Wall Street is gearing up for a rare double feature of market-moving economic events on Wednesday, with the May consumer-price index due in the morning and the Federal Reserve’s policy announcement in the afternoon.

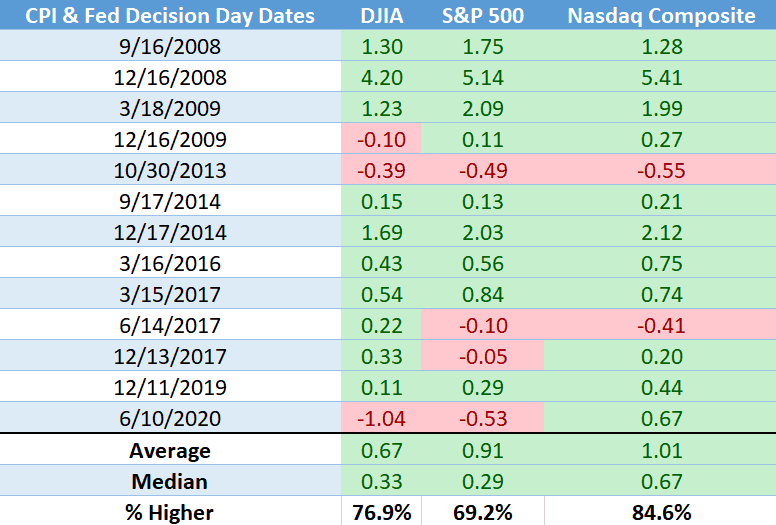

CPI days and Fed decision days both have a reputation for market volatility, but they rarely coincide. The CPI report and the Fed’s policy meeting have fallen on the same day only 13 times since 2008, according to Dow Jones Market Data.

Most Read from MarketWatch

While the sample size is small, all three major stock indexes have tended to post gains on those days, with the S&P 500 SPX rising an average of 0.7%, the Dow Jones Industrial Average DJIA adding 0.9% and the Nasdaq Composite COMP advancing over 1%, according to Dow Jones Market Data (see table below).

Despite the rare event on Wednesday, some strategists don’t expect greater-than-usual volatility in the stock market.

Dave Sekera, chief U.S. market strategist at Morningstar Research Services, said the things that could drive volatility higher on Wednesday would be if Fed Chair Jerome Powell was to “say something unexpected” during his press conference a half-hour after the release of the central bank’s policy statement and the updated economic forecasts at 2 p.m. Eastern.

“But I think that is of a very low probability as he’s [Powell’s] always very measured in his commentary,” Sekera said in emailed commentary on Monday.

MarketWatch Live Coverage: CPI report for May: Investors focus on core after string of hot readings

The CPI, a measure of what Americans pay for goods and services, was unchanged in May for the first time in almost two years, the Labor Department reported Wednesday. It was below the forecast for a 0.1% monthly increase, according to economists surveyed by The Wall Street Journal.

The “core” rate of inflation, which excludes volatile food and energy prices and is more closely watched by economists and the Fed, rose a modest 0.2% last month. That was the smallest gain in seven months.

The yearly increase in the headline number slowed to 3.3% from 3.4% in the prior month, while the core rate slowed to 3.4% from 3.6% in the 12 months ended in May, according to the Labor Department.

See: Good news on inflation? CPI might show signs of easing prices.

Sekera and his team said if inflation metrics come in line or better than expected, that may provide some positive market sentiment, but given the high valuations in the market right now, they don’t see “much of a short-term upside left” for U.S. equities.

U.S. stock-index futures were surging on Wednesday early morning. The Dow Jones Industrial Average futures YM00 were up over 300 points, or 0.8%, while the Nasdaq-100 NQ00 and the S&P 500 futures ES00 were each rising 0.9%, according to FactSet data.

MarketWatch Live Coverage: Fed meeting: Dow futures up 250 points after CPI data as investors await rate-cut guidance

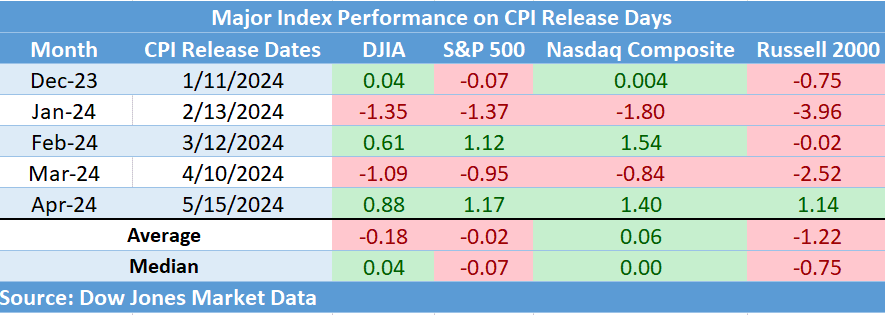

The S&P 500 and Dow industrials averaged small declines of 0.02% and 0.18%, respectively, on the past five CPI days this year. This contrasts with their 10-year averages of a 0.02% gain and a 0.06% decline on CPI days.

So why the reputation for volatility?

CPI day volatility was on display in 2022 as hot inflation numbers sparked the start of the Fed’s rate-hike cycle. The S&P 500 saw an average percentage move — up or down — of 1.9% on CPI release days in 2022. The median move was a 1.7% change, according to Dow Jones Market Data.

CPI day volatility moderated in 2023 but has been significant this year. The table below shows that both the S&P 500 and the Nasdaq saw approximately 1% moves in either direction on four of the last five CPI release days so far this year, according to Dow Jones Market Data.

See: Fed won’t move interest rates this week, but meeting will still be a feast for economists

Meanwhile, stock-market performance on the Fed’s policy decision days also painted a muddled picture this year. The S&P 500 and Dow industrials logged an over 1% advance on March 20 while the three major indexes finished at their record closing levels after the Fed reiterated the prospect of three rate cuts in 2024.

However, the S&P 500 only averaged a 0.1% gain on three Fed decision days this year, while the Dow and the Nasdaq each booked an average decline of around 0.4% in the same period, according to Dow Jones Market Data (see table below).

Most Read from MarketWatch

Signup bonus from