Shares in Amazon (NASDAQ: AMZN) have soared more than 1,000% over the past decade, likely creating more than a few millionaires. The company’s business exploded as its e-commerce site became the go-to for online shoppers in dozens of countries, and it has expanded to high-growth industries like cloud computing with its platform, Amazon Web Services (AWS).

Wall Street has grown particularly bullish about the company since the start of 2023, with Amazon’s stock up about 45% year over year. The company’s growth has followed a trend prevalent throughout the market, as the S&P 500 is up 25% over the last 12 months after entering a bull market in 2022.

Meanwhile, easing inflation and the emergence of budding markets like artificial intelligence (AI) indicate that Amazon still has plenty of room left to run.

So, could this bull market buy help you become a millionaire? Let’s find out.

Amazon is heavily investing in the most profitable part of its business

Amazon is best known for its online retail website, which accounts for more than 80% of its revenue. Its e-commerce business remains lucrative for the company, with sales in its North American and international segments rising 12% and 10% year over year in the first quarter of 2024. Meanwhile, operating income between the two segments hit a combined total of $6 billion after reporting losses of $349 million last year.

However, despite stellar growth in retail, AWS remains Amazon’s most lucrative division. The cloud platform posted revenue gains of 17% year over year in Q1 2024, with operating income climbing 84%. And although it earned the lowest portion of revenue between Amazon’s three primary segments, AWS was responsible for more than 60% of its profit.

As a result, Amazon is investing heavily in expanding AWS. The company is opening new data centers around the world, with recent reports revealing it will invest billions over the next 15 years into building data centers in Taiwan. Taiwan is a crucial market for cloud and AI growth, with Taiwan Semiconductor Manufacturing producing AI chips for a large portion of the industry.

The announcement comes after AWS disclosed plans to spend nearly $13 billion by 2030 on data center infrastructure in India, another high-growth market.

The AI market is projected to expand at a compound annual growth rate of 37% through 2030. Meanwhile, AWS has massive potential in the industry as businesses increasingly turn to cloud services to boost productivity with the help of AI. AWS will likely continue to boost Amazon’s business.

A cash-rich company that is trading at a bargain right now

Amazon’s operating income has skyrocketed more than 1,300% since last June, while free cash flow has nearly doubled. The company’s cash reserves are quickly expanding, making its stock one of the most reliable buys. More cash means Amazon is better equipped to overcome potential headwinds and keep expanding in lucrative markets like AI.

As a result, Amazon could be one of the best companies to invest in AI right now, with its leading market share in cloud computing and the funds to invest in its business while retaining dominance over competitors like Alphabet, Microsoft, and Apple.

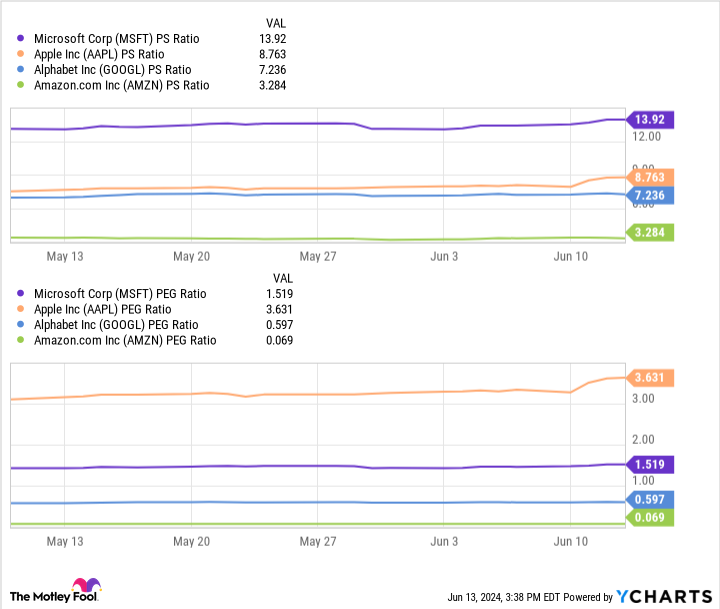

Moreover, despite significant stock price growth over the last year, Amazon is potentially trading at a bargain. This chart shows the company has the lowest price-to-sales ratio and price/earnings-to-growth ratio among some of the most prominent names in the AI software market. The figures indicate Amazon’s stock is offering the most value out of these four companies.

Given its booming retail business, a leading position in cloud computing, and the financial resources to go far in AI, Amazon’s stock is a no-brainer, and could help you become a millionaire with the right investment.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $808,105!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 10, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Microsoft, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Could This Bull Market Buy Help You Become a Millionaire? was originally published by The Motley Fool

Signup bonus from