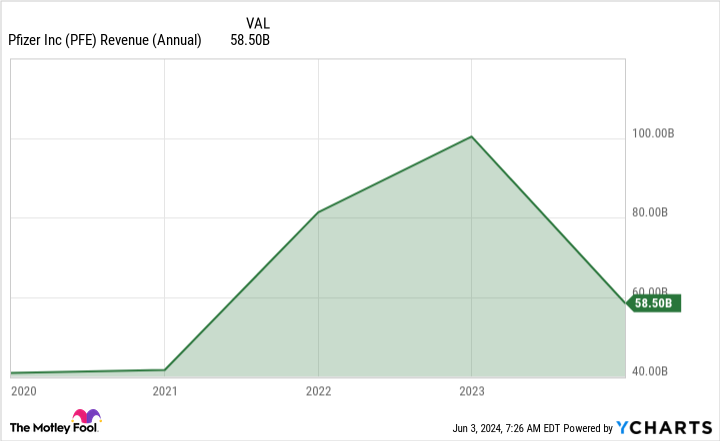

A few years ago, in the race to launch a COVID-19 vaccine, Pfizer (NYSE: PFE) stock was a hot buy after the company ended up with a highly successful product in Comirnaty. The uncertainty surrounding COVID and the potential for there to be a need for ongoing annual shots made investors bullish that the public health crisis could even lead to a long-term revenue boost for the business.

Instead, demand has waned significantly. According to data from Pew Research, just 28% of American adults now say they have received an updated COVID vaccine. Those figures were as high as 69% back in August 2021, when concerns around COVID were still widespread. As a result, Pfizer needs to adjust its business so that it’s no longer reliant on Comirnaty and Paxlovid (its COVID pill), which generated a combined $12 billion in revenue for the company last year and nearly $57 billion in 2022.

The drugmaker does have a plan to turn its business around, and so there is hope that things will get better in the long run. But investors will need to be patient.

The company’s transition will take time

Pfizer is facing some challenges in the near term as it looks to transition its business away from its COVID pill and vaccine. It’s also facing patent cliffs for many top drugs, which will put further pressure on the company to add new products into its portfolio.

All in all, the company’s turnaround attempt will be a serious undertaking. While Pfizer did benefit from a boost in COVID-related revenue in recent years, sales dropped last year and could remain flat this year.

The company has been loading up on acquisitions to help strengthen and diversify its portfolio of products, including its mammoth $43 billion acquisition of cancer specialist Seagen last year. But it’s not a short-term fix by any stretch. Pfizer expects to add $25 billion in new revenue by the end of the decade through acquisitions and the development of its pipeline.

However, that will be partly offset by losses in revenue totaling between $16 billion and $18 billion as a result of losing patent exclusivity on products such as Eliquis, Vyndaqel, Ibrance, and others. At the very least, investors should brace for a bumpy ride over the next six years.

Pfizer plans to cut even more costs

In a further sign that things may be even more challenging in the near term, Pfizer recently unveiled a new cost-reduction plan that it believes will save the business $1.5 billion by 2027. This is on top of a previous cost-saving plan that aimed to shave off $4 billion in expenses. Pfizer has been slashing costs as it looks to adjust to declining COVID demand.

The problem, however, is that these cost-cutting plans often incur expenses in the short term, including severance. This new round of cuts will result in Pfizer incurring one-time charges totaling $1.7 billion, the bulk of which the company expects to show up on its financials this year.

That means the drugmaker’s earnings will again take a hit this year. In 2023, Pfizer reported a net loss of more than $1.1 billion, largely due to restructuring and impairment charges. With more one-time expenses coming this year, that means the company could once again be facing a net loss, which may scare away risk-averse investors.

Should you buy Pfizer stock today?

Pfizer’s stock has been a disappointment in recent years as the hype from its COVID vaccine and pill sales has evaporated. The stock has fallen 27% over the past five years. Investors have been bearish on the business due to its struggles and the challenges that lay ahead for Pfizer, but there is a bullish case to be made: Pfizer trades at a price-to-earnings growth ratio of 1, which suggests there is good value here for investors in the long run.

The pharmaceutical stock is an intriguing contrarian play, but it does come with plenty of risk and uncertainty ahead. If you’re willing to hold shares for at least until the end of the decade to see the company’s transition plan through, there could be some significant upside ahead. But transition plans don’t always succeed, and risk-averse investors may be more comfortable investing in other healthcare stocks instead, or perhaps even an exchange-traded fund.

Should you invest $1,000 in Pfizer right now?

Before you buy stock in Pfizer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Pfizer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $704,612!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 3, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Pfizer. The Motley Fool has a disclosure policy.

Why Things Could Get Worse for Pfizer Stock Before They Get Better was originally published by The Motley Fool

Signup bonus from