Oracle (NYSE: ORCL), Salesforce (NYSE: CRM), and Adobe (NASDAQ: ADBE) are three of the largest U.S.-based software companies. Oracle’s stock price has languished over the past year, but Salesforce and Adobe have done even worse, with Salesforce down more than 10% year-to-date and Adobe down more than 25%.

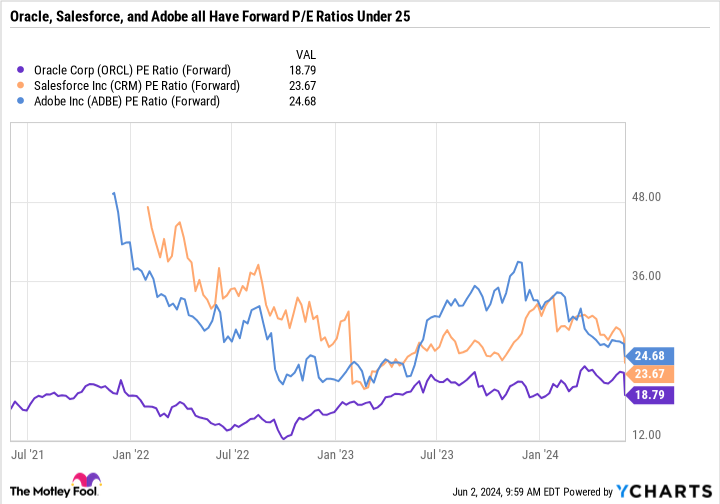

All three companies have slipped to attractive valuations based on their forward earnings projections, suggesting they could be cheap if they can deliver the expected results.

Here’s why it would be better for investors to go with these large, proven companies in the software space rather than some of the smaller companies that are also selling off, and why all three of these growth stocks are worth buying now.

1. Oracle: From dot-com bust to cloud boom

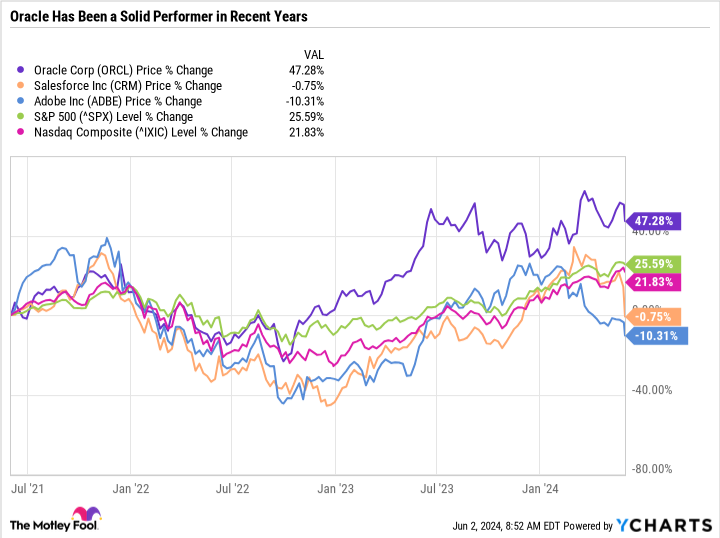

Oracle has crushed the S&P 500 and the Nasdaq Composite over the last three years, whereas Salesforce and Adobe have lost value during that period.

Oracle has been around since the 1970s, when it got its start with the Oracle Database, a relational database management system. Some savvy acquisitions have helped it grow over the years into a leader in enterprise and database software.

At the peak of the dot-com bubble on Sept. 1, 2000, Oracle’s stock price exceeded $46 per share. It would take nearly 17 years for it to set another all-time high.

Centralized data systems have made storage less expensive, safer, and easier to access. Though the cloud was originally seen as a disrupter and potential threat to Oracle, it eventually became a net positive for the company.

Oracle Cloud has largely been responsible for the company’s renaissance. Launched in 2016, Oracle Cloud combines the company’s history of database management with the advantages of modern data centers. Oracle provides the complete package of servers, storage, applications, and other services.

Management claims that its offerings are better than competing services like Amazon Web Services, Microsoft Azure, and Google Cloud because Oracle Cloud is fast and has features like migrating workloads to Oracle Cloud for ease of access.

Despite only having a 2% share of the global cloud services market, Oracle is well-positioned to capitalize on the next chapter in cloud infrastructure by leveraging artificial intelligence (AI) and building customized AI cloud configurations. Folks who are bullish on Oracle believe it has the right approach to take market share from the leaders. The results speak for themselves, as Oracle’s cloud infrastructure revenue soared 49% year over year in its most recently reported fiscal quarter — with cloud software and infrastructure-as-a-service representing 38% of total revenue.

