In less than five months, Americans from across the country will head to the polls or mail in their ballots to determine which presidential candidate will lead our great country for the next four years.

In many ways, what happens on Capitol Hill and in the Oval Office has no bearing on Wall Street. But anything related to fiscal policy legislation can absolutely impact the U.S. economy, corporate earnings, and the stock market.

In a little over two months, the Democratic National Convention will take place, and incumbent Joe Biden will, in all likelihood, earn his party’s nomination for president. Only 1,968 primary delegates are needed to win the nomination from the Democratic Party, and Biden had 3,872 as of June 6.

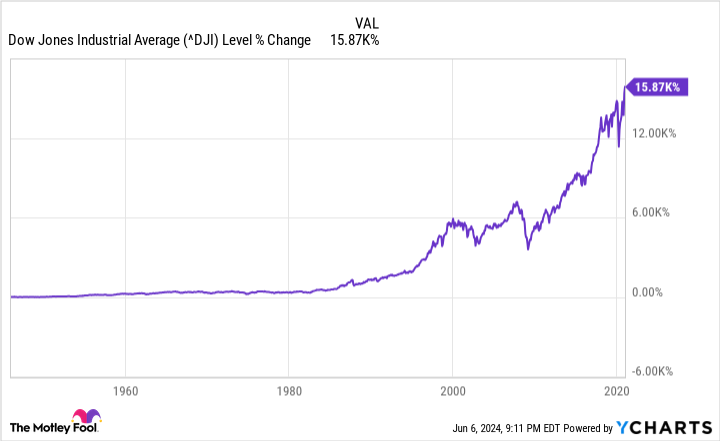

During Biden’s first term as president, investors have had plenty of reason to smile. The ageless Dow Jones Industrial Average (DJINDICES: ^DJI), benchmark S&P 500 (SNPINDEX: ^GSPC), and growth stock-focused Nasdaq Composite (NASDAQINDEX: ^IXIC) have all reached fresh record-closing highs. Since Biden entered the Oval Office on Jan. 20, 2021, the Dow Jones, S&P 500, and Nasdaq Composite have, respectively, gained 25%, 39%, and 28%.

However, stock market returns under Biden’s tenure have been markedly different between the first half and second half of his four-year term. This difference is marked by a switch from a unified Congress during Biden’s first two years in the Oval Office to one that’s been split — in other words, Democrats and Republicans each control one house of Congress — in the second half of his term.

It begs the question: If Joe Biden wins in November and Congress remains divided, could the stock market plummet? Let’s dive into the challenges incumbent Joe Biden would face with reelection and allow history to be the ultimate judge and jury on what’s to come for stocks.

Are stocks going to crash if Joe Biden wins in November and Congress is divided?

Before digging into the nuts and bolts of the headwinds that await, let me make clear that there is no foolproof predictive indicator or metric that guarantees the short-term directional movement in the Dow, S&P 500, and Nasdaq. While certain metrics have strongly correlated with big directional moves in the stock market, nothing is for certain.

With that being said, a Joe Biden win in November, coupled with a split Congress, would be met with policy concerns and possible macro headwinds.

In terms of policy proposals, Biden’s State of the Union address in March made clear that he wants corporate America and the rich to “pay their fair share.” He proposed increasing the peak marginal corporate tax rate to 28% from its current 21% and quadrupling the stock buyback tax from 1% to 4%. Stock repurchases, in particular, have played a key role in fueling earnings growth on Wall Street over the last couple of years.

On one hand, a Republican-controlled house of Congress would oppose these changes tooth and nail, which Wall Street would probably cheer. But don’t forget that the personal income tax rate reductions passed via the Tax Cuts and Jobs Act under President Donald Trump are going to sunset on Dec. 31, 2025. A divided Congress is unlikely to extend these cuts, meaning higher federal tax rates for the average American and lower discretionary spending.

The other concern for Joe Biden is that select metrics and money-based indicators signal economic weakness to come. Keep in mind that these indicators are agnostic to who wins in November.

WARNING: the Money Supply is officially contracting. 📉

This has only happened 4 previous times in last 150 years.

