The last couple of years have been a roller-coaster ride for PayPal (NASDAQ: PYPL). During the peak days of the pandemic, the business experienced abnormally high demand as e-commerce transactions became more widely used. An overly euphoric base of investors poured into PayPal stock, rocketing shares to a high of $308.

Today, they trade for about $62. What happened? As the height of the pandemic waned, PayPal’s business results followed, and its growth began to slow. Moreover, the fintech landscape is highly competitive, which makes it difficult for the company to maintain or acquire market share.

Over the past year, PayPal has undergone something of a makeover. While the company is still in a turnaround, recent financial and operational highlights look encouraging. Let’s explore how PayPal is reinventing itself and assess why now is a great time to scoop up shares.

What’s new at PayPal?

There is virtually no shortage of solutions in the fintech realm. Products and services such as peer-to-peer payments; buy now, pay later (BNPL), or linking bank accounts in payments apps are offered by a number of different companies. PayPal is considered a pioneer in digital payments, and the company operates a number of useful platforms including Venmo, Honey, and more.

The problem? The company hasn’t done a great job of marketing its ecosystem, and so consumers pass up using PayPal in lieu of other apps. With transaction fees the primary driver of revenue, decelerating use has been a problem.

Last summer, its board of directors named Alex Chriss as the company’s new CEO. He was a former executive at financial services company Intuit and was responsible for much of the company’s product road map. Following the appointment of Chriss, PayPal went through management reshuffling, hiring a number of new leaders.

Subsequently, he and his new team spent some time rebuilding PayPal. Specifically, they instituted a number of new services that leverage artificial intelligence (AI). The idea behind this was to have AI serve as the main stitch connecting PayPal’s entire payments fabric.

How is the company performing?

For the quarter ended March 31, PayPal generated $7.7 billion in revenue, an increase of 9% year over year. Although this level of growth might look a bit mundane, there was one metric in particular that signals momentum could be reaccelerating. The table below shows its transaction margin over the last year.

|

Category |

Q1 2023 |

Q2 2023 |

Q3 2023 |

Q4 2023 |

Q1 2024 |

|---|---|---|---|---|---|

|

Transaction margin |

$3.3 billion |

$3.3 billion |

$3.4 billion |

$3.7 billion |

$3.5 billion |

|

Transaction margin YoY growth |

1% |

1% |

(3%) |

0% |

4% |

Data source: PayPal. YoY = year over year.

For several quarters, PayPal has struggled to expand its transaction margin, and this directly affects its revenue growth, margin expansion, and overall profitability. However, during the first quarter, the company’s transaction margin grew by 4% year over year, the highest level it has reached in quite some time.

PayPal is a compelling long-term investment

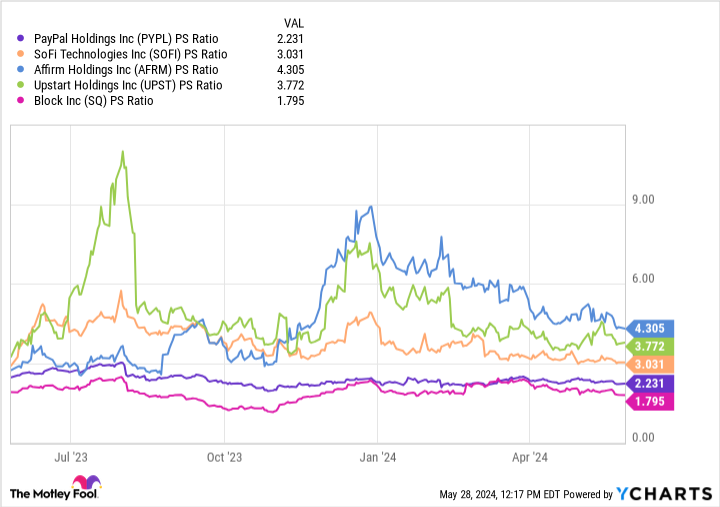

The chart below benchmarks PayPal against a number of fintech peers. With a price-to-sales (P/S) ratio of 2.2, its stock trades at a discount to many other financial services businesses. Furthermore, this multiple is only narrowly above the company’s all-time low P/S multiple of 1.9.

PayPal’s current depressed valuation suggests that investors are flocking to other fintech stocks and perhaps view the company as an archaic payment platform trying to stay relevant among a sea of newer competitors.

I think this is shortsighted, and I see the disparity in trading multiples as a buying opportunity. Will the stock ever reach $308 again? I don’t know. But I also don’t think it matters.

Buying shares of PayPal should be rooted in a belief in the company’s comeback story. Its new growth strategy is still very much in its infancy, so investors should taper expectations for now.

With that said, there are some early indications that these investments are already yielding results. If the company is able to continue improving its transaction margin, it should begin to witness some lucrative growth.

Investors with a long-term horizon might want to consider building a small position as the stock hovers at dirt-cheap prices. A prudent thing to do would be to monitor PayPal’s earnings reports over the next several quarters to ensure that the company is keeping up its newfound momentum.

Should you invest $1,000 in PayPal right now?

Before you buy stock in PayPal, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and PayPal wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $713,416!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 3, 2024

Adam Spatacco has positions in Block and SoFi Technologies. The Motley Fool has positions in and recommends Block, Intuit, PayPal, and Upstart. The Motley Fool recommends the following options: short June 2024 $67.50 calls on PayPal. The Motley Fool has a disclosure policy.

Don’t Call It a Comeback: The Best Is Yet to Come for PayPal. Here’s Why. was originally published by The Motley Fool

Signup bonus from