With the Geneva spring watch auction season behind us, we find no echoing headlines, no tectonic shifts, and nary a memorable surprise. Geneva’s auction results were healthy enough, but the action on the floor was mostly serene. Serenity seems to be the tone across the watch industry in 2024, from quieter collections to steadier sales figures and stabilizing prices. Given the wild ride of the past few years—when production slowed and neophyte “pandemic collectors” drained supply—2024 is shaping up to be downright dull by comparison.

For experienced watch collectors, however, dull markets can be rather interesting. Slow-developing trends are easier to see, making it easier to formulate long-range collecting strategies. Meanwhile, the rising supply creates a buyer’s market.

More from Robb Report

The watch industry tracking platform, EveryWatch, has issued a report collating the sales data from Geneva’s spring season (including auctions from Christie’s, Only Watch, Phillips and Antiquorum), and we can glean some useful insights from the report that help us hypothesize about market drivers.

Looking Back at the Bubble

My sense of the pandemic watch bubble was that the new batch of pandemic-inspired collectors not only lacked a deeper understanding of horological history, but also hadn’t developed their individual tastes over time. As a result, they tended to follow trends. During the pandemic, the trend was most certainly toward sport watches equipped with bracelets (like Rolex), and especially integrated bracelets (like Audemars Piguet’s Royal Oak, Patek’s 5711, and so on). Smaller dress watches and more complicated classic watches weren’t quite as popular as they’ve become in recent years.

As life returned to something like normal after the pandemic, the new batch of collectors appear to have become less vigorous about watches, leaving more experienced and dedicated collectors to recenter around their deeper knowledge that values complication, elegance and rarity over the latest craze. The data from the spring season in Geneva appears to back up my impressions.

Classic Patek Philippe Dominates

Patek Philippe glaringly dominated the auction season, but even here a touch of nuance in reading the data is called for. For example, I think it’s smart to discount the one-of-a-kind Patek Philippe which sold at Only Watch for $17.2 million, because watches sold for charity often spike in price, skewing otherwise realistic market curves. EveryWatch includes that Only Watch sale in its dataset for the Geneva auctions that ran from May 10th to May 14th, but a quick calculation shows that Patek Philippe brought in a healthy $34.38 million without the Only Watch outlier. (Note, too, that Rolex, Audemars and many other brands did not participate in the Only Watch 2024 edition.)

Also interesting is that the high earners for Patek were not the Nautilus and Aquanauts that were so hot during the pandemic, but classically styled dress watches.

With these two thoughts in mind, we see solid—and indeed dominant—results for Patek Philippe, but not especially astounding results. One buyer paid $2.7 million for a 1947 Patek Philippe 1518 perpetual calendar chronograph with a salmon dial, which is a strong result, but not especially hot for that piece. Interestingly, $806,000 was hammered on a Patek Philippe reference 2499/100 perpetual calendar chronograph. Known as a “fourth series” with direct lineage to the 1518, the 2499/100s were produced between 1978 and 1985. This latter sale indicates that a new class of vintage watches is graduating to become high-value collectibles. Accordingly, it may be wise to keep an eye on so-called neo-vintage dress watches.

Classic Dress Watches Are on the Rise

Overall, the Patek results indicate that serious collectors are returning their focus to classically styled, complicated watches while the Nautilus, Royal Oak, and various Rolex models on bracelets are cooling off.

EveryWatch reports that in Geneva this spring a solid $60.4 million in watches with leather straps (usually dress watches) sold compared to just $9.8 million for watches on bracelets (usually sports watches). Does this data suggest steady momentum for the trend toward smaller dress watches? Does the data point more clearly to a longer-lasting trend toward classically styled, complicated watches? Or is it simply that the neophyte collectors have left the room? I’m inclined to answer yes to that last question, and to hypothesize that the departure of pandemic neophytes is helping shift the trend at auction houses back toward classically styled watches.

