CrowdStrike (NASDAQ: CRWD) surged 12% higher following its earnings release for the first quarter of fiscal 2025 (ended April 30, 2024) and has held steady in subsequent trading sessions. The company continues to grow at a rapid clip, and it is now within 10% of its all-time intraday high of $365 per share.

Unfortunately, this situation strongly indicates that new investors might have bought into the stock too late. Hence, prospective buyers will have to ponder whether they can still profit from CrowdStrike or whether they should look elsewhere for opportunities.

The state of CrowdStrike

CrowdStrike has become one of the leading cybersecurity stocks. This is crucial since the IT industry’s migration to the cloud is not possible without cybersecurity products designed specifically for devices that could be anywhere at any time.

Fortune Business Insights estimated the size of the global cybersecurity market at $132 billion in 2023 and believes it will grow to $425 billion by 2030, giving it a compound annual growth rate of 14%.

CrowdStrike has captured its share of this market by specializing in end point security. Its Falcon security suite aims to make sure the entry points of devices such as smartphones, laptops, and servers are well protected whatever their locations.

It also sells modules offering other security products, an increasingly important benefit as more companies seek to deal with only one online security company.

This factor seems to help CrowdStrike in a highly competitive environment. Around 65% of the company’s customers subscribe to at least five modules, and deals involving eight or more modules rose 95% over the previous year.

How it held up financially

In the fiscal first quarter, CrowdStrike reported revenue of $921 million, a 33% increase from year-ago levels. This was only slightly less than the 36% yearly revenue increase in fiscal 2024.

Operating expenses grew at a slightly slower pace, leading to $7 million in operating income. Still, thanks to $46 million in interest income and $8 million from other sources, CrowdStrike earned $43 million in net income after interest expenses and taxes. This was up from $491,000 in the year-ago quarter.

Management forecasts between $958 million and $961 million in revenue in the fiscal second quarter. This would mean a 31% yearly increase, a slightly slower but still robust rate. The modest slowing has not deterred investors if the 120% increase in the stock price over the last year is any indication.

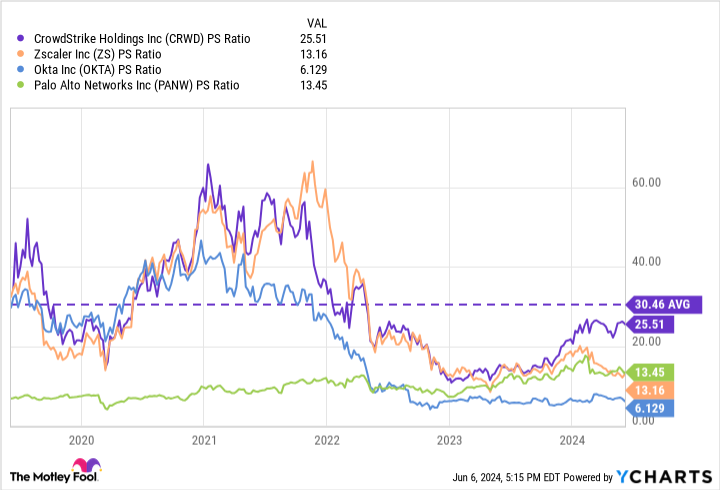

Unfortunately for prospective buyers, this increase has taken the price-to-sales (P/S) ratio to 26. Although that is below the five-year average multiple of 30, that far exceeds the sales multiples of competitors such as Zscaler, Okta, and Palo Alto Networks.

Thus, even though CrowdStrike has become a profitable company, its valuation might price it for perfection, making it a riskier stock to buy at today’s prices.

Am I too late?

For a long-term investor, the company’s growth story should continue for years to come.

Unfortunately, its valuation appears elevated by nearly any measure, which calls for buyers to turn cautious. Those who buy now face a risk of sentiment turning negative, which could take the stock down for months or possibly years.

Hence, if investors buy now, they should make small purchases only, perhaps by taking a dollar-cost averaging approach. Such a move allows them to profit from this potentially lucrative opportunity while positioning themselves to buy more stock should CrowdStrike experience a pullback.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for two decades, Motley Fool Stock Advisor, has more than tripled the market.*

They just revealed what they believe are the 10 best stocks for investors to buy right now… and CrowdStrike made the list — but there are 9 other stocks you may be overlooking.

*Stock Advisor returns as of June 3, 2024

Will Healy has positions in CrowdStrike and Zscaler. The Motley Fool has positions in and recommends CrowdStrike, Okta, Palo Alto Networks, and Zscaler. The Motley Fool has a disclosure policy.

Did Investors Wait Too Long to Buy CrowdStrike Stock? was originally published by The Motley Fool

Signup bonus from