We are living in a digitally powered economy. This includes banking and consumer lending. Companies such as SoFi Technologies (NASDAQ: SOFI) have attracted millions of customers with their online-only consumer banks that offer time-saving features and higher interest rates on deposits than the big banks. The company now has over 8 million members, up from 1 million in 2020.

And yet SoFi stock is off 73% from all-time highs. What is going on with this company, and is the market correct to punish shareholders who bought back in 2020 and 2021?

Growing quickly, finally profitable

SoFi is an online bank that aims to attract individuals searching for high interest rates paid on deposits. It currently offers 4.6% annual interest payments, which is much better than competitors like Bank of America or Chase. Customers of SoFi can also get a debit card, credit card, invest through the SoFi brokerage, and buy insurance. It makes money through fees on these products and earning interest income on deposits at the brokerage account.

The most important moneymaker for SoFi is its lending division. It focuses on personal consumer loans, mortgage loans, and student loans with the majority of its $20 billion-plus loan book in personal loans. Last quarter, the lending division generated $330 million in net revenue, mostly from net interest income on these loan balances.

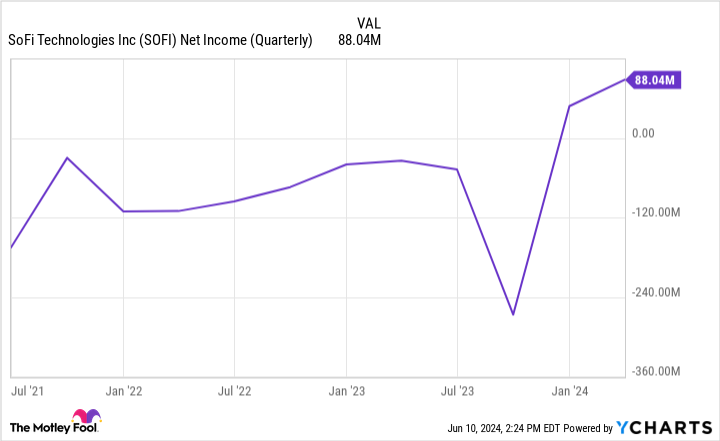

Historically, SoFi has not been a profitable business. Using aggressive marketing campaigns and ultra-high interest rates to attract new customers, it burned a lot of cash in order to get the 8 million current customers on its platform. That began to change last quarter. In Q1, SoFi generated $88 million in net income on $645 million in total net revenue, even as customers grew by 44% year over year.

SoFi is growing and now profitable. So why is the stock down?

Look at the details on profitability

While SoFi posted $88 million in net income last quarter, $59 million of that came from a one-time extinguishment of debt, which is not a profit generated from its business operations. Exclude this $59 million and you get a measly $29 million in net income earned in Q1.

For the full year, SoFi is guiding for $165 million to $170 million in generally accepted accounting principles (GAAP) net income, which does include that $59 million in debt extinguishment. Investors are likely waiting for more profits to show up for SoFi, especially as it reaches a significant scale with 8 million customers on the platform.

Is the stock a bargain?

Today, SoFi trades at a market cap of $7.4 billion. Based on its full-year guidance, it has an expensive looking forward price-to-earnings (P/E) ratio of 43 even if it hits the high end of its range. This shows that the stock was at a very expensive level back in 2020 and 2021 with investors being too optimistic about what earnings would look like in 2024. And remember, $59 million of the $170 million will come from a one-time debt transaction. Exclude this, and the P/E is even higher.

But that does not necessarily mean the stock is expensive today for those looking to hold for many years. Any shareholder or potential shareholder needs to analyze whether SoFi can hit a higher net income margin over the next five years. This is likely the most important task — even more so than adding new customers.

Given its increasing scale and marketing efficiency (marketing spend was actually down slightly last quarter even though new customers surged higher), I think SoFi can hit much higher net income levels over the next few years. However, until this happens, it is unlikely that the stock will do well. Shareholders with confidence in the long-term plan at SoFi need to stay patient with this financial technology and online banking upstart.

Should you invest $1,000 in SoFi Technologies right now?

Before you buy stock in SoFi Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SoFi Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $740,886!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 10, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bank of America. The Motley Fool has a disclosure policy.

What’s Going On With SoFi Technologies Stock? was originally published by The Motley Fool

Signup bonus from