Overview of the Recent Transaction

On June 7, 2024, Warren Buffett (Trades, Portfolio)’s Berkshire Hathaway made a significant addition to its investment portfolio by acquiring 2,565,477 shares of Occidental Petroleum Corp (NYSE:OXY). This transaction, executed at a price of $59.75 per share, not only underscores the firm’s confidence in OXY but also impacts its portfolio with a 0.05% increase, bringing its total holdings in the company to 250,583,605 shares. This move further solidifies Berkshire Hathaway’s position as a major stakeholder in the oil and gas sector.

Profile of Warren Buffett (Trades, Portfolio)

Warren Buffett (Trades, Portfolio), often referred to as “The Oracle of Omaha,” is a hallmark of success in the investment world. As the chairman of Berkshire Hathaway, Buffett transformed a textile company into a powerhouse conglomerate. His investment philosophy, rooted in the principles taught by Benjamin Graham, focuses on acquiring undervalued companies with long-term growth potential. This strategy has consistently outperformed the market, making Buffett one of the most followed investors globally.

Details of the Trade

The recent purchase increases Berkshire Hathaway’s stake in Occidental Petroleum to 28.26% of its portfolio, emphasizing its strategic importance. With a total investment position of 4.51%, this acquisition not only reflects Buffett’s bullish outlook on the oil and gas industry but also aligns with his investment criteria of understanding the business, favorable long-term prospects, and competent management.

Occidental Petroleum Corp Overview

Occidental Petroleum is a leading entity in the oil and gas industry, with diversified operations across the United States, Latin America, and the Middle East. As of the end of 2023, the company boasted nearly 4 billion barrels of oil equivalent in net proved reserves, with a balanced production mix of oil and natural gas. The company’s segments include Chemical, Midstream and Marketing, and Oil and Gas, contributing to a robust business model.

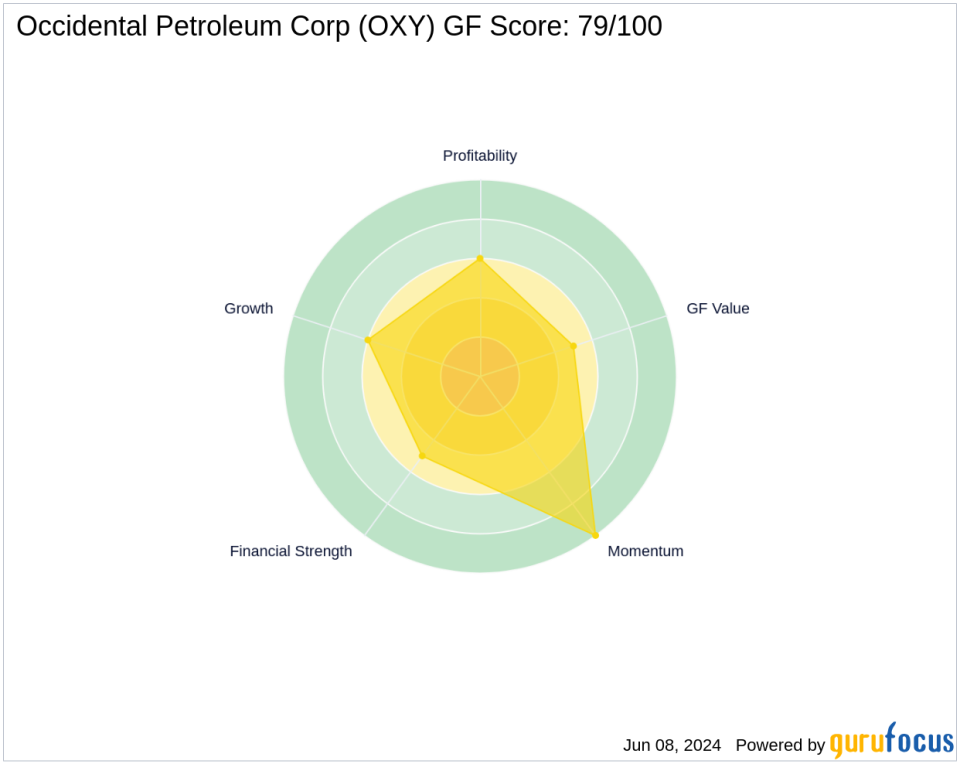

Stock Performance and Valuation

Currently, Occidental Petroleum’s stock is modestly overvalued with a GF Value of $53.59 and a price-to-GF Value ratio of 1.11. Despite a slight year-to-date price decline of 0.39%, the stock has shown a significant increase of 932.64% since its IPO. The GF Score of 79 indicates a likely average performance in the future, supported by a strong momentum rank of 10/10.

Sector and Market Analysis

In the competitive oil and gas industry, Occidental Petroleum stands out due to its substantial oil reserves and balanced production capabilities. The company’s strategic initiatives and operational efficiencies position it well against industry peers, aligning with market trends that favor energy companies with robust production and reserve metrics.

Other Significant Investors

Besides Berkshire Hathaway, other notable investors in Occidental Petroleum include Dodge & Cox, Prem Watsa (Trades, Portfolio), and Smead Value Fund (Trades, Portfolio). These investments highlight the company’s strong fundamentals and the industry’s attractiveness to value-oriented investors.

Future Outlook and Analyst Insights

Analysts remain cautiously optimistic about Occidental Petroleum’s prospects, driven by its strategic asset base and operational efficiencies. Buffett’s increased investment could signal a positive outlook, potentially influencing other investors’ sentiments and the company’s stock performance in the upcoming periods.

This strategic acquisition by Berkshire Hathay not only reinforces its commitment to Occidental Petroleum but also reflects a well-calculated move based on extensive analysis and a bullish outlook on the energy sector. As the market continues to evolve, this investment may yield significant returns, aligning with Buffett’s legendary investment strategy.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Signup bonus from