Real estate investment trusts (REITs) can be great investments for those seeking to generate passive income. Most REITs offer dividend yields well above the S&P 500‘s average of 1.3% (the sector average is over 4%). Many REITs offer even bigger income streams.

EPR Properties (NYSE: EPR) and W. P. Carey (NYSE: WPC) currently yield more than 6%. They should be able to sustain and grow those big-time payouts, making them great REITs to buy hand over fist for income. Unfortunately, that’s not the likely case for Annaly Capital Management’s (NYSE: NLY) monster payout. Because of that, investors should avoid its big-time dividend.

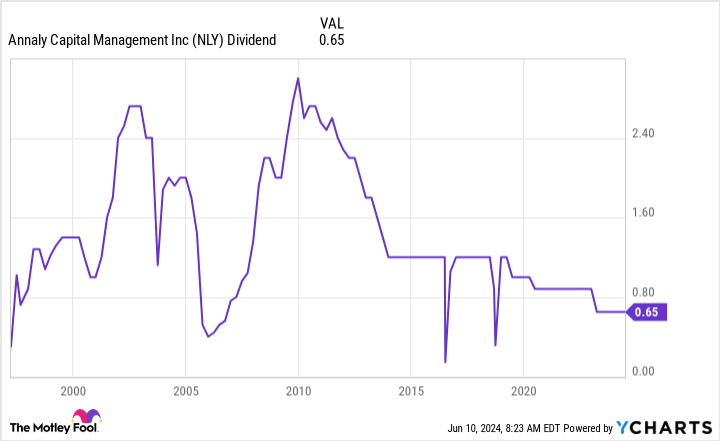

The downward trend will likely continue

Annaly Capital Management currently offers an eye-popping dividend yield of more than 13%. That’s 10 times the income you could generate from investing in an S&P 500 index fund.

However, the issue with Annaly is its inability to sustain its dividend over the years. The mortgage REIT has cut its payout several times:

Another dividend cut seems like a distinct possibility. Annaly’s earnings available for distribution were only $0.64 per share in the first quarter, which was less than its $0.65-per-share dividend payment. That was down from $0.81 per share in the year-ago period.

The company’s falling earnings led it to cut its dividend by nearly 20% last year. If they keep sliding, Annaly will likely need to reduce its payout again.

Reset and resuming growth

W. P. Carey has also cut its dividend in the recent past. It reset its dividend last year following its strategic decision to exit the office sector and have a more conservative dividend payout ratio so it could retain more of its earnings to fund new investments. The diversified REIT currently offers a dividend yield above 6%.

The company sold or spun off its office properties to focus on sectors with better long-term growth prospects, like warehouses and industrial buildings. These properties should maintain higher occupancy rates. The REIT should also benefit from having more leases tied to inflation or that escalate at higher fixed rates.

W. P. Carey has already started rebuilding its portfolio. It plans to invest up to $2 billion this year on new properties, which will supply it with incremental rental income that should steadily grow in the future. That should enable W. P. Carey to increase its dividend.

The REIT has already started raising its dividend again, growing the payout at a faster pace than it did before its office exit. With its office headwinds now in the rearview mirror, W. P. Carey should supply investors with a steadily rising income stream in the coming years.

Building back better

EPR Properties has also cut its dividend in the past. The REIT focused on experiential real estate had to suspend its dividend during the pandemic due to its impact on the movie theater industry.

It has since reinstated a dividend, albeit at a lower rate than its pre-pandemic level. That’s because, like W. P. Carey, it opted for a more conservative dividend payout ratio to retain additional cash flow to fund new investments.

The REIT has steadily increased its dividend from its reset level, including by 3.6% earlier this year. It now yields around 8.5%.

EPR Properties currently expects to invest $200 million to $300 million into new properties this year, a level it can fund with retained cash flow and its strong balance sheet. In the first quarter, it spent $85.7 million to buy an attraction property and to acquire and finance land for two build-to-suit eat & play development projects.

The REIT has also lined up $220 million of development projects it expects to fund over the next two years. These investments should continue diversifying its experiential real estate portfolio and growing its cash flow. That should enable the REIT to continue increasing its dividend.

Better REITs for a growing income stream

Annaly Capital’s dividend has steadily fallen over the years, and it seems likely to continue. Contrast that with what appears to be ahead for the dividends of EPR Properties and W. P. Carey. While they have both reset their dividends in recent years, their payouts seem likely to grow in the future. Because of that, they should supply their investors with a growing income stream and higher total returns compared to Annaly. That makes them much better REITs to buy for income.

Should you invest $1,000 in EPR Properties right now?

Before you buy stock in EPR Properties, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and EPR Properties wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $740,690!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 10, 2024

Matt DiLallo has positions in Annaly Capital Management, EPR Properties, and W. P. Carey. The Motley Fool recommends EPR Properties and W. P. Carey. The Motley Fool has a disclosure policy.

2 Ultra-High-Yield REIT Stocks to Buy Hand Over Fist, and 1 To Avoid was originally published by The Motley Fool

Signup bonus from