Nvidia (NASDAQ: NVDA) stock has soared over the past few years, advancing a whopping 1,900% since the start of 2020. The reason is simple. The technology company has established itself as the go-to artificial intelligence (AI) chip company, taking 80% market share. Nvidia’s graphics processing units (GPUs) are the fastest around, and companies launching AI projects are rushing to buy these and other Nvidia AI products and services.

All this has resulted in massive gains in earnings for Nvidia, with sales and net income increasing in the triple digits quarter after quarter. In the most recent quarter, revenue hit a record high of $26 billion, and the company announced a 10-for-1 stock split. Meanwhile, Nvidia’s shares continue to climb and even roared past $1,000. As a result, Nvidia did something it’s never done before.

Nvidia and Apple

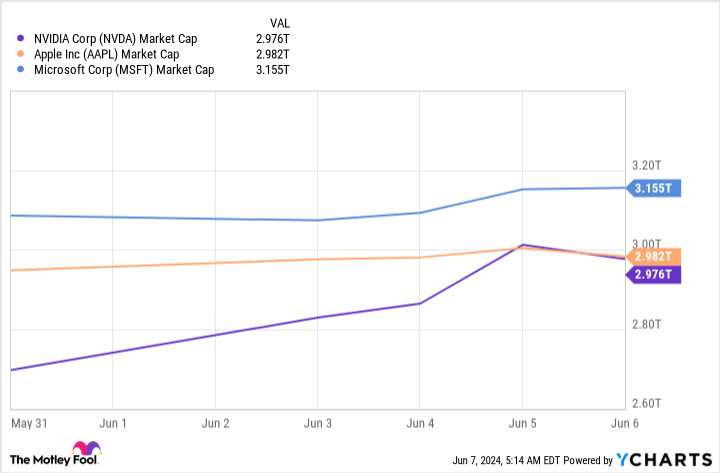

This first-ever event has to do with market value. For the first time, Nvidia’s market capitalization reached $3 trillion, sending it higher than Apple and making it the U.S.’s second-biggest company after Microsoft. That happened earlier this week, and Nvidia’s value has dipped a bit since, putting it slightly behind Apple again.

But this movement isn’t just a random happening. It says something about where Nvidia’s at today and what may be down the road. It’s part of the general momentum that’s been picking up speed since last year, when Nvidia became a $1 trillion company. Then earlier this year, Nvidia’s market value reached the $2 trillion mark, and now, the company is showing that it has what it takes to share the spotlight with stock market giant Apple.

This trend is positive because it’s been accompanied by earnings growth from Nvidia and bright long-term forecasts — solid reasons for the market value gains to last.

As mentioned earlier, Nvidia has become a key player in the AI market, offering companies tools that could determine whether or not their AI projects are successful. Today, Nvidia’s H100 is the top chip on the market, but the company isn’t sitting on its laurels and has instead promised rapid innovation. It’s preparing to ship the H200 — which almost doubles the inferencing performance of the H100 — this quarter, and later this year Nvidia will release the much-awaited Blackwell architecture and its best-performing chip yet.

Beyond chips, Nvidia also offers a range of other tools and services, including an enterprise software platform that streamlines the development of AI programs. And Nvidia’s products and services are available through all public cloud providers, making access easy for any potential customer.

Demand for Nvidia’s products

In more good news, which offers us visibility on the months to come, Nvidia says demand for its products is surpassing supply — and the company expects this to continue into next year. This offers us reason to be optimistic about earnings in the near term. And Nvidia’s market position, ongoing innovation, and general growth forecasts for the AI market offer us reason to be optimistic about earnings over the long term, too. Analysts expect the AI market to reach $1 trillion by the end of the decade, so we’re in the early days of this growth story.

Excitement about Nvidia’s June 7 stock split may have pushed the stock higher this week, lifting the company’s market value. But stock splits are mechanical operations that don’t represent real catalysts for share performance, so this won’t be a driving force for ongoing gains. That’s OK, though, because earnings should do that job.

With Nvidia’s earnings strength today and outlook for more of the same down the road, the company may maintain its market value spot next to Apple — a company that has also built its reputation on innovation, is a leader in its field, and has delivered long-term earnings growth.

Whether Nvidia’s market value remains under $3 trillion and slightly under that of Apple or moves higher, I consider this tech giant one of today’s top growth companies — and a solid stock to buy and hold for the long term.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $741,362!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 3, 2024

Adria Cimino has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Nvidia Just Did Something It’s Never Done Before was originally published by The Motley Fool

Signup bonus from