The tech industry is booming, bolstered by advances in sectors like artificial intelligence (AI), cloud computing, chip design, virtual/augmented reality (VR/AR), and much more. Thanks to its seemingly ever-expanding nature, tech has repeatedly proven to be one of the best markets to invest in over the long term.

Many of the industry’s biggest players have reputations for delivering significant gains over many years, proven by the Nasdaq-100 technology sector’s rise of 390% over the last decade. It’s therefore not surprising that Berkshire Hathaway, led by investment mogul Warren Buffett, has dedicated more than 40% of its portfolio to tech stocks.

It’s never too late to invest in tech, with no better time to start than now. Here are two top tech stocks to buy in June.

1. Intel

You might be surprised to see Intel (NASDAQ: INTC) on this list after a challenging few years for the company. It’s no secret that the chipmaker’s business has recently faced more than a few hardships. Intel was once a king in the chip market, with more than 80% market share in central processing units (CPU) in 2017 and a lucrative partnership with Apple (NASDAQ: AAPL) as its primary chip supplier.

However, much has changed for the company. Increased competition has led its position in the CPU market to fall to 64%, and the deal with Apple ended in 2020. Meanwhile, a shift in the chip industry has seen CPU demand fall while graphics processing unit (GPU) sales have soared. The fall from grace has sent Intel’s stock plunging 47% over the last three years.

Yet sometimes, the best time to invest in a company is at its low when a recovery appears underway. And that seems to be the case with Intel, making it one of the best-valued tech stocks to buy now and hold over the long term.

Intel is in the process of transitioning into a foundry model, prioritizing chip manufacturing over design. The move will see the company open chip plants throughout the U.S. and set it apart from competitors like Nvidia and AMD, which outsource their manufacturing. Intel could be in for a significant boost to earnings in the coming years as markets like AI continue to bolster chip demand because it’s perfectly positioned to fulfill the market’s needs.

The above chart shows that Intel is potentially the best-valued chip stock this month, with the lowest forward price-to-earnings ratio (P/E) and price-to-sales ratio among the three most prominent chip companies. Alongside a promising shift in its business model, Intel is a screaming buy this June and a tech stock you won’t want to miss out on.

2. Apple

Apple has a reputation for reliability. The company’s stock has risen 343% over the last five years despite the COVID-19 pandemic and an economic downturn in 2022, which caused dwindling product sales.

Recent hurdles have made some analysts question whether we’re witnessing Apple’s downfall. However, with the company’s $102 billion in free cash flow, a booming services business, and continued dominance in consumer tech, I wouldn’t bet against the iPhone company over the long term.

For instance, decreasing iPhone sales in China, Apple’s third-largest market, has been a topic of much scrutiny since last year as the nation’s consumers have increasingly turned to domestic competitors. However, the issue seems to be resolving and leaning in Apple’s favor. On May 28, Bloomberg reported iPhone sales in China soared 52% last month after a series of discounts from Apple.

While discounts are often a short-term solution to a problem, Apple’s product connectivity and services indicate recent buyers will remain with the company. Apple has strategically created an interconnected ecosystem for its products that encourages users to branch out to its many other devices after only purchasing one.

Meanwhile, services like iCloud, Apple TV+, Music, and even the App Store allow the company to keep making money, even if consumers decide not to upgrade their devices. As a result, the spike in Chinese sales could see Apple remain a threat in China for years.

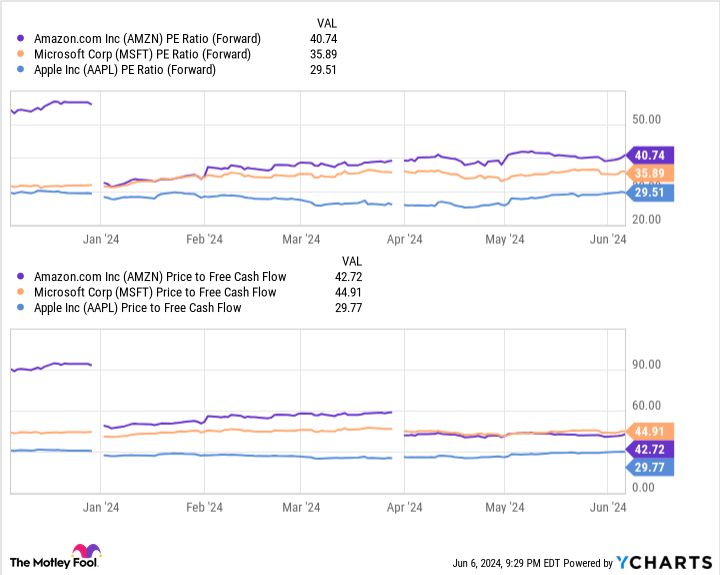

Like Intel, Apple’s stock is trading at a far better value than its top competitors, with a lower forward P/E and price-to-free-cash-flow ratio than Microsoft and Amazon. Add to that the company’s ventures into high-growth markets like AI and VR/AR, and Apple is a no-brainer tech stock to buy this month.

Should you invest $1,000 in Apple right now?

Before you buy stock in Apple, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $740,688!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 3, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Amazon, Apple, Berkshire Hathaway, Microsoft, and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel, long January 2026 $395 calls on Microsoft, short August 2024 $35 calls on Intel, and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

2 Top Tech Stocks to Buy in June was originally published by The Motley Fool

Signup bonus from