Artificial intelligence stock UiPath (NYSE: PATH) looked like a compelling investment in the past. The company’s software platform uses AI to automate business processes, such as scanning bank loan applications for missing info and answering customer inquiries via email.

Its AI-enabled technology attracted customers, generating double-digit, year-over-year revenue growth for the last few years. But those days of growth may be over after UiPath released earnings results for its fiscal first quarter, which ended April 30. In that report, the company announced a reduction in its fiscal 2025 full-year guidance, and its CEO, Rob Enslin, stepped down. This twin blow caused UiPath shares to plunge, hitting a 52-week low of $11.53 on June 3.

With shares still trading near this low is now a good time to invest in the AI firm? To get to an answer, let’s start by unpacking the changes UiPath announced in its fiscal Q1 report.

The factors causing UiPath’s stock to drop

The departure of CEO Rob Enslin is unlikely to impact UiPath’s long-term future. That’s because Enslin’s tenure was brief, and he was replaced by Daniel Dines, one of the founders of UiPath and a former CEO of the company. Enslin joined in 2022, and for most of his time with UiPath, he shared the CEO role with Dines until February of this year.

Looking at UiPath’s fiscal 2025 outlook, it’s apparent that the company estimated full-year revenue of around $1.6 billion, which would have been a 23% year-over-year increase.

UiPath now expects $1.4 billion in sales, representing 7% year-over-year growth. For context, in fiscal 2024, the company’s revenue rose 24% year over year to $1.3 billion.

UiPath’s revised fiscal 2025 outlook means revenue growth unexpectedly dropped off a cliff — not what investors want to see from a growth stock. The firm blamed the current macroeconomic environment of high interest rates and inflation for causing customers to become more cautious about their spending.

But UiPath’s ability to close sales deals was another factor in cutting its revenue forecast. Management described the situation as “inconsistent execution, which included contract execution challenges on large deals.”This operational misstep is surprising given the company’s history of strong revenue growth. For example, in its Q1 results, UiPath’s $335.1 million in sales represented a 16% increase over the previous year.

But starting in Q2, the company expects revenue growth to slow substantially. It forecast around $300 million in Q2 sales compared to $287.3 million in the prior year.

UiPath’s positive attributes

The return of Dines to the CEO seat is encouraging, providing the company with familiar leadership. That’s not the only positive. The company’s Q1 free cash flow (FCF) of $101.3 million was a 40% jump from the prior year’s $72.7 million. In addition, UiPath’s balance sheet is strong. Total assets were $2.8 billion with $1.1 billion of that in cash and equivalents. Total liabilities were $818 million with no debt.

Its FCF and balance-sheet position allow UiPath to make any number of strategic moves. For example, the company could find an acquisition that can help it reignite sales growth or invest in areas of its business, such as strengthening its sales approach, which it intends to do.

At this point, UiPath’s stock has dropped so much, I believe it has upside potential. The company had its initial public offering (IPO) in 2021 at $56 per share, while more recently, in February, its 52-week high was $27.87. So UiPath stock has the ability to increase significantly from its current share price, which is around an historic low.

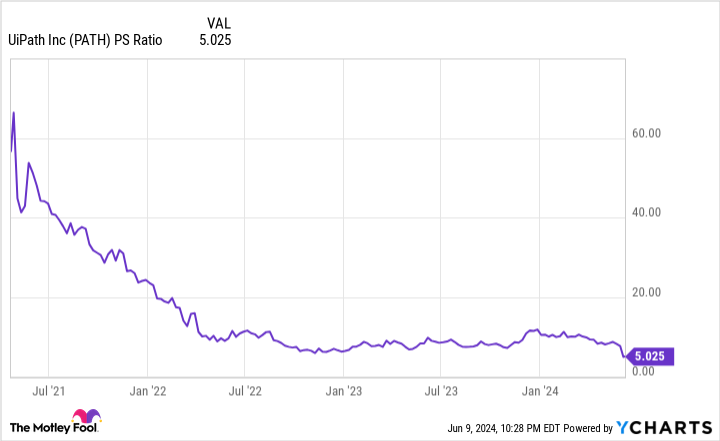

For a look at its current valuation, here’s a chart of its historical price-to-sales (P/S) ratio. Since UiPath isn’t profitable, having incurred a net loss of $28.7 million in Q1, the price-to-earnings (P/E) ratio commonly used for stock valuation isn’t applicable.

Data by YCharts.

In its brief history as a public company, UiPath stock is at a low point in its P/S ratio.

Other factors to consider with UiPath stock

Another factor in evaluating UiPath stock is the current consensus among Wall Street analysts, which is a median share price of $15 with a “hold” rating. The “hold” makes sense given the current uncertainty around UiPath reigniting sales growth, but the share-price target suggests a belief in some upside for the company’s stock.

Despite the sales-growth slowdown, UiPath is still increasing revenue year over year with the majority of it coming from international markets. The Americas accounted for 46% of sales in Q1, so UiPath has an opportunity to expand revenue further in this region.

However, given the sudden changes hitting UiPath this year, buying shares in the company now involves some risk. You may want to wait a couple of quarters to see if a trend suggests UiPath is heading toward a rebound in revenue growth.

But I agree with Wall Street and think the substantial stock-price drop creates greater upside potential. With its history of strong year-over-year revenue growth under Daniel Dines, UiPath is positioned to fix its operational shortfalls and bounce back over the long run.

Should you invest $1,000 in UiPath right now?

Before you buy stock in UiPath, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and UiPath wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $740,690!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 10, 2024

Robert Izquierdo has positions in UiPath. The Motley Fool has positions in and recommends UiPath. The Motley Fool has a disclosure policy.

Is UiPath Stock a Buy? was originally published by The Motley Fool

Signup bonus from