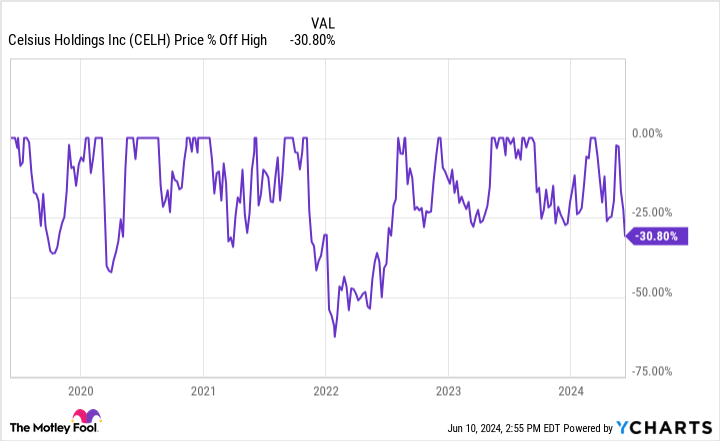

Roughly twice a year for the last five years, the same thing keeps happening to shares of energy-drink company Celsius Holdings (NASDAQ: CELH): Shares drop 20% or more. And as of this writing, Celsius stock is down once again, this time falling more than 30% in just the last few weeks.

For investors who hate losing money, buying shares of a company that routinely drops 20% or more might seem like a bad idea. However, Celsius stock is also up more than 5,000% total in the last five years, making it one of the greatest five-year stock performances in history. Therefore, it has been a great stock to own despite a fair amount of volatility.

Routine volatility has struck again. Now it’s important to consider if anything is different this time for Celsius and whether this is a dip worth buying.

What’s the problem this time for Celsius?

Celsius has enjoyed explosive sales growth for years for two reasons. First, the energy-drink space has continued to grow at a nice pace. Second, the company has taken market share at an encouraging rate. These two factors made triple-digit top-line growth customary for the company.

Evercore analyst Robert Ottenstein notes that this isn’t necessarily happening right now. In May, the analyst talked about a slowdown in growth for energy drinks, and he pointed out that the company had slipped from 12.4% market share down to 12.2% in recent weeks, according to The Fly. And Ottenstein isn’t alone: Many analysts are adjusting their financial models to account for a slowdown in growth for Celsius.

However, this isn’t necessarily new information for investors. In 2023, Celsius’ revenue grew a whopping 102% year over year. But in the first quarter of 2024, revenue was up by only 37%. Therefore, investors already knew that growth was slowing down. Recent commentary from analysts didn’t change this narrative.

Moreover, Ottenstein might have noted a minute decline in market share for Celsius. But the analyst’s market-share estimate of 12.2% is actually higher than the company’s own estimate of 11.4% market share in the first quarter. Therefore, investors could interpret this more optimistically if they wanted to.

In other words, analysts are spooking investors by pointing out slowing growth for Celsius. But it was already apparent beforehand. Moreover, investors are getting worried that the company is losing market share. Estimates show that any dip is inconsequential, however, and its share is still higher than previous estimates.

All of this points to an overreaction from investors for the latest decline for Celsius stock.

What should investors do now?

To summarize up to this point, Celsius stock is prone to volatility, and it’s down more than 30% in recent weeks as investors overreact to commentary regarding its sales growth. Does this make it a stock to buy? Here are two things to consider.

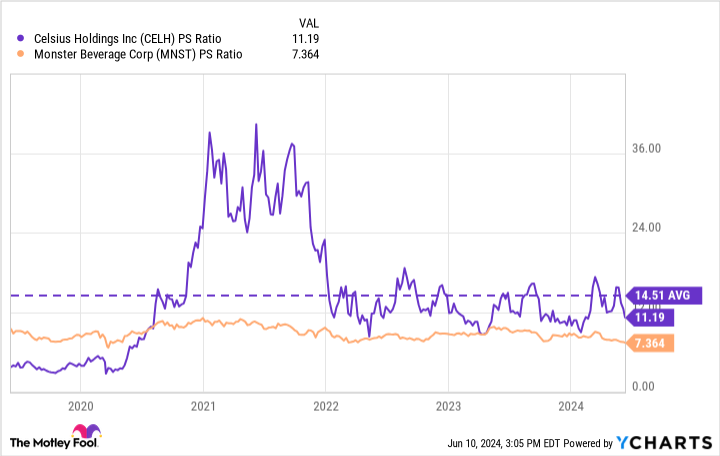

First, for investors looking for a good deal, the stock still has a way to go to be a bargain. Looking at things from a price-to-sales (P/S) valuation perspective, Celsius stock has been cheaper several times in recent years and could drop further. Moreover, it still trades at a premium to top rival Monster Beverage.

You could argue that Celsius stock should trade at a higher P/S valuation than Monster, and that may indeed be so. But it would need to drop further before it could reasonably be called a bargain.

Second, Celsius could still create significant shareholder value from here, so investors shouldn’t discount its growth potential when looking at its valuation.

The most obvious catalyst for growth for Celsius is entry into international markets, where it generated revenue of only $16 million in the first quarter. By comparison, Monster had net sales of over $700 million from international markets during this quarter. That’s nearly $3 billion in annual terms.

Top dog Red Bull is privately held, so investors don’t have access to those numbers, unfortunately. But they can make educated guesses. According to Celsius, Red Bull had almost 37% market share in the U.S. in the first quarter, which would equate to roughly $1.1 billion. This would mean that Red Bull has about $4.5 billion in U.S. sales annually.

According to Red Bull, the company generated around $11 billion in sales in 2023. This would suggest that it’s generating north of $6 billion annually in international markets.

Even if Red Bull and Monster stay at the top of the energy drink market internationally, Celsius could still have an opportunity for over $1 billion in sales, given the size of the other two companies.

For perspective, Celsius generated total annual revenue of over $1 billion for the first time ever in 2023. Therefore, the company could still realistically double its business from here over the long term before its growth even started to hit a ceiling.

In conclusion, I wouldn’t buy Celsius stock like it’s a once-in-a-lifetime opportunity after its 30% pullback; it’s not, and it could indeed get cheaper. But this business is extraordinary, and its long-term potential is still quite high, so perhaps this 30% pullback is a nice opportunity to pick up some shares for the long term at a better price than last month.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,068!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $36,491!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $347,573!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of June 11, 2024

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Celsius and Monster Beverage. The Motley Fool has a disclosure policy.

Celsius Stock Has Plunged More Than 30% in Less Than a Month. Time to Buy the Dip? was originally published by The Motley Fool

Signup bonus from