MARSHALL – For the second consecutive year, Madison County’s budget will see a 3% increase in General Fund appropriations.

The Madison County Board of Commissioners approved the county’s 2024-25 budget June 11. Madison’s $33.1 million budget is up roughly $1 million from its 2023-24 budget of $32.1 million.

County Manager Rod Honeycutt presented the proposed budget to the county commissioners and outlined the county’s 36 cents per $100 valuation tax rate, down from 50 cents per $100 valuation rate in 2023-24.

Honeycutt thanked Finance Director Kary Ledford for her collaboration throughout the process,

“Development of the FY 2024-25 budget during a property revaluation year added complexity,” Honeycutt said, referencing the state General Statute 159.11, which requires a county budget officer to include a statement of the revenue-neutral property tax rate for the budget. The revenue-neutral property tax rate is the rate that is estimated to produce revenue for the next fiscal year equal to the revenue that would be have produced for the next fiscal year by the current tax rate if no reappraisal had occurred.

“The revenue-neutral statement compares property tax revenue that would have been generated using the same mill rate and collection rate from the previous year,” Honeycutt said.

Honeycutt said the county issued 293 new construction permits in FY ’23.

Based upon this figure and the projected tax revenue at the 50 cents per $100 valuation, the county would have generated roughly $13.8 million. According to Honeycutt, this is an increase of more than $1 million from the previous year’s budget of of $12.7 million, based upon the same 50 cents per $100 valuation and 96.7% collection rate.

Honeycutt said the new budget’s 36 cents per $100 valuation will generate $13.3 million in revenue, a decrease of nearly $474,000 from the fiscal year 2023-24 revenue-neutral property tax rate of $13.8 million.

“The main takeaway is we are operating just over $400,000 less in property-neutral, which will reduce the tax burdens on the taxpayer,” Honeycutt said.

According to the county manager, “incremental fund increases” were necessary in some of the county departments. Public safety and transportation saw two of the biggest increases from 2023-24, as the public safety appropriations will jump from $8.5 million to $9.1 million, and the transportation appropriations are up to just under $1 million from $683,000.

Two additional factors — the expansion of the state Medicaid program and the Wages and Fair Labor Standards Act’s increasing the minimum wage of federal, state and local governments — also contributed to the increase, Honeycutt said, adding that the expansion of the state Medicaid program added $422,000 to the budget.

Internal factors for the increase included employee recruitment and retention, such as targeted pay bumps and raising the minimum wage for county employees to $13 per hour.

Board discussion

Board of Commissioners Chair Matt Wechtel pointed to the 36 cents per $100 valuation reduction as “a major cut.”

“I want to thank our department heads, our county staff and the Colonel, for all the work that was put into this budget,” Wechtel said, “Kary, and Amanda, and Mandy and Brandy and Hannah, and everybody that had a role in it. I didn’t mean to leave anybody out, but I know all the folks there at Elizabeth Lane had a lot to do with working on this budget and putting it together.”

Wechtel said of his nine budget cycles, “this, by far, has been the best organized and probably, from a commissioner standpoint, the easiest process I’ve been through, so I want to thank and commend staff for that.”

Commissioner Bill Briggs said he appreciated the work of the county, estimating the county met 12 times during this budget cycle.

“Just think of the time it takes, and when you’ve got $33 million to try to distribute, that’s not a lot of money, when you compare it with Buncombe County, which is $600-plus million, and the city of Asheville, which is another $300 almost, we’re comparing $33 million because we’re a bedroom county, so to speak, to Buncombe County, to $1 billion, with a ‘B,'” Briggs said.

“So you see what we’re up against. I just think they’ve done a tremendous job on this budget. I’ve been in a few budgets, but like Mr. Chairman says, this is one of the best ones that I’ve witnessed. It was laid out, and even I could understand it.”

Commissioner Jeremy Hensley said the 36 cents per $100 valuation tax rate was the result of the county commissioners vying to get “as close to revenue-neutral as we can get it.”

“We looked at it, and if you go down to 35 cents, that’s more or less you’re not collecting as much taxes as you did last year off your real estate,” Hensley said.

“Then, you take into consideration that your vehicle taxes are going to go down, so we’re not collecting as much off of vehicle taxes either. So, when you get your tax bill, your taxes are probably going to go up, but it’s going to be as close to revenue neutral as we can get it.”

Hensley said the commissioners went up to 36 cents from 30 cents after figuring out that the 35 cents figure would put the county at revenue neutral.

