It was perhaps one of the biggest and most important trading theses for investors at the start of 2024, contributing to a mostly upbeat view that helped propel large-cap and tech-heavy U.S. stock indexes to new records in June: The idea that lower interest rates are on the way this year.

May’s jobs report threw an unexpected wrench into that notion — shocking traders and economists with just how much more room the labor market has to run, while complicating where policymakers ought to go from here. The U.S. economy not only created 272,000 new jobs, or 82,000 more than economists’ median forecast, but average hourly wages increased by 4.1% over the past 12 months in a worrisome sign for inflation. This came despite other recent data, which appeared to be pointing toward a U.S. economic slowdown.

On Friday, top executives, economists and traders began openly expressing doubts that the U.S. central bank could even cut rates once this year, a dramatic turnabout from expectations in January and late December for as many as six or seven quarter-point reductions. Treasury yields soared for the first time in seven sessions, pulling the ICE U.S. Dollar Index DXY higher by 0.8%. Meanwhile, stock investors hesitated over how to interpret May’s strong job growth, sending all three major indexes DJIA SPX COMP to lower closes for the day.

Referring to the 2.1% weekly decline seen in the small-cap Russell 2000 index RUT on Friday, Kevin Rendino, chairman and chief executive of 180 Degree Capital in Montclair, N.J., said the S&P 500, which finished up by 1.3% for the week and not far from Wednesday’s record close of 5,354.03, “is not a representation of the carnage that lies beneath the biggest capitalization stocks.”

“Just this week, while the S&P 500 was pushing on new highs, there were over 1,000 stocks making new lows,” Rendino wrote in an email to MarketWatch. The majority of stocks “have been suffering the last few weeks as economic indicators have shown a softening of the economy,” he said. Investors fear a slowdown when the data comes in weak, but “panic” that the Fed won’t cut rates when the numbers are good, as they were on Friday.

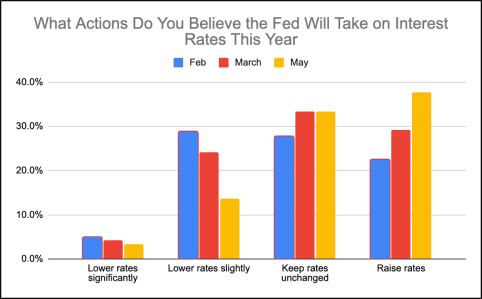

Meanwhile, interest-rate swaps known as OIS were fully pricing out the likelihood of a quarter-point Fed rate cut by December, according to Bloomberg News. Fed-funds futures traders were clinging to a 45% chance of just one quarter-point reduction by September, and a likelihood of possibly two rate cuts before year’s end. And a more pessimistic take was forming out on Main Street: Almost four out of 10 small-business owners are bracing for rate hikes this year, a sharp reversal from three months ago, and more than half now believe the economy is heading for stagflation, said Andrew Crapuchettes, a labor-market expert and chief executive of Idaho-based RedBalloon, which connects businesses to job seekers.

Most Read from MarketWatch

Friday’s jobs data triggered an aggressive selloff in U.S. government debt that pushed the 1-year T-bill rate BX:TMUBMUSD01Y up to as high as 5.19%, one of its highest levels of the year. Yields for 2-year BX:TMUBMUSD02Y and 10-year Treasurys BX:TMUBMUSD10Y jumped by around 15 basis points each to close at one-week highs.

Though the S&P 500 and Nasdaq Composite finished lower on Friday, they still managed to secure weekly gains of 1.3% and 2.4% respectively. They forged their way toward records on Wednesday, even as expectations for six or seven Fed rate cuts have faded since the start of the year. One reason is an increasingly concentrated market, in which a handful of big names are accounting for much of the market’s gains.

See also: A few stocks are driving most market gains. Here’s why investors shouldn’t worry too much.

“At the start of year, the case for rate cuts was built on hope that inflation and job gains would cool, neither of which has panned out so far,’’ said Jeffrey Cleveland, director and chief economist at Payden & Rygel, a Los Angeles-based investment management firm that oversees $161.7 billion in assets. “It’s almost like great expectations at the start of the year were built on hope — a future that didn’t play out. The case for cuts has evaporated: There is not a compelling case, at this point, to cut.”

If the economy continues to grow and avoids a recession, “equities will continue to rise and make all-time highs in the next six to 12 months,” Cleveland said via phone on Friday. “Equities tend to rise until the U.S. business cycle ends, and May’s payroll gains tell me the business cycle has more room to go.’’ And if the Fed is not cutting interest rates as inflation stays higher, “our view is that maybe it will not be such a bad environment to stay in T-bills.’’

Investors and traders started to gradually pull back on expectations for Fed rate cuts months ago, after inflation came in hotter than expected during the first quarter and as concerns grew that interest rates at 23-year highs of 5.25%-5.5% might not be enough. Treasury yields reached their highest closing levels of 2024 in April, with 10- and 30-year rates respectively reaching 4.71% and 4.82%.

Giving renewed hope to the idea that the labor market and economy might still cool off by enough to justify rate cuts was a stream of weaker-than-expected data over the past two weeks.

That data included a slowdown in private-sector hiring; construction- and manufacturing-related data that came in below estimates; and the smallest increase of the year in the monthly core reading from the Federal Reserve’s preferred inflation measure.

In addition, the Bank of Canada and European Central Bank cut interest rates on Wednesday and Thursday, kicking off what many were hoping would be a global rate-cutting cycle that eventually includes the Fed.

May’s unexpectedly hot jobs report isn’t good news for the Fed and “should exterminate any hopes of a rate cut this year,” said Sean Snaith, director of the Orlando-based Institute for Economic Forecasting at the University of Central Florida.

Most Read from MarketWatch

Signup bonus from