Companies like Alphabet, Microsoft, and Nvidia soak up a lot of attention in the artificial intelligence (AI) race — the first two because they invest in public-facing products, like ChatGPT (Microsoft) and the generative AI chatbot Gemini (Alphabet). And in the case of Nvidia, that’s due to its indispensable chips and the stock’s incredible performance.

But don’t forget about what is behind the curtain. A number of smaller, lesser-known companies also play key roles in AI development. Let’s learn about one of them.

Why are data centers important?

Nvidia’s recent success is due to its data center revenue, which reached $22.6 billion last quarter, an astounding 427% year-over-year growth rate. Why are data centers such a big deal? Data centers are critical infrastructure that store, manage, and process vast amounts of information. They enable cloud-based applications, e-commerce, and much more.

Here are some fun data center facts:

-

There are over 10,000 data centers globally, with more than 5,300 in the U.S.

-

The average data center is around 100,000 square feet. While some are small, those built by hyperscalers like Amazon, Alphabet, and Microsoft can occupy more than 1 million square feet.

-

The largest U.S.-based data center, checking in at 4.6 million square feet, is located in Oregon and operated by Meta Platforms.

-

Experts expect more than 120 hyperscale centers to come online annually for a decade. One plan, reported by Reuters, is a Microsoft and OpenAI (the creator of ChatGPT) partnership for a $100 billion project dubbed Stargate.

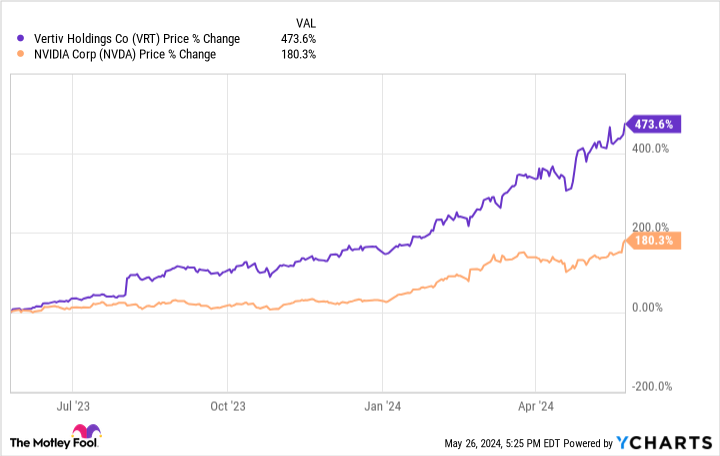

These massive complexes aren’t just empty vessels with servers stacked inside. They require infrastructure such as racking, enclosures, power systems, temperature management components, switches, software, and maintenance. Vertiv Holdings (NYSE: VRT) is a leading supplier of this infrastructure, and the increased demand made it one of the market’s hottest stocks over the past year, as shown below.

Is Vertiv Holdings stock a buy?

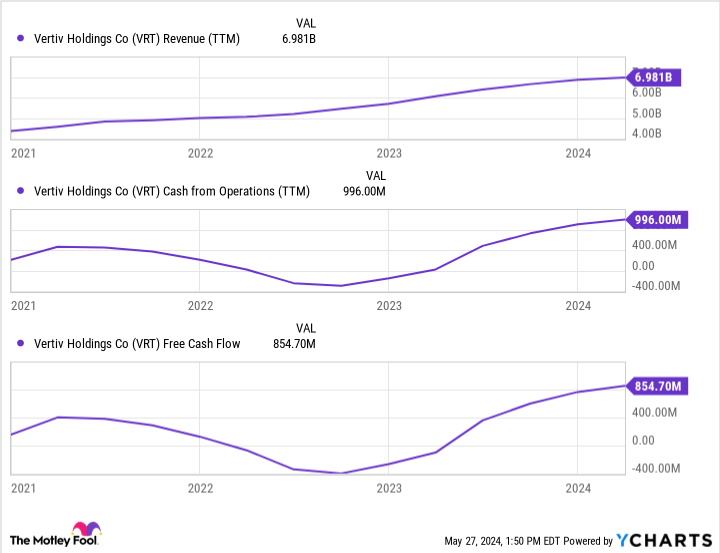

The question is whether there is gas left in the tank. 2023 was a huge year for Vertiv. Revenue rose 20% to $6.9 billion, and margins expanded. Vertiv reported gross and operating margins of 35% and 13%, respectively, compared to 28% and 4% in 2022. Expanding margins show that Vertiv has pricing power in the industry due to ballooning demand. They also show that the company’s business model will become even more profitable as it scales.

Operating cash flow and free cash flow also skyrocketed, as shown below.

The company used $600 million of its cash to repurchase stock in the first quarter of 2024 at an average price of $66 per share, showing Vertiv’s confidence that its stock was undervalued. The stock trades for just over $100 per share now.

Sales for Q1 hit $1.6 billion, an 8% growth rate. The growth doesn’t seem impressive on the surface; however, the company’s order volume grew by 60%. This means that customers placed 60% more orders than in the previous year, and this revenue will be recognized in future quarters.

Vertiv also reported a book-to-bill ratio of 1.5. This means that for every $1 of sales billed to a customer, Vertiv received $1.50 in new orders. Both metrics indicate significant, sustained growth, reinforcing the demand uptrend in data center infrastructure.

The biggest risk for investors in Vertiv is the stock’s valuation. Its forward price-to-earnings ratio is near 45, which seems high. But that isn’t the whole story. Operating profits quadrupled in 2023 over 2022, moving from $223 million to $872 million, and diluted earnings rocketed from a negative $0.04 to a positive $1.19 per share. Vertiv also raised its full-year 2024 guidance in Q1. In Q4 2023, the company forecast a 23% growth in operating income for 2024. Last quarter, it upped this to 28%.

Vertiv looks like an excellent long-term investment, given its secular tailwinds and profitable business model.

Should you invest $1,000 in Vertiv right now?

Before you buy stock in Vertiv, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vertiv wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $671,728!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 28, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Bradley Guichard has positions in Alphabet, Amazon, Nvidia, and Vertiv. The Motley Fool has positions in and recommends Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

1 AI Stock Outpaced Nvidia by Nearly 300%; Is It Still a Strong Buy? was originally published by The Motley Fool

Signup bonus from