His approach to picking stocks may be simple to the point of being boring. Warren Buffett’s results, however, speak for themselves. Given enough time, Berkshire Hathaway reliably beats the market. That’s why you’d be wise to poach a few of his picks for yourself.

Buying every Berkshire holding isn’t a feasible option for most investors, of course. And even if it were, you wouldn’t necessarily want to step into all of these names at the same time. See, even Warren Buffett holds out for the right price. You’ll also want to remain patient and shop around. That’s particularly true in light of how well Berkshire Hathaway has performed recently.

With that being said, there are three great Buffett picks currently discounted a bit from their recent highs, but they remain in Berkshire’s portfolio for good reasons. You just might want to go ahead and scoop up one (or all) of these names for yourself.

1. Occidental Petroleum

Contrary to a common assumption, despite the advent of alternative energy, the need for crude oil isn’t going away. It’s not even shrinking. Standard & Poor’s believes global consumption will continue growing from just a tad over 100 million barrels per day now to 109.3 million barrels per day by 2030. Usage should start to taper off then, but only slightly. S&P says that even as far down the road as 2050, the world will still need a little over 100 million barrels of oil every single day. We will, of course, use up a big chunk of the known supply of it in the meantime, making it scarcer and, therefore, buoying its price.

Given this outlook, Buffett’s 2022 decision to open a major position in oil and gas outfit Occidental Petroleum (NYSE: OXY) suddenly makes a lot of good sense. The Oracle of Omaha didn’t just pick Occidental out of a hat, however. As Buffett noted in 2023’s letter to Berkshire’s shareholders, “We particularly like [Occidental’s] vast oil and gas holdings in the United States, as well as its leadership in carbon-capture initiatives.” He adds, “[CEO] Vicki [Hollub] does know how to separate oil from rock, and that’s an uncommon talent, valuable to her shareholders and to her country.”

This knowledge, paired with Hollub’s understanding of oil’s supply/demand dynamic, could soon pay off in a big way for Oxy’s shareholders, too. Although back in January, she cautioned whomever cared to listen that the industry’s underinvestment in its supply would lead to shortages as soon as 2025, few heeded the warning then. Now, just five months later, Goldman Sachs foresees a “sizable” supply deficit this summer, pushing oil (and therefore gasoline) prices sharply higher. And Goldman isn’t alone in its worry.

If it’s a glimpse of what’s to come — and it is — Occidental Petroleum’s recent decisions to ensure it’s ready to produce are nothing less than brilliant.

The stock is down 13% from April’s high. That’s not a lot, but it may be all the discount you’re going to get here.

2. Kraft Heinz

The Kraft Heinz Company (NASDAQ: KHC) is a rare misfire from Warren Buffett.

This food giant is the result of the 2015 merger of Kraft and Heinz, a pairing partially orchestrated by Buffett when Berkshire held a major stake in H.J. Heinz. The assumption was that the two similar companies could pool resources, apply leverage, cut costs, and find qualitative synergies.

None of that ever really happened to any meaningful degree, though. Instead, the melding of the two companies was a fiasco from the start. Shares of the new stock peaked in 2017 before falling 70% by mid-2019. That’s when Buffett finally conceded that he overpaid for Kraft. The stock hasn’t moved much since, suggesting that little has changed about the combined companies’ prospects.

But, in reality, a great deal has changed for the better.

Take its new CEO as an example. Carlos Abrams-Rivera took the helm near the end of last year, and though he’s an internal hire, he brings something fresh to the proverbial table. He also brought five executives with him to help lead the company, which is reprioritizing innovation. The debut of 360CRISP last year, for instance, offers microwavable grilled cheese sandwiches that taste and feel like they were prepared in a pan.

It’s still just food, so it isn’t a high-growth market. There is significant growth and value here; however, that isn’t reflected in the stock’s price. Shares are priced at only about 12 times their trailing per-share earnings and roughly 11 times their projected profits. The stock’s trailing dividend yield is also a healthy 4.7%, and while this quarterly payment hasn’t grown in years, it’s still reliable income. An increase in its dividend at some point in the foreseeable future also isn’t out of the question.

3. Visa

Last but not least, add Visa (NYSE: V) to your list of no-brainer Warren Buffett stocks to buy right now.

Unlike Kraft Heinz and Occidental, Berkshire Hathaway doesn’t own a huge piece of the credit card middleman. The 8.3 million shares of Visa it does own only account for about 0.6% of Berkshire’s total stock holdings, in fact, and are a mere 0.4% of Visa itself.

It’s a company Buffett has held a stake in, however, going all the way back to 2011. That’s saying something, given how easily he could have shed it without impacting Berkshire’s performance. Indeed, don’t be completely surprised if Buffett begins adding to the position again now that Visa shares are down roughly 7% from their March high. Much like Occidental Petroleum, that’s probably about all the discount you’ll get.

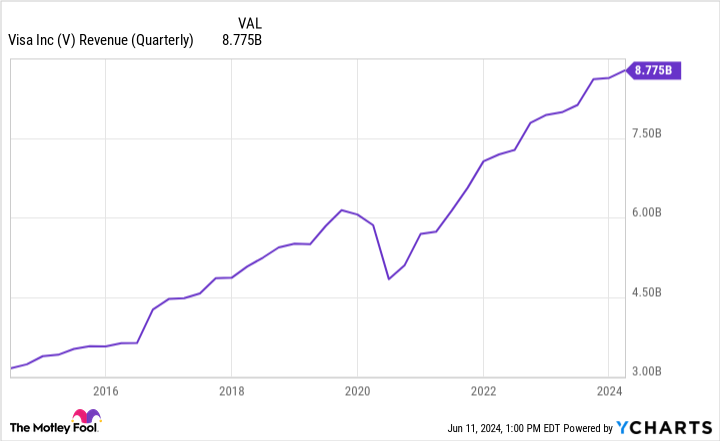

The bullish case here isn’t a tough one to make: People purchase goods and services, and they crave convenience. Visa facilitates the former, and offers the latter. Every time a cardholder swipes their plastic, Visa pockets a few pennies for itself. That’s why (with the exception of 2020, when the COVID-19 pandemic was in full swing) its revenue hasn’t failed to grow in any quarter going back for over a decade.

Of course, being the world’s single biggest card-payment middleman doesn’t exactly hurt the company’s ability to attract more cardholders and encourage more usage of these cards. There’s even an entire arm of the company dedicated to doing just that. A handful of innovation centers found all over the world independently find and develop ways to better meet the payment needs of their particular markets. As an example, earlier this year, Visa unveiled engagement-minded technology that merchants can use to foster loyalty, which in turn drives more sales for that business.

This tech, of course, also generates more swipe fees for Visa itself, whether from credit or debit cards.

Should you invest $1,000 in Kraft Heinz right now?

Before you buy stock in Kraft Heinz, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Kraft Heinz wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $740,886!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 10, 2024

James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway, Goldman Sachs Group, and Visa. The Motley Fool recommends Kraft Heinz and Occidental Petroleum. The Motley Fool has a disclosure policy.

3 No-Brainer Warren Buffett Stocks to Buy Right Now was originally published by The Motley Fool

Signup bonus from