When it comes to corporate computer security, 93% of security operations centers within companies still rely on manual, human-led processes, according to Palo Alto Networks (NASDAQ: PANW). Unfortunately, humans aren’t equipped to deal with the high volume of cyberthreats faced by modern organizations, which means 23% of security alerts are left uninvestigated.

That creates unacceptable vulnerabilities, and artificial intelligence (AI) is one of the most powerful solutions to this problem. SentinelOne (NYSE: S) specializes in automated cybersecurity software driven by AI, which reduces the workload on human operators so that fewer incidents slip through.

SentinelOne stock is trading 78% below its all-time high that was set during the 2021 tech frenzy. However, the company has done nothing but grow since then, so here’s why it might be a great buying opportunity.

A comprehensive AI-based cybersecurity solution

SentinelOne’s Singularity platform is a unified cloud, identity, and endpoint security product to fulfill all of an organization’s needs. AI powers a suite of unique features on Singularity that can identify, analyze, and rectify incidents autonomously, saving managers copious amounts of time.

Its Storyline tool uses AI to rapidly summarize incidents into reports using natural language, inclusive of context so managers can get up to speed without spending hours on manual investigations. Then, Singularity’s One-Click Remediation feature allows managers to instantly reverse unauthorized changes, restoring networks to their pre-breach state.

SentinelOne enhanced Singularity further last year with the release of Purple AI, a chatbot-style assistant that can turn any security analyst into an expert. Using natural language, Purple AI can be prompted to hunt for new and emerging threats, uncover hidden vulnerabilities, and offer more detail about incidents that warrant deeper investigation. In fact, it can speed up some of those workflows by 80%, according to early adopters.

Demand for SentinelOne’s cybersecurity services remains strong, especially among large, complex organizations. During the recent fiscal 2025 first quarter, the company had 1,193 customers spending a minimum of $100,000 annually, which was a 30% increase from the year-ago period. Management also said the number of customers spending $1 million annually reached a new record high, although it didn’t provide a specific figure.

SentinelOne just delivered positive free cash flow for the first time

SentinelOne generated $186 million in revenue during the first quarter, which was a 40% increase from the same period last year. That was a faster growth rate than two of the company’s main rivals in the AI cybersecurity space: CrowdStrike (NASDAQ: CRWD) boosted its revenue by 33% in its recent quarter, and Palo Alto Networks’ revenue rose 15%.

Both of those competitors are much larger than SentinelOne, so it’s harder for them to match its growth rate. However, it’s a sign that SentinelOne is taking a small amount of market share.

Plus, SentinelOne achieved an important profitability milestone during Q1. It generated $33.7 million in free cash flow, marking the first positive result in the company’s history after years of losses. Free cash flow is a non-GAAP metric that strips out one-off and non-cash expenses like some property purchases and stock-based compensation, so it isn’t technically “true” profitability, but it’s a step in the right direction.

On a GAAP basis, SentinelOne still lost $70.1 million during Q1, but that narrowed from its $106.9 million net loss in the year-ago period. Fast revenue growth combined with operating costs that only rose 5.1% contributed to the shrinking loss.

Why SentinelOne stock is a buy now

SentinelOne shares fell 13% after the company released its Q1 report. Despite its strong results, investors were disappointed because the company slightly reduced its full-year revenue forecast for fiscal 2025. It now expects to deliver $811.5 million in revenue compared to previous guidance of $815 million as management weighs the potential for a broader economic slowdown.

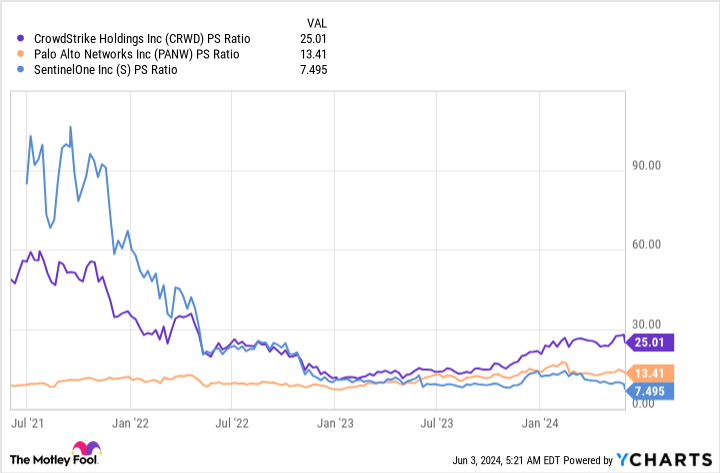

SentinelOne stock is down around 78% from its all-time high. To be frank, its valuation was ambitious back in 2021; it traded at an eye-watering price-to-sales (P/S) ratio of more than 100. For context, CrowdStrike currently sports a P/S ratio of 25, and even that’s expensive relative to many of its peers (Palo Alto’s P/S ratio is 13.4).

But the decline in SentinelOne’s stock price combined with its significant revenue growth since 2021 have brought its P/S ratio down to just 7.4, making it far cheaper than its competitors.

SentinelOne is checking all of the right boxes for investors. Its revenue is growing quickly, it’s attracting high-spending customers, it’s making progress toward true profitability, and it’s heavily focused on AI innovation, which will make it a go-to cybersecurity provider for the long term. For those reasons, now might be a great time to buy the dip.

Should you invest $1,000 in SentinelOne right now?

Before you buy stock in SentinelOne, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SentinelOne wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $704,612!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 3, 2024

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends CrowdStrike and Palo Alto Networks. The Motley Fool has a disclosure policy.

1 Magnificent Stock Down 78% to Buy Hand Over Fist was originally published by The Motley Fool

Signup bonus from