Share prices of athleisure clothing company Lululemon Athletica (NASDAQ: LULU) are down by roughly 40% from their December 2023 peak. Given its strong performance as a company, especially since 2020, is this stock ready for the bargain bin?

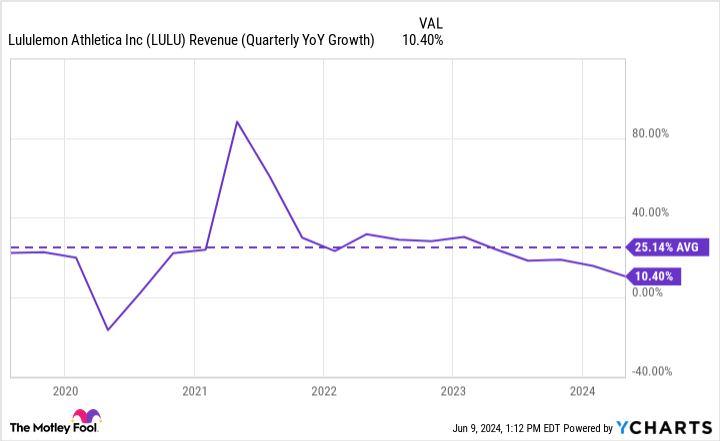

When the COVID-19 pandemic hit, Lululemon benefited from increased consumer spending on a range of goods. That increased spending was driven by the combination of stimulus checks and the limited options consumers otherwise had for spending on experiences. At one point, Lululemon’s quarterly revenue was growing by as much as 80% year over year.

The impact of those stimulus funds has since faded and consumers have pulled back on some of their discretionary spending in the past year to deal with some unevenness in the overall economy. As a result, the company’s growth rate and share price have faltered as it works to overcome tough comparisons and the market reacts.

What the market appears to not be factoring in is that Lululemon’s success wasn’t a pandemic-powered flash in the pan. It’s a world-class company and consumer brand with a bright future. That’s why, rather than giving up on Lululemon, investors should consider doubling down on it.

An excellent business with an impressive track record

Lululemon operates in a ruthlessly competitive industry. I’m talking about consumer retail. The company specializes in the athleisure category, selling leggings, yoga pants, and other exercise apparel. It has gone up against apparel stalwarts like Nike, a tremendous company in its own right.

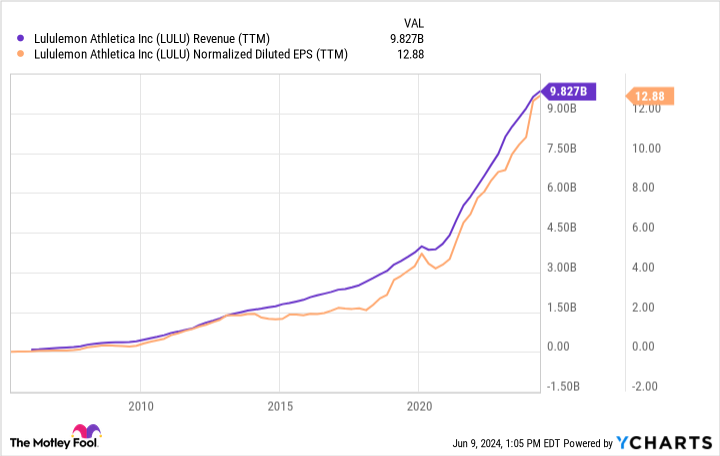

It carved out a share of the retail space by building a lifestyle brand that resonates with young, active consumers. And Lululemon has grown profitably, like clockwork, over the past two decades.

The stock has been an enormous winner, returning over 2,000% during that time. So to reiterate: Lululemon was great before the pandemic, even if conditions during the pandemic (which is still officially ongoing) did give a temporary boost to its sales. Now, though, it’s about looking to the future.

Lulemon has a solid growth outlook

Why is the stock price down? Simply put, its growth rate has slowed over the past two years. You can see below that Lululemon’s sales grew at an average pace of 25% annually for the past five years. Sales growth spiked to over 80% at one point, and the company turned in just 10% year-over-year growth in its most recent quarter.

A few things can be true, and they don’t need to spell trouble for Lululemon. Growth slowed down in the wake of its pandemic surge, which is understandable. Lululemon isn’t some young start-up anymore, so it seems reasonable that such a growth spurt would pull forward some demand, and a growth slump would eventually follow.

Additionally, though inflation is far below its 2022 peak, it’s still higher than the target 2% rate, and consumers continue to feel some financial pressure from the recent price hikes. The personal savings rate in America is near a decade low, and people have less ability to make discretionary purchases. You can love a product, and I believe people love Lululemon. But discretionary items tend to be the first purchases to go when times get tough.

The hope is that the U.S. consumer will bounce back over time. The economy is cyclical, and there’s a good chance people will eventually have more money to use on discretionary spending again. Acknowledging Lululemon’s current struggles without casting the stock into the abyss is OK.

Shares are too cheap considering Lululemon’s fundamentals

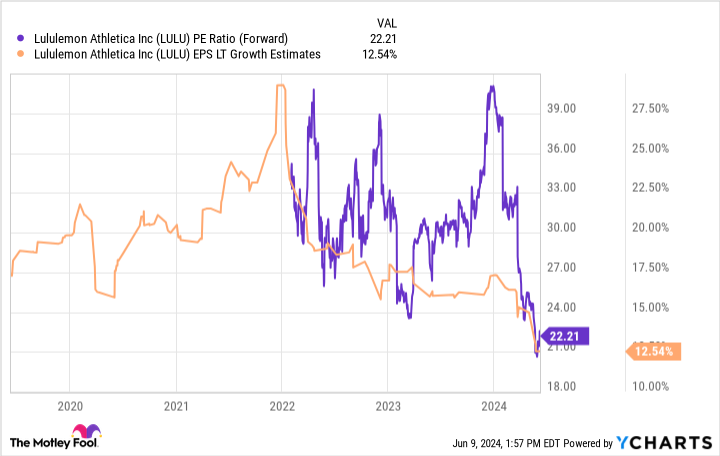

Understandably, the slowdown in revenue growth led analysts to lower their expectations for the company. Lululemon’s anticipated earnings growth rate of 12.5% is its lowest in years by a wide margin. Hence, the stock’s significant decline from highs.

But it’s possible (and seemingly likely) that the market overreacted and took the stock down too far. Lululemon stock trades at a forward P/E ratio of 22 right now. Its price/earnings-to-growth ratio is 1.7, which signals the stock isn’t necessarily a bargain, but it’s a reasonable buy for its anticipated growth. However, expectations change, and Lululemon’s growth rates will likely change more as we get further away from the pandemic and consumer discretionary spending eventually recovers.

Such a scenario could drive estimates (and sentiment) higher again, making shares look cheaper in hindsight than they do today.

That’s a theory, of course, and it is not guaranteed to play out that way. But long-term investing requires you to look at a stock and the company’s circumstances, peer into the future, and make educated guesses about what might happen. Lululemon is a proven superstar brand with years of strong growth behind it. The odds are reasonable that the company will eventually get its groove back, and that its stock will head higher again.

Should you invest $1,000 in Lululemon Athletica right now?

Before you buy stock in Lululemon Athletica, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Lululemon Athletica wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $740,690!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 10, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Lululemon Athletica and Nike. The Motley Fool recommends the following options: long January 2025 $47.50 calls on Nike. The Motley Fool has a disclosure policy.

1 Growth Stock Down Almost 40% to Buy Right Now was originally published by The Motley Fool

Signup bonus from