Each time a Depression with double-digit unemployment rates followed. 😬 pic.twitter.com/j3FE532oac

— Nick Gerli (@nickgerli1) March 8, 2023

For example, U.S. M2 money supply has declined by at least 2% from its all-time high for the first time since the Great Depression. M2 money supply takes into account everything in M1 (cash and coins in circulation, along with demand deposits in a checking account) and adds in savings accounts, money market accounts, and certificates of deposit (CDs) below $100,000.

M2 is rarely in the spotlight because more capital is regularly needed to satisfy an expanding economy. But since peaking in April 2022, M2 has declined by an aggregate of 3.94%.

As you can see from Reventure Consulting CEO Nick Gerli’s post on X, declines of at least 2% in M2 money supply are rare. Using data back-tested to 1870, Gerli notes that this is only the fifth time in more than 150 years that we’ve seen at least a 2% drop in M2. The four previous instances (1878, 1893, 1921, and 1931-1933) were all accompanied by a double-digit unemployment rate and an economic depression in the U.S.

The good news is that a depression and double-digit unemployment rate are highly unlikely in today’s economy. The Federal Reserve has more than a century of knowledge to lean on, and the federal government has tools it can use to spur growth and/or consumer spending.

But despite this silver lining, contraction in M2 would be expected to lower discretionary spending. In other words, it tends to be a precursor to a recession.

Based on policy proposals and a historic decline in M2 money supply over the last two years, stocks could possibly plunge with a Biden victory and a split Congress.

Here’s what history says happens when Democrats win the presidency and Congress is split

With a better understanding of the potential headwinds that would await Joe Biden’s reelection if paired with a divided Congress, let’s now give a voice to history and let it be the ultimate judge of what’s to come.

The best news I can offer is that history has proved exceptionally kind to investors with a long-term mindset. When examined over multiple decades, every single combination you can possibly think of (a unified government, split congress, or unified Congress with a president of the opposing party) has resulted in a positive annual average return for the stock market. Although there’s definitely some return variance in these combinations, the stock market has historically gone up regardless of which candidate voters choose in November.

In January 2021, just prior to Biden taking office, Forbes columnist and Integrity Wealth Management President Mike Patton published an article that detailed the average annualized returns of the Dow Jones Industrial Average under a variety of scenarios. Interestingly enough, a split Congress produced the highest average annual return between 1946 and 2020 — a 12.9% average annual return — of any of the scenarios examined.

Online retirement analysis website Retirement Researcher took things one step further. Author Bob French released a report that examined the performance of the S&P 500 from 1926 through 2023 using a variety of situations.

In the 34 years with a Republican president and a split Congress, the S&P 500 delivered an average annual return of 7.33%. By comparison, the 15 years with a Democratic president and a divided Congress yielded a superior 16.63% average annual return for the S&P 500. Based solely on historical data, a Biden win with a split Congress would be good news for Wall Street and investors.

If there’s a common theme when it comes to putting your money to work on Wall Street, it’s that patience pays off handsomely. Just as economic expansions last substantially longer than recessions, bull markets on Wall Street tend to stick around for an extended period.

As you’ll note in the June 2023 post on X from the researchers at Bespoke Investment Group, the S&P 500 has experienced 27 separate bull and bear markets since the start of the Great Depression in September 1929. Whereas the average S&P 500 bear market has lasted only 286 calendar days (about 9.5 months), the typical bull market over the previous 94 years endured for 1,011 calendar days, roughly 3.5 times as long.

Something else you might have noticed is that the longest bear market in the S&P 500’s history has been outdone in length by 13 bull markets. Even though stock market corrections and plunges are normal and unavoidable, they don’t last very long.

While it’s impossible to concretely predict what’ll occur in the months to come and immediately following the November election, history is quite clear that investors who exhibit patience are perfectly positioned to succeed.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $20,757!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $37,204!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $345,939!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of June 3, 2024

Sean Williams has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Are Stocks Going to Plunge if Joe Biden Wins and Congress Is Split? Here’s What History Says About Stock Market Returns in This Scenario was originally published by The Motley Fool

Signup bonus from