Shares of CrowdStrike (NASDAQ: CRWD) surged after the cybersecurity company reported strong fiscal first-quarter earnings. The stock has now more than doubled over the past year and is up around 900% the past five years.

Let’s take a closer look at the company’s most recent results and whether it’s too late to buy the stock.

Strong revenue growth continues

For its first quarter, CrowdStrike saw its revenue grow 33% to $921 million. That was well ahead of its earlier forecast for revenue of between $902.2 million to $905.8 million. Subscription revenue climbed 34% to $872.2 million.

Its annual recurring revenue (ARR), which is the annualized value of its customer subscription contracts, rose 33% to $3.65 billion. Net new ARR in the quarter jumped 22% to $211.7 million.

The company’s adjusted earnings per share (EPS) surged from $0.57 a year ago to $0.93. It had previously guided for adjusted EPS of between $0.89 to $0.90.

Operating cash flow came in at $383.2 million, while free cash flow was $322.5 million. The company ended the quarter with nearly $3 billion in net cash and short-term investments.

The company continues to strike deals that include more of its cybersecurity modules. Over 65% of CrowdStrike’s customers have five or more modules, while 28% have seven or more. Its number of deals with eight or more modules, meanwhile, surged by 95%. It said the number of deals that included its Cloud, Identity, or Falcon next-gen SIEM modules more than doubled year over year.

CrowdStrike was very bullish on its Falcon and Falcon Flex programs, which it said have strong win rates and are driving larger platform deal sizes. Falcon is an artificial intelligence (AI)-native platform console that lets its 28 modules work seamlessly together. Its Flex program offers a flexible licensing agreement that lets prenegotiated commitments be drawn down over time, and even allows companies to switch out modules as their needs change.

Looking ahead, CrowdStrike forecast Q2 revenue to come in a range of $958.3 million to $961.2 million, with adjusted EPS of between $0.98 to $0.99. For its full fiscal year, it is looking for revenue to be between $3.98 billion to $4.01 billion and EPS of between $3.93 to $4.03. That is up from prior guidance calling for revenue between $3.92 billion and $3.99 billion and adjusted EPS of between $3.77 to $3.97.

Overall, this was a great quarterly report from CrowdStrike that really separated it from its cybersecurity peers. In fact, on its earnings conference call, Wells Fargo analyst Andrew Nowinski immediately contrasted the company’s quarter versus its rivals, pointing out that “every single one of … [its] peers has put up pretty mediocre results this quarter.”

Is it too late to buy the stock?

CrowdStrike has proven to be best of breed in the world of cybersecurity, and not surprisingly, it trades at a premium valuation as a result.

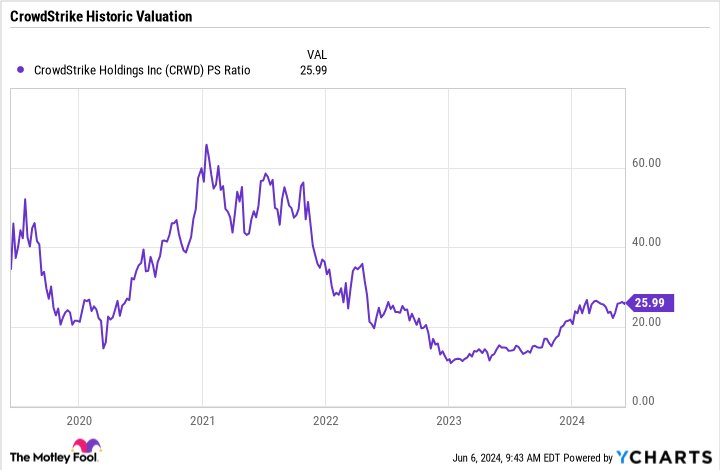

Trading at a nearly 21 times forward price-to-sales (P/S) multiple, the stock is by far one of the priciest cybersecurity stocks out there.

Now the stock is trading at a lower valuation than it has commanded at points in the past, but its growth has also slowed down. Its revenue growth has gone from over 125% in 2018 to around 81% in 2021 to 54% in 2023 down to the low-to-mid-30% range currently. With slower revenue growth should come a lower multiple.

While CrowdStrike has proven to be among the best cybersecurity companies out there, valuation does matter. As such, I prefer to wait on the sidelines and would only be a buyer on a price dip at these valuation levels.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for two decades, Motley Fool Stock Advisor, has more than tripled the market.*

They just revealed what they believe are the 10 best stocks for investors to buy right now… and CrowdStrike made the list — but there are 9 other stocks you may be overlooking.

*Stock Advisor returns as of June 3, 2024

Wells Fargo is an advertising partner of The Ascent, a Motley Fool company. Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends CrowdStrike, Fortinet, Okta, Palo Alto Networks, and Zscaler. The Motley Fool has a disclosure policy.

CrowdStrike Shares Surge as Revenue Soars. Is It Too Late to Buy the Stock? was originally published by The Motley Fool

Signup bonus from