Amid the AI chip race, semiconductor specialist Qualcomm (NASDAQ:QCOM) almost seems like an afterthought. Currently, the crosshairs are on graphics processors. In contrast, Qualcomm focuses on mobile and wireless technologies. However, Qualcomm’s strategic focus on energy efficiency and its new partnership to develop more efficient AI chips position it to make a significant impact in the AI arena.

Therefore, I am bullish on QCOM stock due to its potential to address the critical issue of energy consumption in AI applications.

Qualcomm Partners Up to Offer a Groundbreaking New Chip

According to a Reuters report last month, Ampere Computing announced that it had integrated its chips with semiconductor products from Qualcomm in a bid to lower utility bills tied to AI-related operations. Per the report, Ampere utilizes tech forwarded by ARM Holdings (NASDAQ:ARM) to manufacture central processing chips.

It’s interesting to note that these chips are used by powerhouse enterprises like Oracle (NYSE:ORCL) and Google under parent company Alphabet (NASDAQ:GOOGL). Enticingly, Ampere – which is a startup – aims to make chips that are more energy efficient than what industry leaders Intel (NASDAQ:INTC) and Advanced Micro Devices (NASDAQ:AMD) produce.

“Qualcomm, which dominates the market for mobile phone chips, has been working to break into the market for AI chips in data centers since 2019 with a power-efficient offering of its own,” wrote Reuters contributors Stephen Nellis and Max A. Cherney.

The initiative falls right in line with Qualcomm’s long-term directive. Per its website, it notes, “For over a decade, Qualcomm engineers have pioneered AI processing systems that center on efficiency. The systems, which harmonize our industry-leading hardware, software, algorithms, and memory hierarchy toward AI acceleration, help reduce power usage and bring groundbreaking improvements in power efficiency, performance, and latency.”

Of course, outright performance will always matter. However, so does sustainability. As Qualcomm rightly states, “More efficiency means less charging of smartphones globally, making technology more sustainable — long a priority of this company.”

Focusing purely on outright semiconductor performance and not paying attention to sustainability could have detrimental financial impacts. First, multiple companies have jumped on the sustainability bandwagon. Therefore, it would be incredibly hypocritical if they promoted products that put society in a worse position environmentally than before.

Further, ample evidence demonstrates that consumers care about sustainability. If word gets out about certain enterprises not holding true to their word, it could be bad news. Thus, QCOM stock stands on viable ground as the underlying enterprise moves beyond the low-hanging fruit of chasing outright semiconductor performance metrics.

Efficiency May be Key for QCOM Stock

Earlier this year, The Washington Post ran an alarming headline. Essentially, because of the 2,700 data centers in the country consuming more than 4% of national electricity output in 2022, America finds itself running out of power. It’s not a clickbait concept either.

Other publications have noted that AI processes utilize as much energy as a small nation. Further, this circumstance will likely only worsen. The International Energy Agency estimates that based on its projections, global energy demand – driven by data centers, cryptocurrencies, and AI – could account for as much electricity consumption as currently used by Japan.

And we’re not talking about a specific industry in Japan. Rather, we’re talking about the entire nation.

Paul Hoffman wrote an excellent article on TipRanks about the broad implications of AI energy consumption. In particular, Hoffman identifies the nuclear energy industry as a key beneficiary. Under the context of AI-related consumption, “nuclear power, with its renewed appeal due to low carbon emissions and round-the-clock reliability, appears ideally positioned to meet the skyrocketing power demands driven by AI,” wrote Hoffman.

As it relates to QCOM stock, the tech industry will need to forward viable solutions to address the energy consumption problem. That’s the vulnerability that could impact the usual suspects in the AI trade. It’s wonderful that digital intelligence is expanding and may yield various efficiencies. However, if the cost of the innovation becomes too steep, this dynamic may become self-defeating.

Fortunately, with Qualcomm working on its efficiency-focused directive, it could forward a solution that’s the best of both worlds: incredible computing capacity while being environmentally responsible. I don’t think it’s a coincidence that QCOM stock has gained almost 43% since the start of the year.

Compelling Valuation Bolsters the Bullish Case

Lastly, we’ve got to talk about valuation. At the moment, QCOM stock trades at a trailing-year earnings multiple of 27.43x and a forward multiple of 20.62x. Whether compared to the semiconductor equipment and materials category or the broad semiconductor sector, Qualcomm is undervalued. The former category features an average multiple of 31.4x, while the latter runs at 34.8x.

Where it runs a little bit hot is in the revenue department. Right now, QCOM stock trades at 6.32x trailing-year sales. That’s elevated compared to both semiconductor categories, which run at around 4.3x each. However, with Qualcomm’s efficiency directive, the premium may actually be discounted relative to the long-term upside potential.

Is QCOM Stock a Buy, According to Analysts?

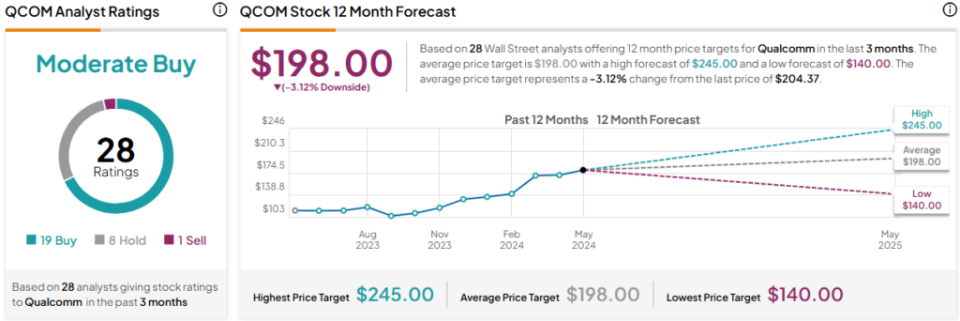

Turning to Wall Street, QCOM stock has a Moderate Buy consensus rating based on 19 Buys, eight Holds, and one Sell rating. The average QCOM stock price target is $198, implying 3.1% downside risk.

The Takeaway: QCOM Stock Could Make a Grand AI Entrance

While other tech firms have embraced AI innovation, Qualcomm has been going about it in a different way, focusing on sustainable digital intelligence. While this approach isn’t as exciting, it’s arguably the most relevant. As many resources have pointed out, AI consumes too much energy, and something must be done. Qualcomm may offer a viable solution, making QCOM stock well worth consideration.

Signup bonus from