Building a $1 million retirement nest egg is achievable for many people. It all boils down to a combination of time, returns, and contributions. The more you have of each one, the more likely you’ll become a millionaire retiree. For example, investing $300 a month into something that returns 10% annually (roughly the average stock market return over the past 50 years) will grow into $1 million in about 34 years. Increasing your contributions or returns can make you a millionaire even faster.

Many companies have excellent track records of delivering above-average total returns. NextEra Energy (NYSE: NEE) and Brookfield Infrastructure (NYSE: BIP)(NYSE: BIPC) stand out for their ability to deliver strong returns, which seems highly likely to continue. That makes them great stocks to buy and hold as you seek to build a $1 million retirement nest egg.

Powerful growth drivers

NextEra Energy is a utility with an exceptional track record of growing value for its investors. Over the last decade, the company has grown its adjusted earnings per share at a 10% compound annual rate. That has helped power 11% compound annual growth in its dividend. Those two catalysts have given it the fuel to deliver a 15% average annualized total return over the past 10 years.

The clean energy-focused power company is in an excellent position to continue generating strong returns in the coming years. In the near term, it expects to grow its adjusted earnings per share at or near the upper end of its 6% to 8% annual target range through at least 2026. That should give it the power to grow its dividend by around 10% per year during that period. With its dividend yield approaching 3%, NextEra’s growing earnings should enable it to deliver total returns in the double digits.

Meanwhile, its longer-term outlook is just as bright. Renewable energy demand is on track to grow at a 13% compound annual rate through 2030. It will likely continue growing briskly in the coming decades as the economy steadily decarbonizes. That should give NextEra Energy, one of the top renewable energy developers, the power to continue generating strong total returns.

Plugged into some powerful megatrends

Brookfield Infrastructure has delivered a 14.5% annualized total return since its formation in 2008. The global infrastructure giant has grown its funds from operations (FFO) per share at a 15% compound annual rate during that period. That has helped fuel 9% compound annual distribution growth.

The company expects to continue growing its FFO per share at a more than 10% annual rate for the foreseeable future. That should support 5% to 9% yearly growth in its dividend, which currently yields more than 4.5%.

Several factors power Brookfield’s strong growth outlook. It has focused its portfolio on three major themes: decarbonization, digitalization, and deglobalization. These investment megatrends should supply it with lots of growth opportunities. Brookfield believes it can organically grow its FFO per share by 6% to 9% per year as it captures inflation-indexed rate increases, grows its volumes with the global economy, and completes high-return capital projects like data centers and semiconductor manufacturing plants. Meanwhile, accretive acquisitions powered by its capital recycling strategy should help push its FFO growth rate into the double digits. Add in its dividend income, and Brookfield should continue producing a strong total return.

Potential millionaire-maker stocks

NextEra Energy and Brookfield Infrastructure have delivered strong total returns over the years. They should have plenty of power to continue generating returns in the double digits. Because of that, they could give investors the fuel to help grow their retirement account to $1 million in the future.

Should you invest $1,000 in NextEra Energy right now?

Before you buy stock in NextEra Energy, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and NextEra Energy wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

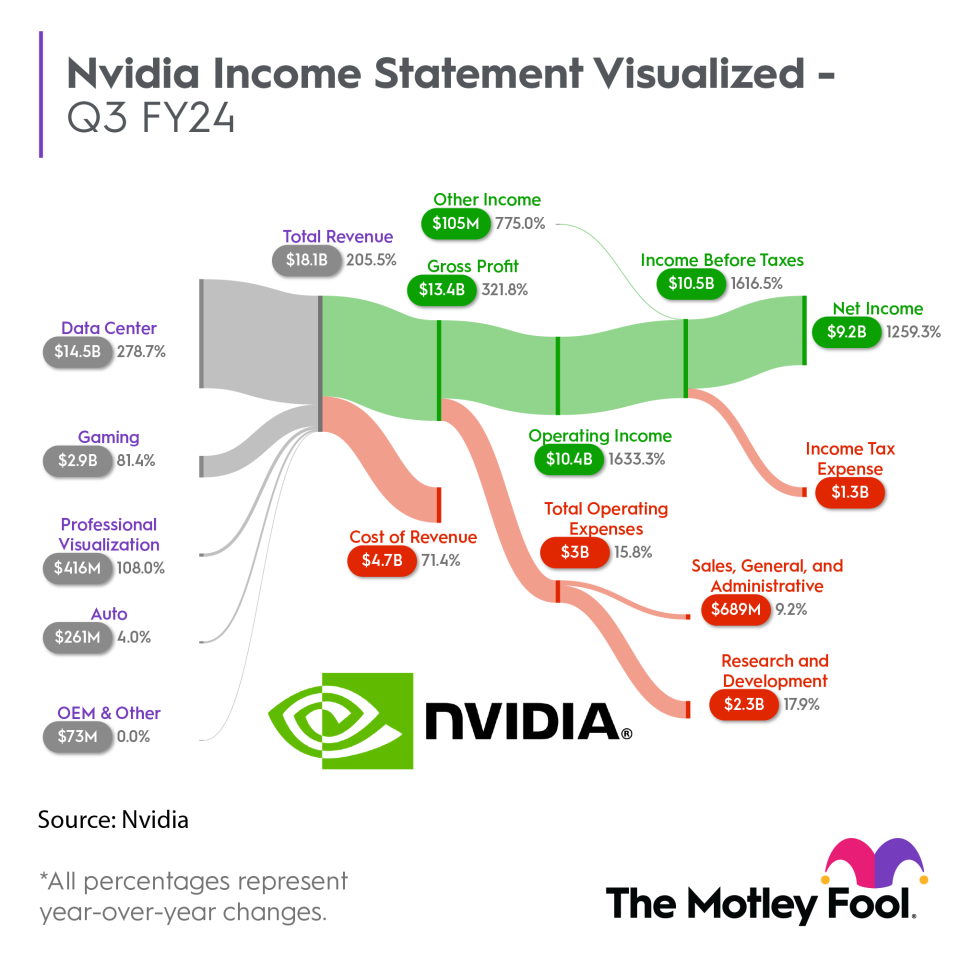

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $740,688!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 3, 2024

Matt DiLallo has positions in Brookfield Infrastructure Corporation, Brookfield Infrastructure Partners, and NextEra Energy. The Motley Fool has positions in and recommends NextEra Energy. The Motley Fool recommends Brookfield Infrastructure Partners. The Motley Fool has a disclosure policy.

Want $1 Million in Retirement? 2 Stocks to Buy Now and Hold for Decades. was originally published by The Motley Fool

Signup bonus from