Financial technology, or fintech, is crowded with many companies jockeying for market share. It’s for a good reason. According to Fortune Business Insights, the global fintech market is worth approximately $300 billion today and will grow to over $1.1 trillion by 2032.

The problem for investors is that since nobody can reliably tell you which companies will dominate the industry a decade from now, many promising stocks in the space have languishing share prices because Wall Street doesn’t trust them. Conversely, that creates an opportunity for substantial long-term investment returns for those who ultimately back the right companies.

These three companies are trading at shockingly low share prices despite having enormous long-term potential and producing strong business results. Let’s check them out.

1. SoFi Technologies

Digital bank and fintech company SoFi Technologies (NASDAQ: SOFI) continues to churn out excellent results quarter after quarter. The company got its start in student loans, which has seemingly helped it develop a sticky appeal to younger people as they mature into mainstream citizens with banking needs. SoFi surpassed 8.1 million banking customers in the first quarter, due to a 44% year-over-year jump.

Customers seem to enjoy SoFi’s “everything app,” which offers financial education, lending products, banking and investing services, and payments in one place. SoFi’s digital footprint completely negates the need for physical bank branches, and the app’s 4.8-star rating on over 340,000 reviews speaks volumes about customer satisfaction. SoFi grows with new users, but can also cross-sell different products and services to customers at no additional expense once users are on the app.

SoFi’s profits (net interest income) began to explode after the company formally received its banking charter in 2022. The stock’s valuation via its price-to-book ratio has fallen steadily over time. Now, at a more reasonable 26% premium to book value, SoFi could power higher if the company’s growth continues at this torrid pace.

2. Affirm

Buy now, pay later (BNPL) emerged a few years ago as a rival to credit cards in part because it is a more transparent method of consumer borrowing. Affirm (NASDAQ: AFRM) is one of the top players in the industry, thanks mainly to partnerships throughout the retail sector, including with Amazon, Shopify, and more than 292,000 other merchants. Affirm uses data to underwrite every transaction individually as its loan, which helps Affirm keep customers from overborrowing. The company charges zero late fees, so it’s in Affirm’s interest that customers repay their loans promptly.

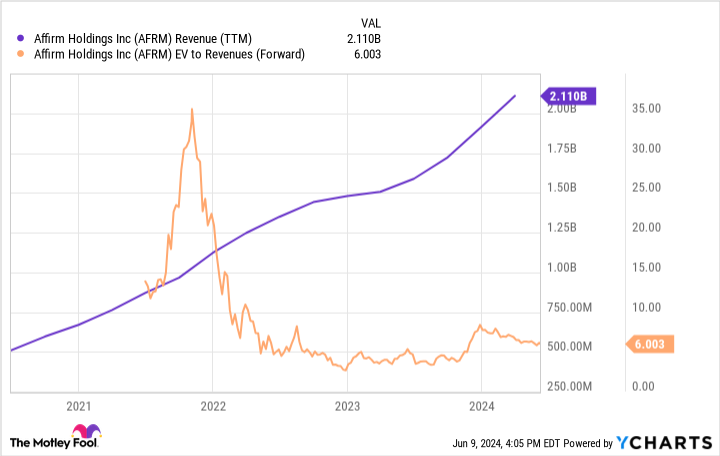

Affirm’s growth has been rapid; revenue grew 51% year over year in its most recent quarter. Despite competition from other BNPL companies, there are multiple reasons to like Affirm. The BNPL industry is poised for tremendous growth over the coming decade. According to Grand View Research, BNPL will grow by over 24% annually in the United States (where Affirm primarily operates) through 2030.

Additionally, Affirm is going offline to attract additional customer transactions with the Affirm Card. It gives users dual abilities to spend as debit or retroactively create installment loans at the point of sale. The card has amassed over a million users since its launch in 2021. Like many other fintech stocks, Affirm’s valuation has been depressed as the company grows and the share price falls. Investors who are bullish about the BNPL space should consider Affirm as a stand-alone innovator with the potential to grow for the foreseeable future.

3. Marqeta

Most people won’t know what Marqeta (NASDAQ: MQ) is, but the company plays a crucial role as a modern card issuer in fintech. Essentially, Marqeta’s technology connects fintech applications to the existing payment networks, allowing companies to create innovative payment products that wouldn’t otherwise be possible. For example, Marqeta powers the payment cards that Instacart gives shoppers. The technology unlocks the card’s funds only when the criteria are met, such as paying for the appropriate items on an order.

Marqeta collects a small piece of every transaction its technology powers. The upside of Marqeta is that its technology gets its foot in the door of some of the financial industry’s fastest-growing industries, including cryptocurrency, Buy Now, Pay Later, and digital banking. Marqeta’s payment volume grew 33% year over year in Q1, and the payment industry’s massive size means growth could go on for a long time.

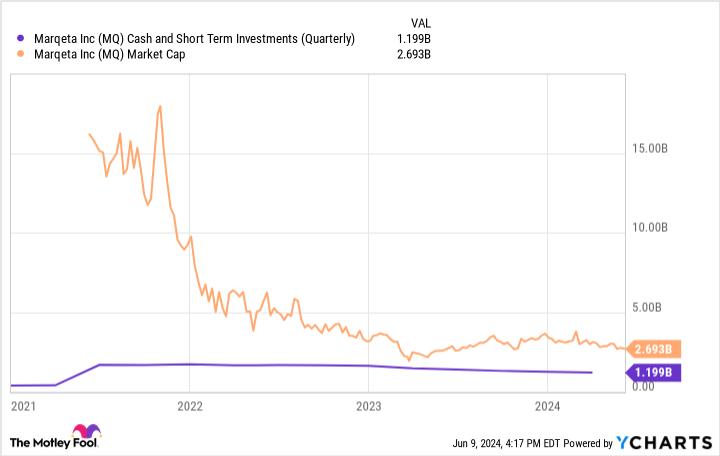

Valuing the stock became complicated after Marqeta renewed its contract with Block (its largest customer) in a deal that changed how revenue was recognized. So, consider this instead. Marqeta has a market cap of just $2.7 billion today. The company has $1.2 billion in cash on its balance sheet, representing 44% of its market value! In other words, Wall Street isn’t assigning much value to the actual business. Time could prove that to be a mistake because innovation should continue fueling demand for new payment solutions, and Marqeta plays a vital role in that.

Should you invest $1,000 in SoFi Technologies right now?

Before you buy stock in SoFi Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SoFi Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $740,886!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 10, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Justin Pope has positions in Affirm and Marqeta. The Motley Fool has positions in and recommends Amazon, Block, and Shopify. The Motley Fool recommends Instacart and Marqeta. The Motley Fool has a disclosure policy.

3 Fintech Growth Stocks That Are Screaming Buys in June was originally published by The Motley Fool

Signup bonus from