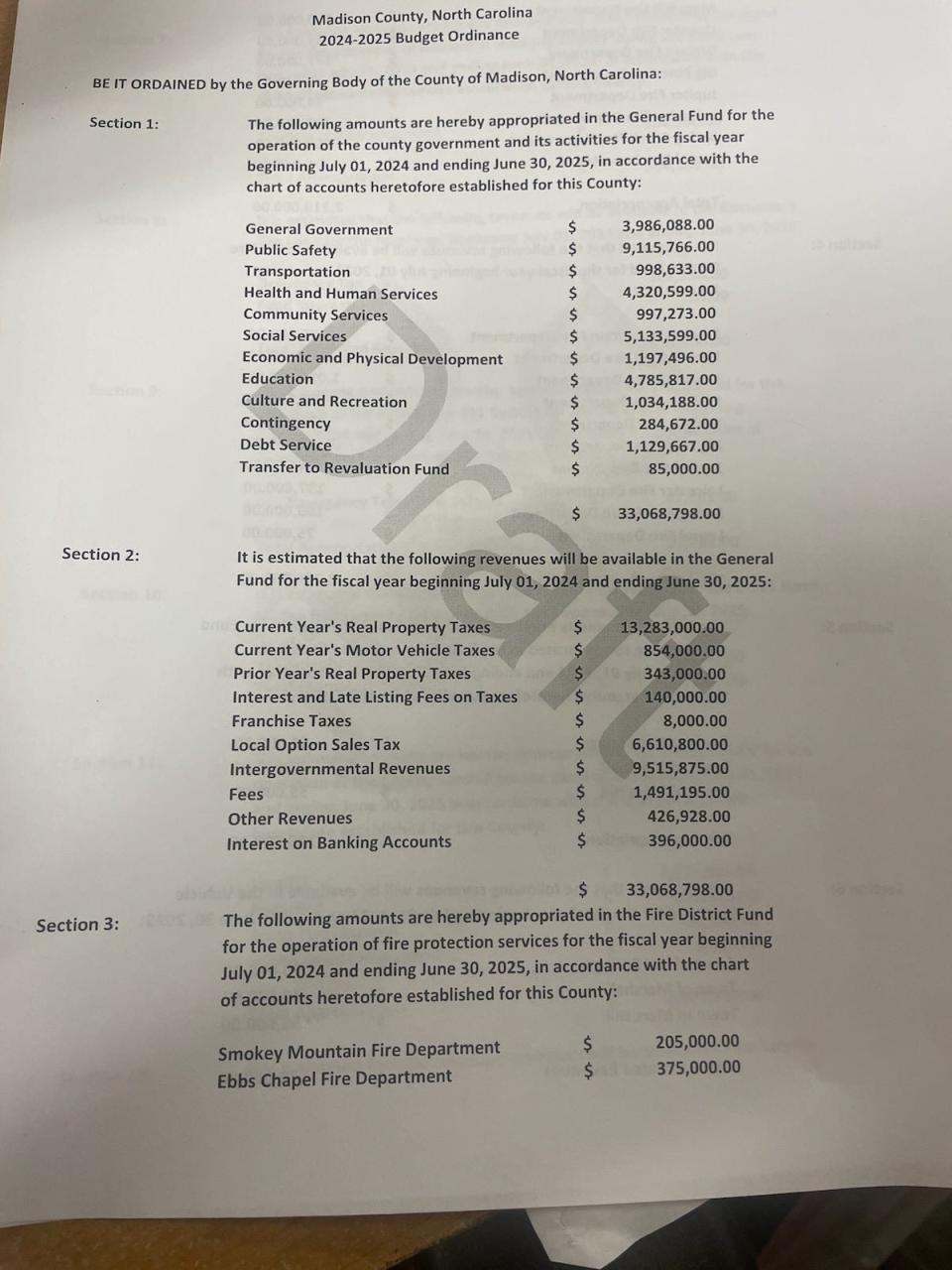

According to a copy of the budget ordinance, it is estimated that the following revenues will be available in the General Fund for the fiscal year beginning July 1, 2024, and ending June 30, 2025.

-

Current year’s real property taxes: $13.3 million

-

Intergovernmental revenues: $9.5 million

-

Local option sales tax: $6.6 million

-

Fees: $1.5 million

-

Other revenues: $427,000

-

Interest on banking accounts: $396,000

-

Current year’s motor vehicle taxes: $854,000

-

Prior year’s real property taxes: $343,000

-

Interest and late listing fees on taxes: $140,000

-

Franchise taxes: $8,000

Commissioner Alan Wyatt reiterated that the reappraisal year created challenges for the county, but thanked his fellow commissioners for “their due diligence in really, really, really scrutinizing these numbers, and not just passing stuff off.”

Property revaluations will be sent out in the mail in the coming weeks, according to Wechtel.

“If you have any questions or concerns about those revaluations, first and foremost, I encourage you to reach out directly to the tax office,” Wechtel said. “The tax office can potentially handle your problem over the phone with the appraisers that are still going to be remaining with us for a period of time.

“The appraisers are the ones that are best suited for answering questions about their work. If you have concerns or you think an error was made, the appropriate time to do that would be right away when the appraisers are still here, because it’s easier for them to figure out if a mistake was made than it is for us to go back at the Board of Equalization and Review and have to try to determine whether a mistake was made, or whether someone is just being unreasonable, or somebody just doesn’t like what they’re having to hear.”

More: Madison’s home revaluation process Madison County holds town halls to explain 1st post-COVID home revaluation process

More: County proposes 3% hike in 23-24 Madison County proposes more than 3% budget increase; to hold public hearing end of month

Wechtel reiterated the message he delivered in a series of town halls in February 2024 in which the county commissioners met with county residents to inform them on the revaluation process, in which he said the ratio of the county’s home sales compared to property valuations skyrocketed post-COVID, the state strongly suggested the county perform a revaluation in 2024.

Johnny Casey has covered Madison County for The Citizen Times and The News-Record & Sentinel for nearly three years, including earning a first-place award in beat reporting in the 2023 North Carolina Press Association awards. He can be reached at 828-210-6071 or jcasey@citizentimes.com.

This article originally appeared on Asheville Citizen Times: Property tax rate slashed in Madison County’s 2024-25 budget

Signup bonus from