If I pointed out that Walmart (NYSE: WMT) was a $650 billion retail business, no one would bat an eye — we all know it’s huge. But if I said that Walmart was a $100 billion e-commerce platform, that might turn some heads. Well, turn those heads then, because it’s true: Walmart is an enormous e-commerce business.

When Walmart refers to e-commerce sales, it includes items that are bought online and picked up in stores. Therefore, these aren’t necessarily pure e-commerce sales like many people are probably thinking.

That said, Walmart does over $100 billion in digital sales, and that’s a big deal. Having this many customers on the website and on the app unlocks a new opportunity for the company: Digital advertising. Consumer brands pay big money to get in front of its huge audience.

The beauty of digital advertising is that it’s a revenue source with little incremental cost for Walmart — in other words, it’s quite profitable. Keep in mind that advertising was already a $3.4 billion business for the company in its fiscal 2024, which ended in January. And in its fiscal first quarter of 2025, advertising was still fast-growing with 24% growth.

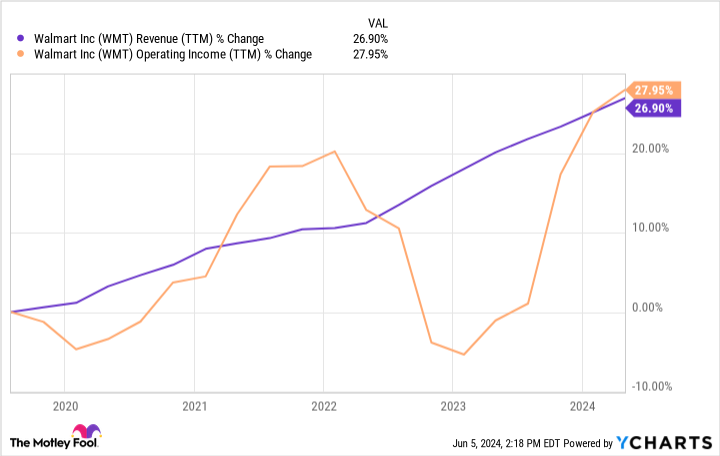

Since it’s high-margin, digital advertising is playing an important part in Walmart’s rebounding operating income — a surge that started just over a year ago.

All of this is important for Walmart shareholders. But it may also be important for shareholders of Costco Wholesale (NASDAQ: COST), since the warehouse club chain could be about to pursue the same strategy.

Is this actually a big deal?

For Costco, its sprawling stores are clearly the main event. The average location has 147,000 square feet selling thousands of products at discount prices for its members. But this is relatively low-growth. In the company’s fiscal third quarter of 2024 (which ended on May 12), its same-store sales were up less than 7%. That’s a great result for a business of this size, but it’s hardly high-growth.

Moreover, with nearly 900 locations already, Costco doesn’t have a huge expansion opportunity either.

In contrast, Costco’s e-commerce sales are quietly surging. In Q3, they were up by almost 21%. Management doesn’t tell us just how high its e-commerce sales are, but we do at least know they’re fast-growing.

On the Q3 earnings call, Costco’s management was asked about retail media. According to Amazon (a company that’s darn good at digital advertising itself), retail media is “A type of advertising platform that allows retailers to sell ad space on their digital channels to third-party brands.” In other words, Costco can sell digital space to brands that want to advertise to its more than 73 million paid members.

Costco’s CEO Ron Vachris didn’t go too deep into his reply about retail media. But he did say: “We see some great upside potential.”

How much potential is there? Well, this will be speculative on my part. Walmart’s overall business is about 2.5 times bigger than Costco’s. But given Costco’s growth in e-commerce and comparing it to Walmart’s monetization, it’s not outrageous to think that retail media could be a $1 billion annual business for Costco someday.

That day won’t be tomorrow. But retail media could potentially be a big deal for Costco eventually.

Consider that Costco earned about $2.2 billion in Q3 operating income, putting it on pace for around $8.5 billion for the year. Adding another billion-dollar, high-margin business would definitely move the needle once the company pursues retail media more aggressively.

Costco stock is richly valued — a subject I don’t have time to address here. But suffice it to say that when a stock has a high valuation, either the price needs to come down or the profits need to go up. Retail media is just one example of how profits could go up for Costco, which could go a long ways toward supporting the price of its stock today. That should be encouraging for shareholders.

Should you invest $1,000 in Costco Wholesale right now?

Before you buy stock in Costco Wholesale, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Costco Wholesale wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $740,688!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 3, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Costco Wholesale, and Walmart. The Motley Fool has a disclosure policy.

For Walmart, This Is a $3 Billion Business. Could Costco Pursue the Same Strategy? was originally published by The Motley Fool

Signup bonus from