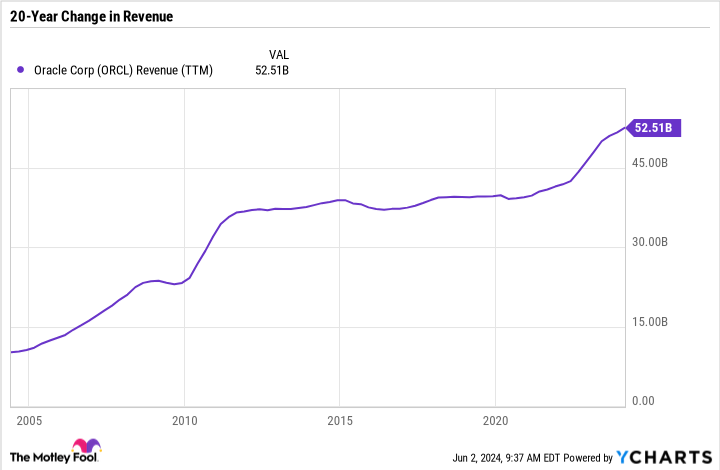

Oracle’s revenue stagnated from the early 2010s till about 2021. But sales spiked over the last few years largely thanks to Oracle’s high-margin cloud business. It’s not just sales that are growing. Analysts’ consensus estimates call for earnings per share of $5.59 in 2024 and $6.23 in 2025.

Its rapidly growing sales and earnings have left the stock a great value despite its market-beating performance in recent years. Oracle’s forward price-to-earnings (P/E) ratio is just 18.8. That will look like a bargain valuation down the road if Oracle’s cloud growth proves sticky.

2. Salesforce: Growth continues to disappoint

Salesforce has long been a leader in the enterprise-software-as-a-service space. For a while, investor expectations for the company were based on it taking a revenue growth at all costs approach, with profits as an afterthought. And Salesforce delivered — growing into one of the largest U.S.-based software companies and joining the Dow Jones Industrial Average in 2020– a testament to its integral role across enterprises. But as Salesforce matured, investor expectations changed, putting more emphasis on its profitability.

To its credit, Salesforce has made strides in managing costs and improving margins. Its trailing-12-month operating margin is 18.5%. Its operating margin was negative or in the low single-digit percentages for most of the last decade.

The issue is that Salesforce’s growth is decelerating at an alarming rate. It’s guiding for revenue growth of just 7% to 8% in the second quarter — a rate that would be more natural for a stodgy consumer staples company than a high-octane tech player.

Unsurprisingly, Salesforce stock got clobbered after it reported its latest quarterly results and issued weak guidance. But now, Salesforce is beginning to look like a better value.

Salesforce has yet to monetize artificial intelligence (AI) in a meaningful way. Its profits are also being bolstered by layoffs (lower expenses), so not all of its progress is tied to growth. The stock could remain pressured in the short term as investors reset expectations, but Salesforce is still well positioned to be a long-term winner for patient investors.

3. Adobe: AI is spurring much-needed innovation

Adobe’s Creative Cloud is a textbook example of the effectiveness of the software-as-a-service business model. In 2012, Adobe began bundling its software suite through monthly or annual subscriptions instead of licensing individual applications to users. It was a brilliant move. However, Adobe has arguably been in an innovation lull for some time, reaping the benefits of its business model and market position, but leaving itself vulnerable to losing market share to Canva and other rivals.

Adobe reports its fiscal second-quarter 2024 earnings on June 13. All eyes will be on its expenses and full-year guidance updates. The stock is down 22% since the company’s last report in mid-March. And unfortunately, the sell-off was somewhat justified.

Adobe’s near-term guidance was not good, as AI investments are weighing on expenses rather than leading to meaningful earnings growth. Adobe soared toward the end of last year due to AI-driven enthusiasm. But the market’s perception of it has changed, and investors are demanding a visible path to profitability from AI instead of cheering investments and assuming they will pay off.

The good news is that Adobe has already developed many exciting new tools and product improvements that may be largely underappreciated. The company’s annual digital experience conference, Adobe Summit 2024, showcased exciting developments, like Adobe’s AI Assistant for Acrobat and Reader, FireFly Services, and applications built on the Adobe Experience Platform.

The stock could continue to languish — so long as Wall Street scrutinizes Adobe’s near-term results. But longer term, I think the company is making all the right moves. Adoption could take some time, but Adobe’s market position and valuation are too compelling to pass up, especially considering how much the stock has sold off.

Should you invest $1,000 in Oracle right now?

Before you buy stock in Oracle, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Oracle wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $704,612!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 3, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Adobe, Alphabet, Amazon, Microsoft, Oracle, and Salesforce. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

3 Top Cloud Software Growth Stocks That Are Too Cheap to Ignore was originally published by The Motley Fool

Signup bonus from