don’t like due to the extra paperwork come tax time. The stock currently sports a 5.8% yield.

Overall, Kinder Morgan is another solid high-yielding pipeline play well-positioned to benefit from increasing natural gas demand coming from AI. As such, the stock looks like another smart buy.

Should you invest $1,000 in Energy Transfer right now?

Before you buy stock in Energy Transfer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Energy Transfer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $808,105!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 10, 2024

Geoffrey Seiler has positions in Energy Transfer. The Motley Fool has positions in and recommends Kinder Morgan. The Motley Fool has a disclosure policy.

The Smartest High-Yield Energy Stocks to Buy With $1,000 Right Now was originally published by The Motley Fool

Signup bonus from