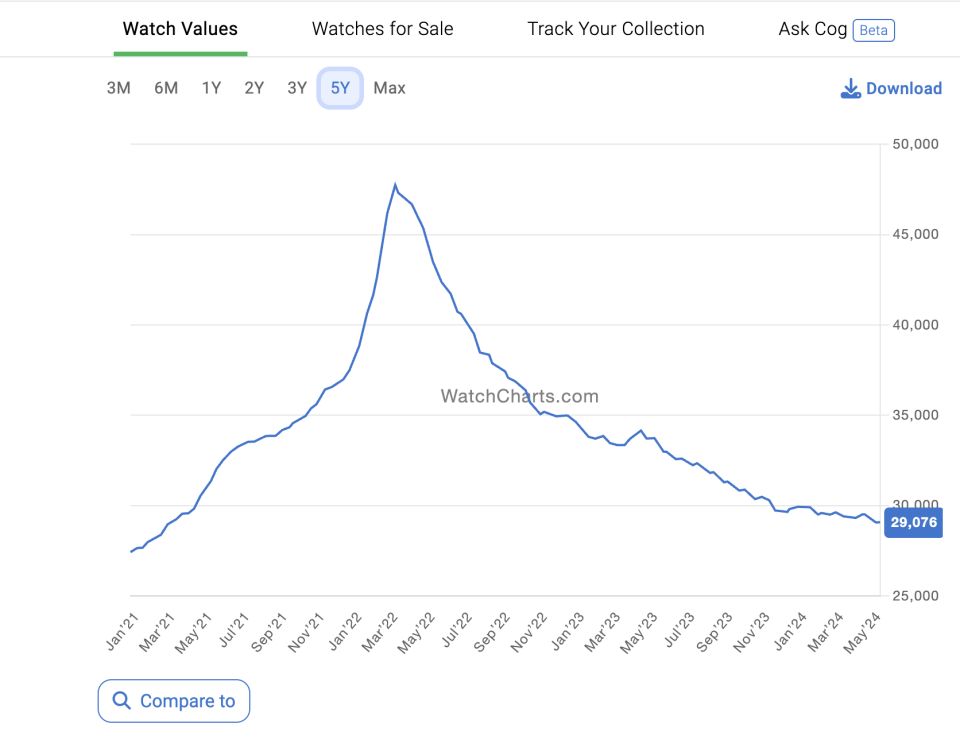

The EveryWatch report goes on to note that in Geneva the number of Rolex lots increased by 14.29% while the total sales for Rolex fell by 30.08%. That means that more Rolexes sold for considerably less money. Those figures effectively indicate a glut, which is also reflected in dropping prices for Rolex on the pre-owned market. Vintage and pre-owned Rolex sports watches were the most obvious choice for new collectors who stormed into the watch scene during the pandemic, so perhaps these figures are reverberations of the drastic post-pandemic watch market decline of 2023.

The 2024 Geneva auction results may also reflect the impact of Rolex’s newly announced Certified Pre-Owned program on the pre-owned market. Rolex’s CPO program might be causing some folks to speculate less on middle-aged Rolex models. For example, a beautifully “ghosted” 1981 “transitional” Rolex Submariner reference 16800 with a series-two matte dial—a relatively common but rather hot watch during the pandemic—sold at Phillips at the low estimate on May 25th. Meanwhile, a 31 mm “pink on pink” Patek Philippe Calatrava reference 3796 from 1994—a tiny neo-vintage dress watch unlikely to attract neophyte collectors—shot right past the high estimate earlier in the auction. These small dramas point to the larger shift I’m seeing in the market more generally.

What’s The Long Game?

So how does one play the long game based on this information? That’s going to depend, of course, on your personal collecting interests, but the savvy collector right now will have an eye on small and mid-sized dress watches from the 20th century (including neo-vintage from the 1980s and 90s) and on more complicated watches (annual calendars, perpetual calendars, chronographs) from evergreen brands like Patek Philippe and Vacheron Constantin. When it comes to newer brands and independents, keep an eye on those who are following traditional styles and techniques: EveryWatch reports that F. P. Journe is rising still, and Rexhep Rexhepi’s classically styled watches seem to be following that same upward arc.

However, because we’re entering a buyer’s market, this is also a good time to be adding Rolex to your collection. If you’re inclined toward The Crown, there are a number of exceptional neo-vintage models (for example, reference 16800 subs and 16750 GMT Masters—both five-digit references) that will soon age into vintage. Rare pieces are still going to pin the needle, but for more common Rolex models prices have cooled for now.

Barring some unforeseen event, as I look at the vintage watch market this spring, I feel relatively confident that these trends toward smaller dress watches and away from sports watches will stay relatively stable for the time being. Happy collecting!

Best of Robb Report

Sign up for Robb Report’s Newsletter. For the latest news, follow us on Facebook, Twitter, and Instagram.

Signup bonus from