Semiconductor equipment manufacturing is a notoriously lumpy business. The companies in this line of business, such as ASML (NASDAQ: ASML), make the intricate (and expensive) machinery that creates various semiconductor chips, such as Nvidia’s graphic processing units (GPUs). The demand for their services varies from year to year, making investing a bit of a cyclical guessing game.

For ASML, analysts forecast the company will see a jump in revenue later this year and into the next. Let’s look at the reasons behind that upbeat forecast and determine whether now is a golden opportunity to buy the stock.

New EUV machines will power better ASML results

The lumpiness of ASML’s business could be seen in its fiscal first-quarter results reported in April as the Dutch company saw its Q1 revenue decline nearly 22% year over year to 5.3 billion euros ($5.74 billion), while sequentially revenue fell 27%. The company generates revenue from both selling new and used lithography systems, as well as from after-sales support. Its Q1 equipment sales were down nearly 26% year over year to 3.97 billion euros ($4.3 billion), while its service revenue fell nearly 6% year over year to 1.32 billion euros ($1.43 billion).

The company sold 66 new lithography systems and four used systems in Q1 compared to 96 new and four used systems a year ago. In Q4, it sold 113 new lithography systems and 11 used systems.

While Q1 was nothing to write home about, what is exciting is that the company began shipping its newest machine, a High Numerical Aperture Extreme Ultraviolet lithography system, or High NA EUV for short, to customers. Intel (NASDAQ: INTC) was the first to receive and install one of these new High NA EUV systems in April.

At the time, Intel said the new system would allow its foundry to provide never-before-seen precision and scalability in chip manufacturing. It will also help it develop chips with innovative features and capabilities that are needed for advancements in artificial intelligence (AI).

Meanwhile, ASML recently said that two of its other large customers, Taiwan Semiconductor Manufacturing (NYSE: TSM) and Samsung, would also take shipments of new High NA EUV systems by year’s end. TSMC had previously balked at buying the system because of its $380 million price tag. However, recent reports indicate that negotiations with TSMC are nearly complete and that ASML expects “significant” 2nm-related orders from its largest customer starting in the second or third quarter of 2024.

ASML is bullish that the new High NA EUV system will be a big growth driver, previously forecasting 2025 revenue to climb to between 30 billion to 40 billion euros ($32.4 billion to $43.2 billion). The company generated 27.6 billion euros ($29.8 billion) in revenue last year.

Is now a golden opportunity to buy ASML stock?

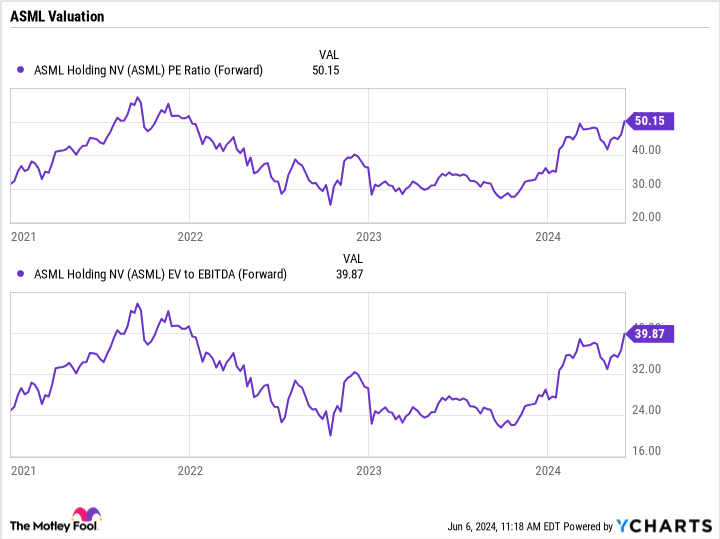

Looking at valuation, ASML stock is not cheap on the surface, trading at a forward price-to-earnings (P/E) multiple of about 50 times and an enterprise value (EV)-to-EBITDA multiple of 40 times. The latter metric takes into consideration its net cash position and takes out non-cash expenses such as depreciation.

However, with its new system and continued capacity expansions by semiconductor manufacturers to keep up with demand for the latest chips to help power AI, ASML is expected to see a big increase in 2025 earnings per share (EPS) and earnings before interest, taxes, depreciation, and amortization (EBITDA) over 2024 levels. Analysts project 2025 EPS to jump from an estimated $20.76 this year to $32.23 in 2025. For EBITDA, analysts are looking for an increase to over $16 billion from projections of $10.3 billion in 2024. That would bring its P/E multiple down to around 32 times and its EV/EBITDA multiple to about 25 times based on 2025 projected numbers.

Given the growth and tailwinds behind the company, those valuation metrics look attractive. ASML is currently the only company building chip manufacturing machines with High NA EUV technology, and it looks to have a huge technological advantage over its competitors in this area. At the same time, the company is in a good spot as the demand for AI and the chips needed to power it continues to explode.

With TSCM giving in and buying its latest equipment, one large risk has now been removed. As such, now does look to be a golden opportunity to buy ASML stock before its revenue and earnings head much higher from here.

Should you invest $1,000 in ASML right now?

Before you buy stock in ASML, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and ASML wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $740,688!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 3, 2024

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends ASML, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel and short August 2024 $35 calls on Intel. The Motley Fool has a disclosure policy.

Is Now a Golden Opportunity to Buy ASML Stock, With Revenue Set to Jump? was originally published by The Motley Fool

Signup bonus from